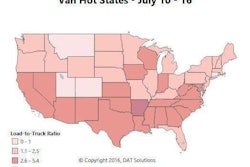

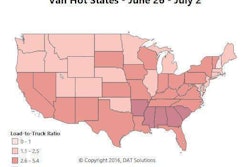

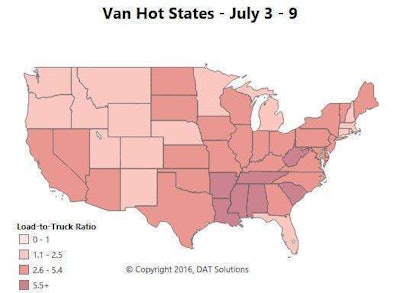

Spot market rates typically take something of a drop after July 4th, but that wasn’t the case in the “short week” last week, notes DAT’s Ken Harper. The week was on the whole “a good one for van freight and rates. As you can see from the Hot States maps [below], areas of the south are turning shades of red as the load-to-truck ratio rises. The rest of the country isn’t too shabby either.”

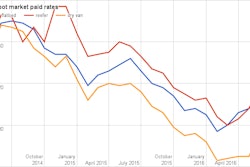

Rates moved higher than the June averages for both van and reefer freight. Some truckers may have taken an extended holiday, which made it harder for shippers and brokers to find trucks last week – or it could be a signal of an improvement in the freight market. We’ll know more next week.

For now, the demand picture in vans and reefers last week follows:

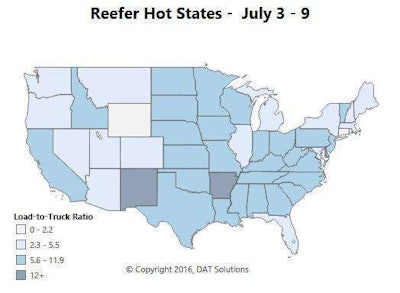

The national average rate rose 5 cents per mile for reefers last week, though rates edged down on the highest-volume lanes. This is still a transition period for produce, with the focus shifting to the north. Florida is getting quieter, and now Atlanta is starting to trend down, too. In the West, we’re seeing more volume out of Central California instead of the southern parts of the state. Also, reefer rates and volumes continue to decline at markets that share a border with Mexico, in Arizona and Texas.

The national average rate rose 5 cents per mile for reefers last week, though rates edged down on the highest-volume lanes. This is still a transition period for produce, with the focus shifting to the north. Florida is getting quieter, and now Atlanta is starting to trend down, too. In the West, we’re seeing more volume out of Central California instead of the southern parts of the state. Also, reefer rates and volumes continue to decline at markets that share a border with Mexico, in Arizona and Texas. For vans, too, the focus is starting to shift North, but there are still plenty of loads available in the Southeast. Markets with rising rates include big cities like Chicago, Philadelphia, Atlanta and Dallas. Outbound van rates started to decline in Los Angeles, Houston and Memphis, however.

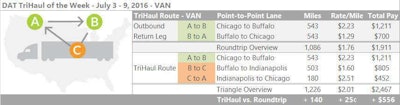

For vans, too, the focus is starting to shift North, but there are still plenty of loads available in the Southeast. Markets with rising rates include big cities like Chicago, Philadelphia, Atlanta and Dallas. Outbound van rates started to decline in Los Angeles, Houston and Memphis, however.Van rates were trending up overall last week in the Midwest, including eastbound lanes out of Chicago. You shouldn’t have trouble finding a load from Chicago to Buffalo, and the rates are up to $2.23 per mile now on average. There aren’t as many loads available for the return trip.

Split the return with a load to Indianapolis, averaging $1.60 per mile, instead of the $1.29/mile Buffalo to Chicago run. Then you can pick up a quick load from Indianapolis back to Chicago, average $450, or $2.51 per mile, for the 180-mile trip. If the route works with your schedule within hours of service constraints, you’ll end up with $550 more in revenue with an additional 140 miles for the three-leg run, based on the averages. If not, you make almost $2,000 on the straight round trip, and you’ll average $1.76 per mile, well above the current van national average.

Lane-by-lane rate information is available in DAT TruckersEdge Enhanced. TriHaul recommendations are available in DAT Express. For more information on weekly trends, see DAT Trendlines.