Lease-purchase plans are the only way for some owner-operators to buy a truck. Use a wary eye to assess contract terms and do the math to see if it’s really a smart deal.

Jesse Russell’s first lease-purchase contract in 2005 started out well, she says. But halfway through the final year of the three-year agreement her miles began dropping. Fearful of being able to make her truck payment and pay other bills, she found outside financing to pay off the balance and signed on with another carrier.

“Their lease was set up better and they weren’t in charge of my miles,” she says.

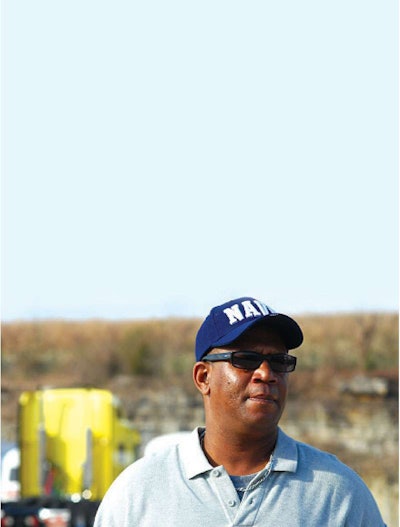

After two years in U.S. Xpress’ lease-purchase program, Roderick Jones opted out of the contract. “Over the last three years, I made pretty good money and saved some,” he says. The program gave him confidence to go out on his own, Jones says, and he plans to buy a truck, finance it through a bank in his hometown of Richmond, Va., and either lease to the carrier or get his own authority.

A few months into a lease-purchase plan in 2009, George Mills was told his carrier had been bought out and he no longer had a company to drive for. Operating under the same lease-purchase contract, he was referred to another carrier.

“My friend and I thought it was going to be a good deal, but it didn’t turn out,” he says. “The pay was terrible and I was not getting the miles or getting home.” On his third carrier with the same contract, he’s says he’s making good money, receiving a fuel surcharge and getting at least 2,700 miles weekly.

Russell and Mills are owner-operators who learned first-hand some of the pitfalls of acquiring a truck through lease-purchase. While such plans are popular paths to truck ownership, some carrier contracts make it difficult to generate enough revenue to meet payments. Appealing to nascent operators who have few financial resources or bad credit, the contracts often require high weekly payments, maintenance accounts or end-of-lease balloon payments.

Carrier lease-purchase programs generate the most controversy for practices that favor the company at the expense of the independent contractor. Common complaints include mileage manipulation in the latter stage of the contract and unadvertised fees and charges.

Carrier programs with unsavory reputations have been “a stigma to overcome,” says Schneider Finance President and General Manager Steve Crear. The carrier has run its lease-purchase program 16 years. “Our measure of success is not reseating trucks over and over again. [For] a lot of carriers, the measure of their success is keeping their trucks filled, not necessarily with the same person.”

There are two approaches to these programs, says Greg Labrasca, manager of independent contractor and lease-purchase recruiting at U.S. Xpress. “The company can go into it either to develop an owner-operator base and help contractors, or they can go into it to make a profit center out of it,” he says.

Sheri Aaberg, general manager of ATBS Leasco, which sets up operators in truck leases with carriers and some dealers, says some leases are essentially weekly rentals with ongoing renewals. “I’ve seen leases where the truck is already sitting on 600,000 miles, and if you read all the way through it, it’s a five-year contract,” she says. “If you’re running 120,000 miles a year, you’re going to be at 1.2 million to 1.3 million miles by the time it’s over.”

Know the contract

If you have questions after reading the contract, consider hiring a lawyer or financial adviser to review it. Make sure items such as down payment, weekly or monthly payments, maintenance escrow account, length of contract and what you’ll owe at the end of the agreement are spelled out.

Work up a budget to give you an idea of what truck payments you can afford and how much revenue you’ll need to cover payments and other financial obligations. Given the age of the truck, estimate what it will be worth when you complete the contract.

Many carriers offer no-money-down contracts, but this often means higher periodic payments. Weekly notes of $400 to $600 aren’t uncommon.

“It might be no money down, but you end up paying for it in the end,” says Joe Hoovestol, president of Lone Mountain Truck Leasing, a finance company. His company offers lease-to-own plans requiring $3,000 to $4,200 down with payments of about $1,100 a month over 24 to 42 months.

A few carriers have introduced no-credit-check deals. These contracts focus on driving history, references and where you’ve worked. Like no-money-down contracts, the weekly or monthly payments will likely be higher to offset the carrier’s risk.

“You have to look at the lease in its entirety,” Aaberg says, “and don’t pull pieces apart and look at them individually. People come to the table with stars in their eyes and expect to work half as hard to generate the income they need in their budget. The reality as an owner-operator is you work harder than if you were an employee.”

Be alert to the amount of any balloon payment at the contract’s end and how you’re going to save for it. “Even if a buyout is predetermined, it should be no more than three payments’ worth,” says Dave Strand, president of Wholesale Truck and Finance.

Twelve-month leases not covering the entire cost of the truck often are used by carriers to qualify a trucker. If the operator completes the short lease satisfactorily, the carrier often pays a bonus, part of which can be applied as a down payment on a long-term contract. On the other end, “Anything over 42 months hurts the owner-operator,” Strand says. “The truck is going to be outdated and you’re still making payments as if it were three years newer when you’re three and a half to four years into it.”

Research the carrier

As you interview the carriers about their lease-purchase contracts, ask how much revenue you might generate, availability of miles and referrals of others who have gone through the program. If the carrier is reluctant to communicate, it’s time to knock on another door.

When Mills couldn’t get the miles he needed, he visited Risinger Bros. and saw a sign that says the carrier wants its contractors to get at least 2,700 miles weekly. “I’m getting $1.30 a mile loaded and unloaded, including a fuel surcharge,” he says.

Seferino Aguirre had been driving for an owner-operator leased to Greatwide and heard about its lease-purchase program. The owner-operator paid Aguirre’s down payment and the Dallas-based operator now owns his truck.

Check out the truck

Knowing the truck’s condition and where it came from can help you avoid maintenance problems. Many carriers assign trucks from their fleets to lease programs, while third-party finance programs buy from fleets, as well.

Trucks for lease typically range from a couple years old up to five years. U.S. Xpress owner-operators Roderick Jones and Joel Jaramillo both started with trucks that had just 100,000 miles. However, Todd Long, who recently leased to Landstar, is driving a 2006 truck that had 501,000 miles when he began a lease in 2010.

In cases where you cannot get a truck’s maintenance records from the carrier that owned it, Strand recommends talking with the carrier’s drivers to get a sense of the company dedication to timely maintenance. He says he knows of one carrier where drivers, because of the long wait for company maintenance, take extra runs and postpone oil changes.

Strand’s company performs an oil analysis on every truck it leases, most of which come from a carrier’s fleet.

Hoovestol says he encourages prospective buyers to get a U.S. DOT inspection and dynamometer test done on the truck before purchase. “If it doesn’t pass the dyno, they can bring it back here and we’ll fix it and cover the cost of the next dyno to make sure it passes,” he says.

After 5 years,

‘very happy’

After about five years leasing trucks through U.S. Xpress, Jaramillo paid off his truck in April.

His lease experience took longer than usual. The company’s Greg Labrasca says Jaramillo was caught in the middle of a transition as the company was deciding how to structure its lease program. “Joel went through three 12-month leases before he went into a long-term lease,” he says. After each 12 months, the buyout figure became smaller.

The lease program served his needs. “Everywhere I went I had to have good credit or a down payment I didn’t have for a truck,” he recalls. “It was a dead-end street everywhere I went. I came here and they said they had a lease program where I could get a truck and in time it would be mine. I’m very happy with it.”

Rodger Koons:

Lacking money, credit

Driving since 2007, Koons wanted to be an owner-operator, but most places he applied to first wanted him to work as a company driver for a while. Schneider National said it would sign him on as a contractor.

Lease-purchase was Koons’ only option because he didn’t have the money to buy a truck. Plus, his credit was weak because he had filed for bankruptcy on a company he owned in 2007. “I didn’t have much of a choice and I had to go to work,” he says.

Schneider signed him to a no-credit-check lease option. He started on a 1-year lease before he was approved for a 3-year lease-purchase agreement. That contract is pending the arrival of newer trucks than the 2005 he’s been driving that has had maintenance problems, he says.

Koons believes the $460 weekly truck payment and $130 weekly maintenance account on his 12-month lease will probably be carried over to the 3-year contract.

Burned on program

During her first lease through a West Coast-based carrier in 2007, her miles began dropping from about 15,000 a month to 9,000, she says. She also complains about administrative fees and other charges. Some weeks, she figures she was making only $200.

Not wanting to lose her truck, Russell found third-party financing and bought the truck for about $10,000. She eventually sold the 2001 truck to her dad, who made the payments.

After leaving the road to drive locally, the Oregon resident returned to owner-operator status in 2010. Leery of another carrier lease-purchase plan, she signed on with Lone Mountain. She put $3,500 down and is paying $1,095 a month for 42 months for a 2006 truck with an initial 450,000 miles. She moved on to Landstar last December and estimates she’s averaging about 2,500 miles weekly.

In 42-month contract

Accustomed to self-employment in construction, Long wanted to be an owner-operator after driving for carriers. Yet as his wife, Kate, says, “I didn’t think anybody would lease to us because our credit was so horrible,” even though they had kept up with house and vehicle payments.

Carriers were quoting weekly payments up to $800 with no money down. She eventually found Lone Mountain. After about two months spent providing documents, the Tennessee couple signed a lease-purchase contract. They put $3,200 down and are paying $1,150 a month over 42 months.

Recently, Todd Long signed on with Landstar and hopes to make more money than he was making with his previous flatbed carrier.

One lease, three carriers

After more than 35 years as a company driver, Mills turned to independent status when the dispatcher at his carrier in 2009 told him “to buy out your truck or you’re out of a job” as the company was being bought out. He signed on with ATBS Leasco for a lease-purchase contract on a 2006 truck.

His 28-month lease required $2,000 down and an $8,000 buyout at the end. His $600 weekly payment includes $350 for the truck, $200 for maintenance and the rest for an accountant to take care of his taxes. What’s left over in the maintenance account can be applied to the buyout when the lease is completed in December.

He’s been on the same lease as he’s worked with three carriers, finally landing at Risinger Bros. last July.

Tax implications

Leasing a truck with an option to buy has tax benefits. As an owner-operator, you can deduct expenses, including truck payments, or you can elect to depreciate the vehicle.

David Blair, owner of Blair Tax Service, recommends deducting the down payment and lease payments, along with other truck expenses. “The truck is 100 percent deductible,” he says, and the deductions stay relatively constant over the term of the lease-purchase.

His argument against depreciation involves the financial hit you could take in the second half of the depreciation cycle. Assume an $80,000 truck in a three-year depreciation schedule, which can be spread over four years. The first year’s depreciation is $26,664, or 33.3 percent of the value. The second year’s depreciation is $35,560, or 44.5 percent. He says those first two years are “almost like untaxed money.”

In the third year, the depreciation would be only about $11,848, or 14.8 percent. The fourth year, the depreciation declines to 7.4 percent, or about $5,920. Most owner-operators find it challenging to save for those years with leaner tax writeoffs.