Normally, an economic recovery is like a tennis ball: “The harder it goes down, the higher it bounces,” William Strauss, senior economist with the Federal Reserve Bank of Chicago, told attendees at CCJ’s Spring Symposium. Coming out of the 1981-1982 recession, for instance, the economy grew 5.4 percent.

Following the most recent downturn, economic growth is slow and unemployment remains above 8 percent, facts that lead many to wonder if we’re still in a recession, Strauss said. But economic expansion of 2.1 percent over the past year means we’re not. “The technical term we would use is, “it’s a lousy economy,” he quipped. Gross domestic product is only projected to grow at trend this year and slightly above trend in 2013.

Such weak economic growth means the employment picture remains bleak, coming off the loss of 8.7 million jobs between December 2007 and February 2010. “It will take a long time when we’re only generating 500,000 jobs per year to absorb the unemployed,” Strauss said. “By the end of next year we’re talking about an unemployment rate still at 7.5 percent – an awful situation for the economy.”

Despite recent concerns over high fuel prices, when adjusted for inflation, current oil prices are below the levels that existed 30 years ago, Strauss said. Historically, Americans spend 6 cents out of every dollar on energy and currently spending is below the historical average. If fuel prices did surge to $5, consumers have the ability to deal with it, Strauss said. “It won’t take us to recession, although it would slow economy. “

One of the biggest growth areas in the economy is the manufacturing sector – partly because it was so hard hit during the recession, he said. Output has averaged 6.5 percent over the last 34 months and has recovered 74.8 percent of the production lost during the recession. Automotive manufacturing has been particularly strong, although, “things have now come in line and will begin to slow,” he said. A continuing bright spot is the energy sector, especially natural gas.

The housing sector still weighs on the economy, although it appears to have bottomed, Strauss said. Home pricing continues to be weak. Foreclosures remain quite high. Production on housing remains very low and will be low for quite some time, he predicted.

Looking ahead, the Fed has maintained its near-zero interest policy since December 2008 and Strauss anticipates rates will be kept low, possibly beginning to rise by the end of 2014 and then only reaching 1.4 percent.

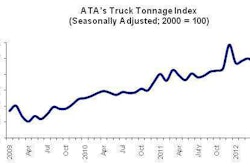

Speaking from a trucking industry perspective, Kristine Kubacki, senior industrials analyst with Avondale Partners, pointed to modest growth in truck tonnage – currently up 2.8 percent year over year. “We say the economy should be doing better, but keep in mind this is growth without a housing recovery,” she said.

Fleets’ equipment purchase cycle has decoupled from the freight cycle due in part to the emissions changes driven by the Environmental Protection Agency, she said. At the same time, access to capital and high costs are driving equipment purchases toward mid- to large-sized fleets.

Currently, truck makers are on pace to produce 315,000 trucks this year. For that to happen, “we’re going to need something in terms of freight growth or some bonus depreciation” to encourage fleets to buy, she said. Uncertainty about driver availability, the economy and high costs are keeping fleets from buying.