Finding the bottom line for two paths in a financial matter can be as murky as driving through fog. What might appear to be the most cost-effective choice isn’t always what it seems. Following are analyses of some common but tough decisions that owner-operators face, with enough information to guide you toward a wise decision.

Buy a truck or lease it?

Few owner-operators lease a truck. All things being equal over enough years, buying leaves you with more in your pocket.

A new truck is a three-year depreciable asset; the most common depreciation schedule yields deductions overlapping four calendar years. So for a five-year loan, the trick is planning to cover cash flow in the fifth year, after the tax deduction has ended.

“We’re not seeing a lot of folks who have that kind of money and can afford a big down payment,” says Steve Crear, Schneider Financial’s general manager.

Another advantage of leasing is that “you’re generally not as committed to the length of the contract,” says Mark Miller, tax manager for ATBS, the nation’s largest owner-operator financial services provider. That means it’s easier to get out of the lease or renegotiate into a newer truck to keep maintenance expenses low.

“We like to see the deal structured in order that before the five-year end they could trade,” says Crear. “That’s an ideal guideline – 42 months, 48 months to trade.” The goal is to keep truck maintenance down and tax management simple.

Unlike a purchase loan, where scheduled depreciation determines your tax deduction, under a lease your tax deduction is equal to your lease payment, typically $2,000to $2,500 for a new truck at Schneider, Crear says. “You deduct everything just as it’s paid.”

Compared to buying, leasing generally costs you more, but saves more in taxes. In some programs, like Schneider’s, you can reduce your monthly lease payments to reflect your tax savings, a tax management tool Crear says is invaluable to new owner-operators.

On the other hand, claiming depreciation on a new truck gives you the flexibility to structure the rate to match your tax deductions. But Miller warns against spending money “just to take advantage of the tax deductions. If you need tax deductions, we’ll raise our fees,” he jokes. Rather, “Let your business dictate your tax decisions.”

Length of the loan term

If you’re buying, the bottom line is the longer your term, the more you pay. See estimates below. The ideal loan term for a three-year depreciable asset like a heavy-duty truck is three or four years, during which you can reap the tax benefits of depreciation to maximize the affordability of the monthly payments. After depreciation has expired, tax savings will be limited to interest payments.

New truck: $118,000 at 7.5% interest

Loan term length/years: 3 4 5 6

Monthly payment: $3,120 $2,425 $2,010 $1,734

Total vehicle cost: $130,018 $134,107 $138,289 $142,562

2009 aerodynamic truck, 70-inch sleeper; purchase price:

$118,000

Five-year TRAC lease, $2,195.78 monthly payment

Total payments: $131,746.80

Ending term 20 percent buyout: + $23,600.00

TOTAL COST OF VEHICLE: = $155,346.80

Cumulative tax savings: – $62,604.75

ADJUSTED COST OF VEHICLE: = $92,742.05

Conventional financing, 7.5%, five years, $2,009.81 monthly payment

Total payments: $120,588.60

Down payment (15 percent): + $17,700.00

TOTAL COST OF VEHICLE: = $138,289.60

Cumulative tax savings: – $55,682.81

ADJUSTED COST OF VEHICLE: = $82,606.79

Above scenarios and calculations based on numbers from Overdrive research and online calculators at MSN.com and SLS Financial.

Do an in-frame or trade?

With today’s tight credit and rising new truck prices, an in-frame overhaul to keep a rig running might be more popular than ever. Still, for a borrower with excellent credit and solid buying history, trading the old truck is often the best choice, as this example shows.

It assumes an interest rate of 7.5 percent on the new truck loan, which is available today only to borrowers with better-than-average credit. As that percentage increases, the in-frame choice looks better.

A typical in-frame will consist of “replacing cylinder kits and heads, injectors, the turbo or turbos – the power-producing parts, really,” says Bill McClusky, ATBS maintenance management consultant. If done at a shop in the engine manufacturer’s network, warranties on an overhauled powertrain are available – and worthwhile for the price, says owner-operator Ken England. He purchased extended coverage for an overhauled Caterpillar C12 for five years at less than $2,000, and the warranty saved him around $5,000 in repairs and towing charges.

One variable not accounted for in this example is the expected downtime associated with any older truck, overhauled or not – the “wild card,” as Schneider Financial’s Dan Kleiser, lease portfolio manager, calls it. “You count on needing the overhaul, but you don’t count on the nickel-and-diming that comes along with an older truck.”

Twelve cents or more per mile in maintenance savings is the industry’s operative figure for trucks older than five years. Considering that, a new or late-model truck starts to look pretty good, especially after an older truck’s extended period in the shop – or a $1,000 tow bill.

This comparison doesn’t include financials beyond year three, when in this scenario the powertrain warranty on the in-frame runs out. In the fourth and fifth years, you’ll still be making payments of $2,000 a month on the new truck. Maintenance costs for the in-frame and other needs go on, but you could continue to run that truck for several more years. “If the truck remains in good condition,” says Chris Brady of Commercial Motor Vehicle Consulting, the owner-operator “can run it for another year or four years – he’s reducing his cost of ownership. The longer you own the vehicle, the better ownership becomes.”

In today’s economy, with investment return rates low and short-term interest rates high, it’s usually better to pay off high-interest credit card debt before considering any new savings or investments.

“You’re getting very low return on your cash today,” says analyst Chris Brady. “Money market returns are only 1 percent.” Because credit card debt is often at double-digit levels, paying it down produces a far better yield for your available cash.

In-frame overhaul

at 900,000 miles

Repair: $18,000

3-year/300,000-mile powertrain warranty coverage: + $1,000

TOTAL REPAIR COST: = $19,000

300,000-mile maintenance costs: + $36,000

Cumulative tax savings: – $4,500

Cost over three years: = $50,500

Trade for new truck

($118,000) at 900,000 miles

Down payment minus trade-in credit: $2,000

3 years of payments (at 7.5 percent): + $72,353

TOTAL TRADE-IN COST: = $74,353

300,000-mile maintenance costs: + $9,500

Cumulative 3-year tax savings: – $39,589 Cost over three years: = $44,2649

Save extra cash or pay down debt

In today’s economy, with investment return rates low and short-term interest rates high, it’s usually better to pay off high-interest credit card debt before considering any new savings or investments.

“You’re getting very low return on your cash today,” says analyst Chris Brady. “Money market returns are only 1 percent.” Because credit card debt is often at double-digit levels, paying it down produces a far better yield for your available cash.

The average credit card debt held by owner-operators today is $12,363, according to the 2009 Overdrive Owner-Operator Market Behavior Report, which Brady authors. For a transportation business where “guys might be throwing fuel bills on it monthly, and purchasing equipment,” this amount could be better managed at lower levels, he says. Focusing on any excess short-term debt in lieu of extra saving or investing is by far the best choice. “First get your cash in a good situation,” Brady says, before hunting out any decent investment opportunities.

Owner-operator credit card balance profile

Average

Number of outstanding credit cards balance

1, business only $12,509

3, business only $13,125

All business and personal cards $12,261

These numbers reflect the general practice among owner-operators of using credit cards as a business tool. Besides being convenient, cards help in expense record-keeping and often offer affiliation benefit programs.

Refrain from credit cards or use for affiliation benefits?

This one is something of a no-brainer, with one important caveat: that you pay the credit card balance in full monthly. Benefits from credit card use extend beyond discounts on credit fuel purchases. Some cards offer cash back on every purchase, credits for airline or other travel use, or other givebacks.

For instance, the average FleetOne fuel card, the company claims, will save you $400 a year on fuel at 20,000 gallons purchased, via rebates granted in $15 increments. Add the $1,400 you’ve saved by getting the cash diesel price with the card, and that’s a total savings of $1,800 a year.

By comparison, consider the same amount of fuel purchased with the business/consumer Miles by Discover card, which offers credits for all purchases to be put toward travel expenses. At $2.62 a gallon for diesel, the national average Aug. 10, 20,000 gallons ($52,400) in fuel purchases would net you 52,400 miles at the base rate of a mile per dollar in purchases. With each 10,000 miles worth $100 in travel purchases, your fuel purchases alone would net you $524 in yearly travel benefits. Discover’s Miles and certain other cards also offer double-mile promotions, so annual benefits could be even higher.

Some users prefer straight cash-back programs because the benefit is not limited to travel or gifts.

Take Social Security early or late?

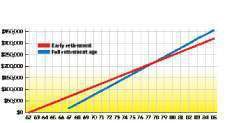

Cumulative Social Security benefits

Cumulative Social Security benefitsYou have a choice whether to begin receiving Social Security benefits early (age 62) or at full retirement age (at 66 if you were born between 1943 and 1959, at 67 if 1960 and later). Say you’re 62 and, like the average owner-operator, with a working income of $51,000 averaged over enough years to qualify, you would be eligible for $1,050 a month now or $1,393 a month in 2013, at age 66.

As illustrated in the graph, if you start now, by the time you turn 66, you’ll have collected $50,400 in benefits. If you start at 66, you’ll need to live through age 78 and a half to make up for those missed benefits; beyond that, the higher payments would be to your advantage. (SS payments are taxable at varying levels depending on your income, which can skew these calculations a bit; if you want to do this precisely for your situation, take it into consideration and get with your accountant. Or visit ssa.gov/planners for some good calculators.)

The average male life expectancy is 81, according to the Social Security Administration. For women, it’s 84.

If you’re healthy and can continue working, it’s probably best to wait. “It isn’t a hard and fast rule,” says ATBS’ Miller. “It’s a personal value decision.” Balancing your needs with those of your spouse, as well as evaluating your life expectancy, will likewise figure into your decision.

Traditional IRA or Roth IRA

A contribution to a traditional Individual Retirement Account has the benefit of avoiding income tax in the year the money was earned, as well as during the years the investment appreciates, but it is taxed when you take the money out. A Roth IRA contribution offers the opposite scenario: tax due for the year it was earned, but no tax later.

Assuming equivalent returns on a traditional IRA and a Roth IRA, the Roth is generally the better choice after all taxes are paid. For the traditional IRA to produce a better yield, you would have to determine how much you saved by deferring taxes each year and then invest all of it, getting a rate of return generally above 5 percent. n