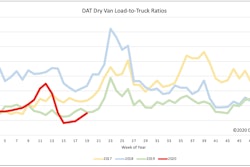

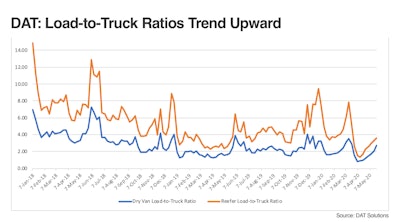

After steep declines in late March and April, van and reefer load-to-truck ratios are gearing up.

After steep declines in late March and April, van and reefer load-to-truck ratios are gearing up.Spot truckload freight markets picked up steam last week, as load-to-truck ratios increased for dry van, reefer and flatbed freight, said DAT Solutions, which operates the DAT network of load boards. Truckload rates followed suit, rising on most lanes just in time for June, typically a peak month for the spot market.

The number of posted loads on the DAT network of load boards jumped nearly 10% during the week ending May 31, which had one fewer workday because of Memorial Day. And compared to April, spot load posts increased 79.6% in May while truck posts declined 15.7%.

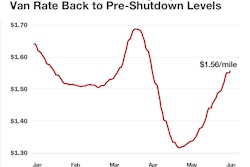

National Average Spot Rates Through May 31

**Van: $1.60 per mile, 3 cents lower than the April average

**Flatbed: $1.90 per mile, 4 cents lower than April

**Reefer: $2.02 per mile, 9 cents higher than April

Those are rolling averages for the month and current rates are higher. On June 1, the van spot rate averaged $1.72 a mile, the flatbed rate was $1.98, and the reefer rate was $2.08.

Trend to watch: Retail freight is moving

At 2.8 loads per truck, the national average van load-to-truck ratio is on track with the same period in 2019, a soft year for spot freight but an improvement compared to the last five weeks. Spot rates were higher on 79 of DAT’s top 100 van lanes by volume compared to the previous week.

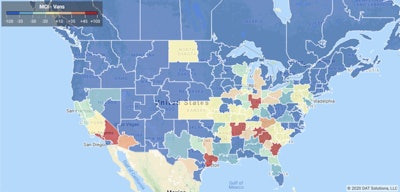

Retail freight markets and lanes are coming to life. Los Angeles averaged $2.32 per mile, up 12 cents compared to the previous week, and Stockton, California, averaged $2.09 per mile, up 15 cents. Rates from Atlanta ($1.80, up 9 cents), Charlotte, North Carolina ($1.82, up 14 cents), and Columbus, Ohio ($1.85, up 14 cents) also made strong gains.

DAT’s Market Conditions Index shows van load availability warming up in the middle of the country last week, a good sign for carriers.

DAT’s Market Conditions Index shows van load availability warming up in the middle of the country.

DAT’s Market Conditions Index shows van load availability warming up in the middle of the country.Market to watch: Border-market reefers

The national average reefer load-to-truck ratio was 3.7 last week, a half-point higher than the previous week. Rates increased on 42 of the top 72 reefer lanes by volume. Fourteen lanes had lower rates compared to the previous week, and half of those were out of Florida. In a one-week period, Miami to Atlanta went from an average of $1.87 to $1.68.

Peak shipping season for Mexican produce is driving demand for trucks in Nogales, Arizona; McAllen, Texas; and Ontario, California. Check out two lanes from Nogales:

**Nogales-Dallas: $2.89/mile, up 29 cents compared to a week ago. That lane averaged $1.88 a month ago.

**Nogales-Chicago: $2.41/mile, up 23 cents compared to last week and up 69 cents over the last four weeks.

A bonus market to watch: Georgia, where onions and blueberries are driving demand for trucks. Blueberries are noteworthy because they’re quick to perish and growers have urgency to get them to market, so they tend to fetch a premium. As temperatures rise, domestic blueberry shipments will shift north and eventually wrap up in the Pacific Northwest in late summer and early fall.