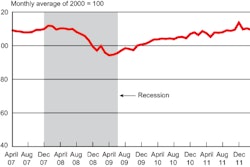

New analysis from Frost & Sullivan (http://www.automotive.frost.com), “Strategic Analysis of North American Class 4-8 Truck Safety Systems Market,” finds the market earnings of $196.4 million in 2010 and estimates it to reach $609.8 million in 2017.

The safety systems market, after remaining in a state of flux for the past two to three years due to its compliance with the Environmental Protection Agency’s regulations, is developing sustainable revenue streams, the study found. Moving forward, trucking original equipment manufacturers focusing on soft technologies and system integration will stoke higher adoption rates because of the Federal Motor Carrier Safety Administration’s Compliance Safety Accountability regime, possible upcoming legislative support and energy-price volatility, Frost & Sullivan believes.

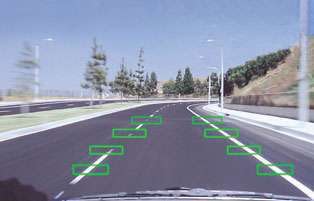

The development of ISS focused on collision mitigation, rising accident coverage costs and shortage of skilled drivers in the industry point towards the need of advanced safety technologies for trucks.

In North America, the legal environment poses significant barriers for OEMs offering safety technologies as a standard. The fear of lawsuits impedes rapid market penetration and growth of several nonmandated technologies, according to Frost & Sullivan. Improved legislative support, a clear return on investment, effective technologies reducing accidents and driver acceptance will ensure uptake of advanced safety technologies, the firm says.

With the market’s evolution, Frost & Sullivan says truck OEMs and system suppliers must work closely with each other as well as with new and disparate market groups such as telematics service providers. Rising awareness and the demand for standalone systems – such as stability control systems, tire pressure monitoring systems and lane departure warning systems – are expanding the revenue growth potential for participants.