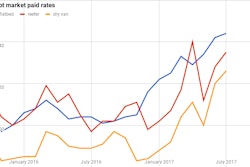

It’s a new day on the freight spot market, notes DAT’s Ken Harper with this week’s update on dry van and reefer demand, rates and more. Post-Hurricane Harvey and Irma, van freight rate gains have been more or less sustained, and “to put this in perspective, we haven’t seen van rates this high for a protracted time (2-plus months) since the Polar Vortex/Snowpocalypse of 2014,” Harper says.

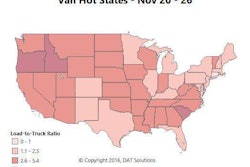

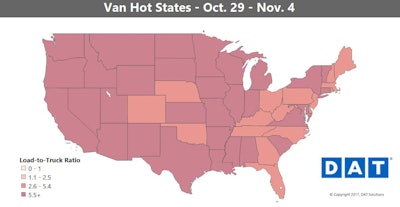

Van freight and rates continued strong in the last week with the national average at $2.07/mile, just 2 cents less than the peak post-Irma. Los Angeles continues as the top market for outbound freight, with double-digit load-to-truck ratios and rates climbing to almost $2.50/mile on average. This all confirms that “holiday season freight continues to come in from Asia,” Harper quips.

Chicago, meanwhile, was also very strong outbound, with slightly lower freight volumes last week but higher rates ($2.73/mile).

With holiday retail and e-commerce expected to rise 6 percent over last year, Harper says, van freight and rates should be strong through January. All of this is happening with the ELD mandate looming in December, which will likely keep capacity tight and prices high for a while.

With holiday retail and e-commerce expected to rise 6 percent over last year, Harper says, van freight and rates should be strong through January. All of this is happening with the ELD mandate looming in December, which will likely keep capacity tight and prices high for a while.Van hot markets: As noted above, Los Angeles is still the top market for van volumes, and the load-to-truck ratio there is still in the double digits. That pushed outbound rates in L.A. up 5 percent last week. Key lanes out of Chicago rose considerably, such as the one to Columbus, Ohio (more on that below).

Not so hot: Rates were up across most of the country, which means some “backhaul” lanes out of Denver took a step back – what else is new? One of the few headhaul lanes out of Denver is to Albuquerque, N.M., and even it was down 13 cents at $1.96 per mile on average.

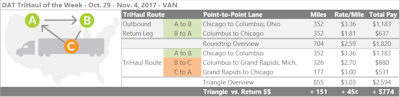

The higher rates on the van lane from Chicago to Columbus led to rates falling on the return trip, but since Columbus is an outbound hub for freight to many other markets, you can easily split the return for a triangle to boost your average revenue per loaded mile. Columbus to Chicago averaged $1.81 per mile last week, which still makes for a decent round trip, but instead of heading straight back to Chicago, you could haul a dry van load from Columbus to Grand Rapids, Mich. That paid an average of $2.70 per mile last week. The last leg of the trip would be a pretty short haul from Grand Rapids to Chicago, which paid more — $3 per mile on average.Not counting any deadhead you might incur on any end, the “TriHaul” adds about 150 miles to the Columbus-Chicago return, and if you just negotiated the average rate on every load, your average for the whole trip would go up from $2.59 per mile to $3.03. That’s an extra $774 in your pocket if you can make it work with your hours.

The higher rates on the van lane from Chicago to Columbus led to rates falling on the return trip, but since Columbus is an outbound hub for freight to many other markets, you can easily split the return for a triangle to boost your average revenue per loaded mile. Columbus to Chicago averaged $1.81 per mile last week, which still makes for a decent round trip, but instead of heading straight back to Chicago, you could haul a dry van load from Columbus to Grand Rapids, Mich. That paid an average of $2.70 per mile last week. The last leg of the trip would be a pretty short haul from Grand Rapids to Chicago, which paid more — $3 per mile on average.Not counting any deadhead you might incur on any end, the “TriHaul” adds about 150 miles to the Columbus-Chicago return, and if you just negotiated the average rate on every load, your average for the whole trip would go up from $2.59 per mile to $3.03. That’s an extra $774 in your pocket if you can make it work with your hours. Holidays are also a good time for reefers with lots of turkeys (duh!) and potatoes on the move. National average reefer rates are at $2.37/mile in DAT’s analysis.

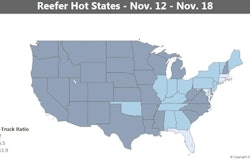

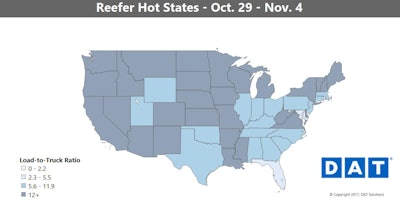

Holidays are also a good time for reefers with lots of turkeys (duh!) and potatoes on the move. National average reefer rates are at $2.37/mile in DAT’s analysis.Reefer overview: Thanksgiving turkeys have been on the move, and reefer capacity has gotten tighter. Just like with vans, California and Chicago led the charge for reefer rates. Volumes were down slightly, though, and the picture was a bit more mixed nationally. Of the top 72 reefer lanes, 39 had rising rates, while 33 lanes were down.

Hot markets: The biggest spike was on the lane from Chicago to Kansas City, which surged 49 cents last week to an average of $3.10 per mile. Demand is also extra-high out of potato-shipping regions ahead of Thanksgiving. In general, rates for reefer loads leaving Southern Idaho and going east were up, while south and westbound lanes paid a little less compared to the week before.

Not so hot: The biggest drop-off last week was the lane from Grand Rapids, Mich., to Cleveland, which tumbled 54 cents to an average of $3.16 per mile. And as we were saying up above, southbound lanes out of Idaho tended to pay a little less last week, and the lane from Twin Falls to Phoenix dropped 27 cents to $2.74 per mile.