Owner-operator miles and income: A look at 2020's first half

How has the pandemic impacted owner-operators' miles and income? ATBS’ Todd Amen has the details. #GATSWeek

Posted by Overdrive Magazine on Monday, August 24, 2020

An early-year prediction of an “uncertain” 2020 proved true by an unimaginable degree, noted Todd Amen, whose Aug. 24 webinar recapped owner-operator performance into this summer.

While it’s unlikely we’ll see economic gridlock as severe as what happened in the spring, producing negative freight effects that were marked into June, the lingering pandemic means continued uncertainty, said Amen, president of owner-operator financial services provider ATBS.

His presentation as an Overdrive’s Partners in Business webinar opened Overdrive‘s GATS Week, a series of online programs initially planned for the Great American Trucking Show in Dallas, which was canceled due to coronavirus concerns. Using averages from thousands of owner-op clients, Amen detailed mid-year benchmarks against which you can measure your own performance — and that help explain this year’s increasingly volatile freight markets.

“I don’t think another nationwide lockdown is going to happen,” Amen said. “Most people I know are getting back into the world – they’re out driving, buying things, going to stores, but COVID’s still out there.”

And it continues to scare people. Amen noted that will translate broadly into “a lower GDP” for the balance of 2020 yet to come. That means generally less freight moving around. Owner-operators, he said, should manage for that downside, factoring in a high measure of uncertainty. If an upside does appear, it will “take care of itself” in the form of better profits.

Spot market’s volatility is cycling faster than ever

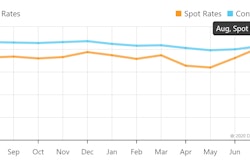

For now, larger carriers with longer-term freight contracts with shippers are having trouble keeping up with demand. The shifting sands of a typical year on the spot market are nowhere to be found. Following the big upswing in March and the fall-off for independents in April and May, the spot market’s now back on a big upswing, as measured by the number of loads posted versus the number of trucks advertised as available.

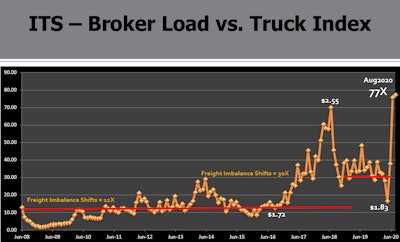

This graph shows ATBS’ long-term tracking of the overall demand on Truckstop.com via its posted load-to-truck ratio. Analysts once held that 12 loads for every posted truck indicated a neutral level of demand. Any level above that and the balance tips in favor of the negotiating carrier. Following the boom in rates in 2018, though, as behavior changed with more parties from brokers to carriers’ brokerages and shippers looking to spot markets to get freight covered, ATBS changed its interpretation of just where the balance shifts to 30 loads per truck.

This graph shows ATBS’ long-term tracking of the overall demand on Truckstop.com via its posted load-to-truck ratio. Analysts once held that 12 loads for every posted truck indicated a neutral level of demand. Any level above that and the balance tips in favor of the negotiating carrier. Following the boom in rates in 2018, though, as behavior changed with more parties from brokers to carriers’ brokerages and shippers looking to spot markets to get freight covered, ATBS changed its interpretation of just where the balance shifts to 30 loads per truck.In the current spot market, things are well in truckers’ favor, as indicated by the chart. “In the last six weeks – we’ve gone from 16 to a high of 77” loads per truck, Amen said. Since the chart was produced, “It was 99 today. Rates today overall in the spot market are about $2.33 per mile.”

The Partners in Business program is sponsored by TBS Factoring.

The Partners in Business program is sponsored by TBS Factoring.One way to look at the quick, steep ups and downs independent carriers and other truckers have experienced this year: “We’ve had a three-year economic cycle in the last six weeks,” as demand “plummeted and then reached back up to the top.” When spot market rates rise, that draws truckers of all varieties back to the boards and brokers. Too many do that and, Amen guessed, “we could be back to that 16 loads to a truck in a month.”

![The Cass Freight Index, Amen said, showed how far off the contract freight market has been through June, when it comes to volumes. In the subsequent months, clearly some of that contracted freight has turned to the spot market for capacity. A key question remains pertaining to carriers and drivers that may have been sidelined during the worst of the down period. He estimated that nationwide among owner-operators “some 5-10 percent [may have] parked their trucks. Others sat it out some, and ran some. A lot of people are asking, ‘Did small fleets sit it out? Or did some of them go out of business and eliminate capacity'” from the market entirely? If enough don’t return, that could be a good sign for surviving carriers that demand could be strong.](https://img.overdriveonline.com/files/base/randallreilly/all/image/2020/08/ovd.ATBS-2020-cass-freight-index-through-June-2020-08-25-09-12.png?auto=format%2Ccompress&fit=max&q=70&w=400) The Cass Freight Index, Amen said, showed how far off the contract freight market has been through June, when it comes to volumes. In the subsequent months, clearly some of that contracted freight has turned to the spot market for capacity. A key question remains pertaining to carriers and drivers that may have been sidelined during the worst of the down period. He estimated that nationwide among owner-operators “some 5-10 percent [may have] parked their trucks. Others sat it out some, and ran some. A lot of people are asking, ‘Did small fleets sit it out? Or did some of them go out of business and eliminate capacity'” from the market entirely? If enough don’t return, that could be a good sign for surviving carriers that demand could be strong.

The Cass Freight Index, Amen said, showed how far off the contract freight market has been through June, when it comes to volumes. In the subsequent months, clearly some of that contracted freight has turned to the spot market for capacity. A key question remains pertaining to carriers and drivers that may have been sidelined during the worst of the down period. He estimated that nationwide among owner-operators “some 5-10 percent [may have] parked their trucks. Others sat it out some, and ran some. A lot of people are asking, ‘Did small fleets sit it out? Or did some of them go out of business and eliminate capacity'” from the market entirely? If enough don’t return, that could be a good sign for surviving carriers that demand could be strong.Owner-operator net income, in spite of challenges, has held strong

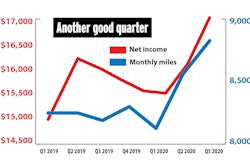

Across all segments tracked by ATBS, the 12-month period from July 2019 to June 2020 shows an average $63,700 in net income for clients. Independent (those with authority, with any trailer type) and leased reefer clients showed gains. Leased flatbedders took the biggest hit, reflecting the pandemic slowdowns and so-so conditions before it took hold.

Compared to the prior 12 months:

Independents gained $260 to a $64,259 12-month net income average

Leased dry van owners were down $1,389 compared to 2018-19 to $64,296

Leased reefer haulers added $1,308 to $57,530

Leased flatbed owners were down $4,851 to $68,712, though they were previously higher than the other segments.

Government stimulus to the economy to the tune of $3 trillion over the course of this period has minimized losses, Amen said, sustaining freight flow to an extent over “what could have been a tremendous depression.”

So far, too, the booms have in a sense outweighed the busts even considering just the first six months of the year for ATBS clients, when it comes to net income (which does include what an owner-operator in an S Corp structure might pay himself in addition to overall profit). Looking at six-month averages for 2018 (about $31,800), 2019 ($31,200) and 2020 ($32,000), believe it or not, 2020’s net with the big decline in fuel costs exceeds even 2018’s on the average. That year was widely considered a “great year in trucking,” Amen said, with “plenty of freight” and rates that “skyrocketed.”

2020 “will probably be tougher the back half of the year,” Amen said.

Find more information and advice about trucking as an owner-operator in the 2020-’21 edition of the Overdrive/ATBS Partners in Business manual, newly available for download.

Also for the short term, the outcome of the election could have ramifications for confidence in the independent contractor model for carriers leasing owner-operators, given the headwinds represented by California’s A.B. 5 contractor rule — still currently on hold by court order for truckers, Amen noted. The current president and his party, too, tends to have a generally more permissive view of business classification of independent contractors versus employees than did the prior president.

Long-term, though, the overall trend over the last two decades for net income, Amen said, is positive. Owner-operators are making more money on far fewer miles. For those who can “stick it out and manage your business – the long-term trend in net income is a good thing.”

View the full presentation in the video at the top of the post.