Van rates out of Los Angeles added another 1 cent last week to $2.10 per mile with container traffic flowing more steadily through Southern California ports.

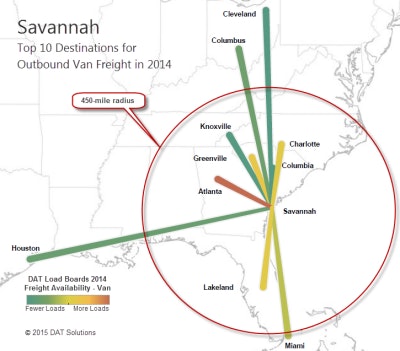

At once, however, the company pointed to this March 30 post from Jeff Nastoff on the DAT blog, about diversion from the West Coast of containerized freight to Newark and, discussed more fully, Savannah.

Click through the image for more of Nastoff’s analysis.

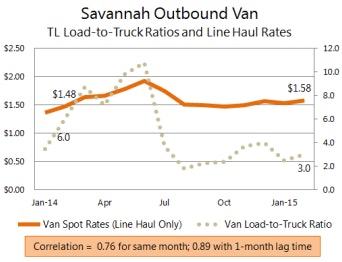

Click through the image for more of Nastoff’s analysis.Diversions have been ongoing to one degree or another since last summer, even with the almost twice-as-long ocean transit time between Asian origins to the East Coast, making the state of Georgia an at least better place for van freight, a notion echoed in my conversation yesterday with Chad Boblett about rates in recent history. “Georgia’s been showing some strong rates” over the last year, the van hauler said.

Reflecting the peaks and valleys in DAT’s line-haul rates (minus fuel surcharge) outbound from Savannah are, to one degree or another, Truckstop.com rate averages outbound from the entire state of Georgia through 2014. These averages are “all-in,” with any fuel surcharge reflected in the rate. Even with the drops in fuel prices, which fell markedly lower toward the end of the year, Georgia outbound for van last year looked well better than the year prior (shown in blue).

In Truckstop.com numbers, Georgia was also No. 4 among top states for reefer rates in 2014, beat out only by Illinois, Tennessee and Kentucky on average.

In January this year, wrote Nastoff, “freight availability was up 8.3 percent outbound from Savannah … compared to January 2013, which is a strong result.” Nastoff compared 2015 to 2013 due to the uncommonly strong shift of freight to the spot market in 2014 in part due to that season’s severe winter. 2013, ultimately, makes for a better marker year for 2015 comparisons.

If trends continue, watch for better rates out of Georgia as freight heats up with the Spring. Wrote Nastoff, “The diversion of freight from West Coast to East Coast ports may be permanent. At minimum, it is likely to continue until late May, when the backlog is expected to clear at the Ports of Los Angeles and Long Beach.”

Read more of his analysis via this link.

What are you seeing out of Georgia?