In building up its network of carriers, analysts say Amazon is pushing to ensure it has capacity to move its own freight — while trying to squeeze competitors’ ability to move theirs.

In building up its network of carriers, analysts say Amazon is pushing to ensure it has capacity to move its own freight — while trying to squeeze competitors’ ability to move theirs.With little fanfare, Amazon in December launched freight.amazon.com, a freight brokerage pilot program that will initially be concentrated in five Northeast states.

Unlike other brokers, analysts contend, Amazon isn’t looking to monetize the brokerage, at least not directly or initially. Instead, the brokerage is part of a larger strategy by the company to build up a network of small carriers and owner-operators by assuring them access to loads at pre-determined rates.

Whether Amazon has loads to keep them rolling is inconsequential: The company is selling that capacity to other shippers, sometimes at a loss, via the new brokerage platform, according to analysts familiar with the system.

Amazon brushes off assertions that it’s undercutting brokers with those cheaper rates. The company provided little information about how the brokerage will operate or how carriers can access its freight. A spokesperson said the brokerage is a “beta program” that will operate in Connecticut, Maryland, New York, New Jersey and Pennsylvania.

Amazon’s push to build a network of smaller carriers is partially intended to ensure that the company has the necessary trucking capacity during peak shipping seasons, such as Halloween, Christmas and Memorial Day, says Carson Krieg, co-founder and director of carrier operations at delivery management platform Convey. In buying up that capacity, says Krieg, Amazon hopes to squeeze its retail competitors by making it harder for them to find the capacity needed to deliver products during those peak periods.

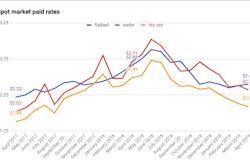

Reports last month suggested that Amazon will offer low-margin or even no-margin rates to shippers, therefore allowing shippers to move freight for cheaper than via other brokerages, while still providing carriers access to freight at the rates Amazon already agreed to pay them.

“Analysis suggesting dramatic undercutting of pricing is false,” Amazon said in a statement to Overdrive. “We work with many line-haul service providers in our transportation network and have long utilized them to carry loads for Amazon. This service, intended to better utilize our freight network, has been around in various forms for quite some time.”

Krieg’s Convey works with major shippers that compete with Amazon, such as Walmart, Neiman Marcus and Bed, Bath, and Beyond. He says he’s worried about the impact Amazon’s move might have on those companies’ ability to find trucks and carriers. But those concerns don’t address the more immediate impact Amazon’s buy-and-sell brokerage could have on brokers, he says.

“It’ll have a wave of immediate impact on pricing and margins,” he says. “Amazon consolidating buying power” of truckload services “is the scariest thing.”

He provided an example: A broker could buy a carrier’s service on a certain load for $800, then sell that to a shipper for $900, earning $100 off the load. Instead, Amazon reasons, “We’ll just buy up [these lanes] for $850 for 12 weeks,” says Krieg, then sell it to other shippers for $875 — a better deal for shippers and carriers than under the traditional brokerage example. This provides small carriers an above-market price, with Amazon either providing them loads from its own freight network or selling its pre-purchased truck service to other shippers, either for a small profit or a break-even.

Under a scenario like this, brokerages would suffer the most, says Krieg. Carriers, particularly small carriers who hunt the spot market for loads, could fare better.

Craig Fuller, CEO of data firm FreightWaves, provided a similar analysis. By establishing a network of carriers, Amazon can then “offer shippers the ability to buy capacity from their network,” he says, and the company is “selling it off at a discount to the market rate.” His firm’s analysis of lanes where Amazon’s brokerage operates shows the rates offered to shippers by Amazon “were significantly discounted versus the published rates that are out in the market.”

That’s not to say the rates were cheaper for carriers. It’s simply that shippers weren’t paying the usual 12-18 percent markup that brokers add, he says.

With an annual spend on truckload freight alone that likely reaches upwards of $10 billion, Fuller says, Amazon has built a fleet of owner-operators and small carriers, intending to “soak up lot of the capacity,” Fuller says. “But they have to keep those trucks running” during non-peak seasons by “auctioning off that capacity when they don’t need it.”

“Shippers do this all the time,” he notes. The difference, however, is the scale at which Amazon operates and the discounts on truckload services it can offer to other shippers.

“At the end of the day it really impacts the broker,” Fuller says. “What they’re doing is creating an opportunity for shippers to bypass brokerages and go buy direct at wholesale prices.”