It’s not exactly common when dealing with a broker that accessorials like layover, detention and the like are up-front accessible and available to anyone — or guaranteed should situations arise that cause them to come into play. I’ve written about issue of the mysteriously canceled load, the fraudulent variety where contrary to the common definition of cancel something else is up entirely.

That kind of situation was one of a few that featured in anecdotes owner-operator James Woods shared in my Overdrive Radio podcast talk with him a few weeks back now:

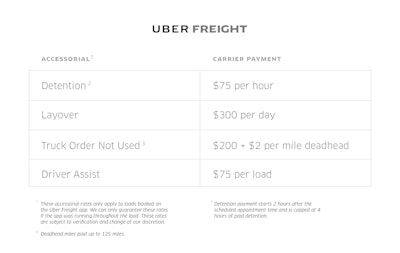

Accessorials like detention, truck-ordered-not-used payments and the like typically arise out of negotiation, if they come at all, a frustrating aspect of dealing with many brokers. Though I’m sure they’re not the only one to take a different tack, the new Uber Freight brokerage has gone out of its way to make public fairly standardized accessorials in a few categories, of a piece with their app’s no-negotiation pricing structure for loads selected in the app (as we learned from Uber Freight’s launch, however, there are other ways to get to Uber loads, as they utilize boards like other brokers when they need to — that’s how the operators interviewed for the last I wrote about them came to the company).

Read about Uber Freight’s announcement earlier today of personalized load push notifications from the app at this link.

Read about Uber Freight’s announcement earlier today of personalized load push notifications from the app at this link.An offering of “fair market rates” has “always been our strategy,” says Bill Driegert, company director. “We’ve had good and bad feedback” from drivers and carriers on those rates. Everybody would “always like another $25 in the load,” after all, he adds. “We’re hopeful for a sustainable community in the end,” with fairness on rates on both ends. “We don’t want to ever be critiqued as unfair in the marketplace. We’re here to put the right rates out there.”

Long-term success of their platform will be the ultimate judge of that, of course, but for now I think they’ve done at least this right in the pricing area: providing transparency to owner-operator users on those aforementioned accessorials. Here’s the broker’s accessorial table from a somewhat recent blog post on the subject Uber Freight wrote:

Layover pay applies if a carrier maxes out its detention at 4 hours, or, says Uber Freight’s Eric Berdinis, “If they book a load and it gets bumped to the following day after the carrier arrives at the facility.” In that case, “it’s automatically a layover.”

Layover pay applies if a carrier maxes out its detention at 4 hours, or, says Uber Freight’s Eric Berdinis, “If they book a load and it gets bumped to the following day after the carrier arrives at the facility.” In that case, “it’s automatically a layover.”Read the fine print, of course, if you can. If you can’t: Detention at $75 an hour kicks in only after the somewhat industry standard of two free hours, and it’s limited to a total four hours, which won’t well cover exceedingly long waits like those detailed in this story from early in the year, among others.

And on that two-free-hours standard that’s developed over the years: There are plenty in the industry who’ve long believed it’s too lengthy, and with ELDs coming into play will of necessity need shortening. Mark White of Old Time Express, with brokers he works with only occasionally, today has pushed for a shorter one-hour standard, with $100 an hour for the detention rate — related reporting coming next week will detail his story in full. Stay tuned.

Yet some kudos are probably in order for this approach to standardization and at least partial automation of accessorial billing and collection. Use of the app by owner-operators in Uber Freight’s case will allow the broker to calculate deadhead miles (fine print alert: limited to 125 miles) toward the shipper before a load’s cancellation, for instance, likewise duration of the truck on location for loading.

I’m not sure about line-haul rates, which vary according to the company’s proprietary algorithm.

Minnie Gilmore, owner-operator with her husband, Edwin, of one-truck Gilmore and Long Enterprises, are the only operators I’ve talked with at any length who utilize the Uber Freight app. They seemed to be happy with rates to the truck within the app. If you’ve given it a whirl, what was your take-away on rates there?

The company’s intention, as Driegert says, is to hit the upper end of where a typical negotiation might stop between a traditional brokerage and an owner-operator with market knowledge. On the accessorials, “We work with each shipper individually to negotiate accessorials directly [to where] they believe in it and trust it and work with us on the accessorials. … We want to make commitments to the driver with pay that are fair, and work with the shipper to get them to the same place.”