Need a credit card to rebuild your credit? Or you just want a card that skips the frequent flyer miles and cheapo electronics, but gives you the biggest cash kickback?

It’s hard to sort through zillions of cards to find what you want, especially since banks and other lenders are constantly changing what they offer. One option is to check ratings by consumer finance groups, such as this compilation of top-ranked cards by NextAdvisor.com.

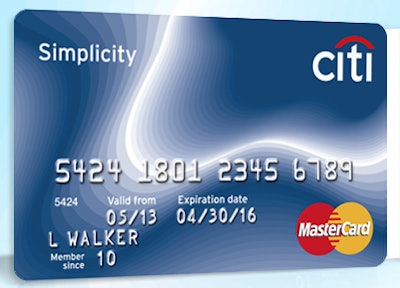

The Citi Simplicity Card was rated tops for low annual percentage rate.

The Citi Simplicity Card was rated tops for low annual percentage rate.The website analyzes, reviews and rates online services, such as insurance, online dating and payday loans. There is plenty more detail on the site regarding its credit card ratings, including links to apply for the cards.

Here are three cards that would interest many owner-operators:

BEST CASH BACK: BankAmericard Cash Rewards Credit Card. It has no annual fee and gives you $100 after spending $500 in the first 90 days. You earn 1 percent cash back on general purchases, 2 percent at grocery stores and 3 percent on “gas” (presumably diesel counts), for the first $1,500 in combined grocery and gas purchases each quarter. APR is zero for 12 months, then variable 13 percent to 23 percent.

BEST LOW APR: Citi Simplicity Card. I imagine there’s some churn on this card after 18 months: zero APR for 18 months on balance transfers, zero APR on purchases for 18 months. Those zero APRs are the longest of any card. The purchase APR rises to 13-22 percent after 18 months. Plus there is no annual fee and no late fees.

BEST TO REBUILD CREDIT: Capital One Secured Mastercard. APR: 23 percent variable. Secured card deposit: $49, $99 or $200. Annual fee: $29. Secured cards are for those whose credit is so shot they can’t get a normal card. You put your own money in the account, typically around $300 to $500, for charging later. Handle it well and take care of other credit red flags, and months later you might qualify for something much better.

NextAdvisor’s recent rating also names the best travel card, student card, business card, rewards card, balance transfer card.