While the spot market often “goes into hibernation the last week of July,” says DAT’s Ken Harper, that was certainly not the case this year. DAT boards “saw record freight volumes for vans on the Top 100 lanes,” he adds, though rates didn’t keep up, “largely because weaker reefer freight had those trucks competing with vans, so there was excess capacity on many lanes.”

National average van rates dropped 2 cents to $1.79.

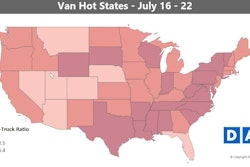

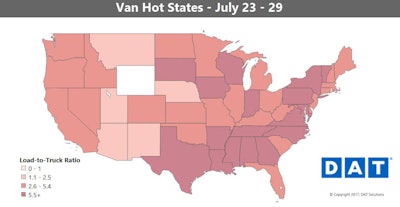

Much of the map remained dark for van into the latest full week, illustrating good conditions for truckers pulling dry vans. The question, notes Harper, into August is “whether we’ll see the typical August slump in freight and rates for vans and reefers, or if the economy has enough oomph to make August as exceptional as July was.”

Much of the map remained dark for van into the latest full week, illustrating good conditions for truckers pulling dry vans. The question, notes Harper, into August is “whether we’ll see the typical August slump in freight and rates for vans and reefers, or if the economy has enough oomph to make August as exceptional as July was.”Van overview: As noted, van volumes got a welcome boost to close out July, which led to an uptick in load posts on DAT load boards. It’s unusual to get a surge in freight that late in July, but the top 100 van lanes set all-time records for volumes last week.

Hot markets: The three markets with the biggest increases for van rates also happened to be in areas where nearby crop yields have been strong this year: Philadelphia, Seattle and Buffalo, N.Y.

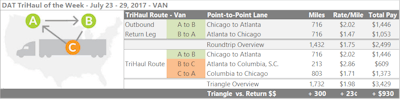

Not so hot: Demand for dry vans is still high across the South, but in the late summer we usually see activity shift to the Midwest. As a result, we’ve seen some seasonal adjustments on lanes out of Atlanta. For example, the average rate for a van load going from Atlanta to Chicago was down 14 cents to $1.47 per mile.

Following a seasonal pattern to some degree, van rates can be seen shifting downward out of the Southeast and rising in the Midwest. You can see that trend play out on the lanes going back and forth between Chicago and Atlanta. Atlanta to Chicago is the lower-paying leg of that trip, and prices fell on that lane to the paltry $1.47/mile on average last week. Triangular route suggestions are available in DAT TruckersEdge Pro, which show options to split the less-potentially-lucrative leg to boost revenue for the roundtrip. If you can work it into your schedule, a short haul from Atlanta to Columbia, S.C., then another pick to head back to Chicago, would add 300 miles to the roundtrip and boost rate per loaded mile on average to $1.98 versus $1.75.

Following a seasonal pattern to some degree, van rates can be seen shifting downward out of the Southeast and rising in the Midwest. You can see that trend play out on the lanes going back and forth between Chicago and Atlanta. Atlanta to Chicago is the lower-paying leg of that trip, and prices fell on that lane to the paltry $1.47/mile on average last week. Triangular route suggestions are available in DAT TruckersEdge Pro, which show options to split the less-potentially-lucrative leg to boost revenue for the roundtrip. If you can work it into your schedule, a short haul from Atlanta to Columbia, S.C., then another pick to head back to Chicago, would add 300 miles to the roundtrip and boost rate per loaded mile on average to $1.98 versus $1.75. The national average reefer rate dropped a penny to $2.08 last week.

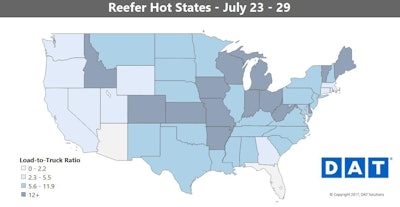

The national average reefer rate dropped a penny to $2.08 last week.Reefer overview: There’s been a nice run of higher rates on many of the top reefer lanes. High heat is taking a toll on crops in some regions, though, and triple digits in Northern California and the Pacific Northwest could hamper produce shipments there in the near future. Although reefer freight in general was down, the upper Midwest was strong, as it usually is this time of year, with fruits (apples, berries, etc.) and vegetables there being harvested.

Hot markets: The Midwest is also coming on strong for reefer demand. Michigan harvests are pushing reefer rates higher out of Grand Rapids. The lucky lane of the week came out of Grand Rapids to Cleveland, the average rate jumping 50 cents to a whopping $4.12 per mile.

Not so hot: Florida’s peak shipping season has been in the rearview for a few weeks now, but the lane from Lakeland, Fla., to Baltimore took another sharp decline last week, down 39 cents to $1.46 per mile. Prices were also down out of the Mexican border markets of Nogales, Ariz., and McAllen, Texas.