Rates were pretty stable out of most of the major van markets last week, though some inbound lanes to the Northeast were down.

Rates were pretty stable out of most of the major van markets last week, though some inbound lanes to the Northeast were down.It’s looking more and more like we could get an early spring on the spot market. While the national average van rate declined for the sixth week in a row, it’s still higher than at any point in 2017 at $2.17 per mile – and it’s February. The pace of that decline slowed last week, and volumes are now ahead of where they were a month ago, so there are already signs that momentum is building. That could start to reverse pricing trends soon.

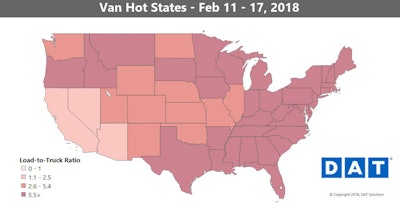

Hot van markets: Load counts rose in both Houston and Chicago, which could set the stage for prices to rebound in March. Rates were already up on some lanes out of the Gulf Coast. New Orleans to Dallas paid $2.15 per mile on average, 19 cents higher than the week before.

Not so hot: As you can see in the map above, trucks are relatively easy for brokers and shippers to find in California, Arizona and Nevada compared to the rest of the country. Several inbound lanes to the Northeast had falling rates, as retail freight slows in February. For example, the average rate on the lane from Columbus, Ohio, to Allentown, Pa., was down 23 cents at $3.56 per mile.

Reefer rates had farther to fall in February than van rates, so the declines in that segment have been sharper.

Reefer rates had farther to fall in February than van rates, so the declines in that segment have been sharper.There were some dramatic shifts in reefer volumes last week, which in addition to overall rate declines led to more price changes.

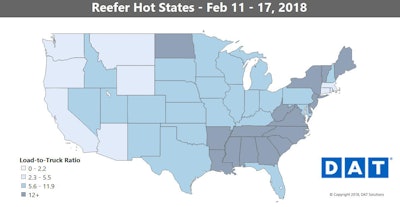

Hot reefer markets: Volumes were up big in four very scattered markets. Outbound volume rose in Nogales, Ariz., and Sacramento, Calif., but as you can see in the map above, there’s no shortage of trucks in those areas. Potatoes are on the move again, boosting load counts out of Twin Falls, Idaho, and Green Bay, Wis., though prices haven’t responded yet.

Not so hot: Most other produce areas are either inactive or have falling prices. Outbound rates from Florida have been unusually high, but volumes have started to back down. As a result, prices fell sharply on a couple of lanes out of Miami, like the one to Baltimore, but the average of $2.05 per mile is still high for February.

Flatbed volumes and prices are pretty similar to where they were last month, but both are much higher than they were a year ago.

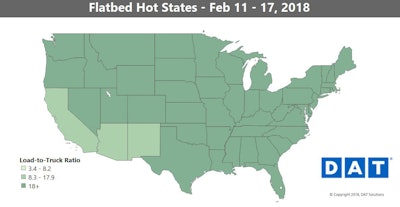

Flatbed volumes and prices are pretty similar to where they were last month, but both are much higher than they were a year ago.Hot flatbed markets: The Sunbelt and Gulf Coast are still strong, with Memphis rates up 6 percent. The No. 1 market for flatbed volumes is Houston, and the average rate edged up there as well.

Not so hot: There were a handful of significant declines. Flatbed rates out of Los Angeles fell 7 percent last week, while Roanoke, Va., prices continued to slide. Tampa, Fla., is often the lowest-paying of the major flatbed markets, but Phoenix got that dubious distinction this week.