It wasn’t just for their novelty that Trevor Milton’s announcements of the Nikola One hydrogen fuel cell-powered electric-drive truck turned more than a few owner-operators’ heads last year. It was the promise of an operating cost benefit that took diesel-price volatility out of the equation.

Owner-operator Matthew Hurley had been dreaming of an electric semi-truck for more than 10 years. Then last year, after reading about Nikola and its serial-entrepreneur founder, he came to the company’s Salt Lake City headquarters for its December announcement.

“This is far better than anything I imagined,” Hurley said after the reveal. “This is way over the top.”

Operational costs for a new hydrogen-electric-powered Nikola One could be more or less than the similar costs for over-the-road Class 8 traditional diesel trucks, based on average independent clients of financial services provider ATBS. Nikola’s Trevor Milton projects savings of 20-30 percent with the Nikola One.

Operational costs for a new hydrogen-electric-powered Nikola One could be more or less than the similar costs for over-the-road Class 8 traditional diesel trucks, based on average independent clients of financial services provider ATBS. Nikola’s Trevor Milton projects savings of 20-30 percent with the Nikola One.Paul Terry, owner and operator of Utah-based Paul Terry Trucking, placed 100 orders for the One, despite only operating a 30-truck fleet. Terry says he intends to buy, not lease, the trucks, perhaps to resell at a marked-up price should the technology prove to be as good as it’s touted. Like Hurley, Terry also doesn’t want “to be held hostage” by high diesel prices.

“The industry was under extreme volatility based on diesel fuel prices from 2008, really all the way through 2011,” he says. “That could happen again in the blink of an eye.”

Terry says an early investment in hydrogen-electric vehicles could give him a long-term advantage over his competitors. His fleet operates in 11 Western states, hauling food products.

Recent hydrogen fuel cell-powered vehicles from automakers such as Honda and Toyota are available in California, mostly under lease, and come with a substantial credit to cover years’ worth of fuel. Nikola also is planning to offer its over-the-road Class 8 for purchase or lease with fuel and scheduled maintenance included for up to a million miles.

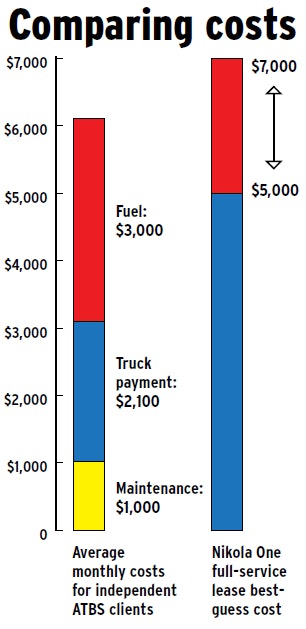

In Milton’s December announcement, he said a $5,000 to $7,000 monthly full-service lease for the hydrogen-powered truck could be a reality.

If costs come in on the lower end of that calculation – particularly if maintenance, fuel and financing costs in a straight purchase or TRAC lease-purchase do so – the Nikola One could represent a 15 percent reduction in operating costs even for the average independent owner-operator. That’s based on the average truck payment, maintenance and fuel costs for independent clients of financial services provider ATBS, which totaled around $6,100 monthly in 2016.

Leased to Nashville, Tennessee-based New Waverly Transportation, owner-operator Hurley might stand to benefit more than the average independent. At the time of Nikola’s December announcement, he was making a monthly truck payment of $1,000 and spending about the same amount every week on fuel. He was doling out $1,700 per month, on average, to maintain his aging truck, putting him about $600 a month above the average in costs. Owner-operators with notes on new-truck purchases, which can run $3,000 monthly or more in some scenarios, might benefit even more.

Many owner-operators are skeptical of maintenance and downtime costs with the Nikola, particularly given the technology’s novelty and the lack of a substantial fueling infrastructure. The latter could force out-of-route miles, cutting into net income.

The manner in which Milton says he plans to roll out the rig and fueling infrastructure doesn’t do much to alleviate concerns about versatility, either, at least in the short term. The plan is to bring groups of eight stations online at any one time and positioned in areas where customer carriers are operating along dedicated or otherwise predictable lanes.

Other factors complicate the cost-savings estimation. “Unfortunately, hydrogen costs are more expensive than [conventional fuels] on an energy-output basis,” says Toyota engineer Tak Yokoo. He’s involved in the company’s proof of concept of its Mirai hydrogen fuel cell stacks and electric-drive powertrain in a port drayage operation in Southern California. “If hydrogen cost goes down to half of [what it is] today, to be equivalent or better [than diesel], in addition to mechanical/maintenance reductions in costs,” then overall cost of ownership truly becomes less than diesel.

Considering the durability of truck materials and components, electric vehicles generally “reduce the number of moving parts,” Yokoo says. “So, generally maintenance costs should go down.”

Citing a hypothetical example, Milton hopes that if total operating costs for a Class 8 diesel-powered truck in a particular operation totaled $1 million over a certain period, the One could handle the same operation for costs under $700,000. The biggest unknown is access to affordable hydrogen in his company’s future network.

An owner-operator thinking about a Nikola One is “not really paying for the truck,” Milton says, but also the fuel and maintenance network in any deal to purchase or lease – an investment in a future that could reside completely outside the realm of traditional fossil fuels. –Aaron Huff contributed reporting to this story