With this freight/rate weekly report, DAT’s Ken Harper notes that this time of year is one when, typically, van freight begins to see the benefit of the Christmas season to come. Yet, as he noted, “freight remains relatively soft for this time of year…. The question is why.”

E-commerce continues to grow as a shopper’s option, which Harper notes has to one degree or another negated some of “the need for the amounts of retail inventory required in the past” for individual local businesses to keep on hand, shifting more freight to distribution centers.

On a lighter note, another possible explanation, Harper says, “is that there are way too many naughty people in the U.S. and Santa Claus is [planning] fewer stops this year.”

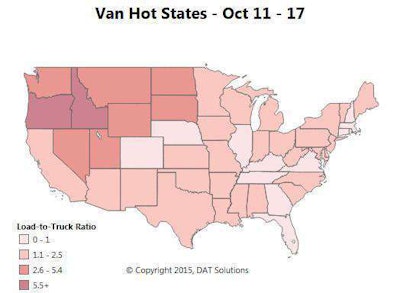

Van load availability has returned to reality after our prior segment update, reflecting the end-of-quarter rush. Last week, load availability dropped another 9 percent on the spot market, while truck posts on DAT Load Boards held steady. As a result, the national load-to-truck ratio fell from 1.6 to 1.4 loads per truck, down from 2 loads per truck in the last update. Harvests in Idaho are down from their fall peak, but demand in the southern part of the state remains high. Expect volume to ramp up again as Thanksgiving approaches. This Hot State Map for the week of Oct. 11-17 also shows favorable load-to-truck ratios in Oregon. This is due partly to strong seasonal demand in the Medford market area, known for its apple orchards.

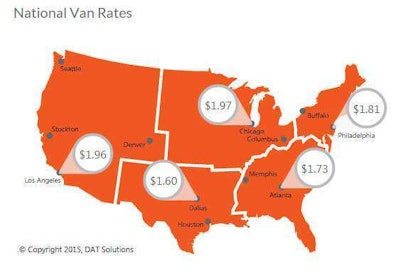

Van load availability has returned to reality after our prior segment update, reflecting the end-of-quarter rush. Last week, load availability dropped another 9 percent on the spot market, while truck posts on DAT Load Boards held steady. As a result, the national load-to-truck ratio fell from 1.6 to 1.4 loads per truck, down from 2 loads per truck in the last update. Harvests in Idaho are down from their fall peak, but demand in the southern part of the state remains high. Expect volume to ramp up again as Thanksgiving approaches. This Hot State Map for the week of Oct. 11-17 also shows favorable load-to-truck ratios in Oregon. This is due partly to strong seasonal demand in the Medford market area, known for its apple orchards. Spot market rates slipped a penny for vans last week for a national average of $1.72 per mile. Outbound rates are up 3 percent for the month in Buffalo, N.Y., fueled by freight entering the U.S. from Canada. Rates trended downward in the Southeast, with prices falling in Charlotte and Atlanta. Outbound rates remained relatively strong in Los Angeles and Chicago.

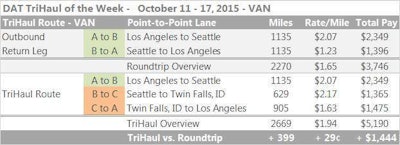

Spot market rates slipped a penny for vans last week for a national average of $1.72 per mile. Outbound rates are up 3 percent for the month in Buffalo, N.Y., fueled by freight entering the U.S. from Canada. Rates trended downward in the Southeast, with prices falling in Charlotte and Atlanta. Outbound rates remained relatively strong in Los Angeles and Chicago.In Seattle, which has been fairly warm for vans in the past month, it cooled off a bit last week as outbound rates dropped. If you’re stuck in Seattle and you need to get back to Los Angeles, a tight schedule with a load to Twin Falls, Idaho, then another to L.A., might fit your hours. If you negotiate at least these average rates, derived from those in DAT RateView, you’ll fill your wallet with an additional $1,400 for the roundtrip. Examine the numbers below: