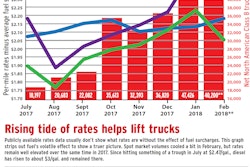

Normally there’s something of a freight lull after the end of the first quarter, as that urgency to get freight pushed out the door before month’s end falls off. The drop in demand typically leads to lower rates for truckers in early April, but that wasn’t the case for the week ending April 7. National average spot rates jumped up compared to the March averages.

Van: $2.24/mile, up 9 cents compared to March

Reefer: $2.48/mile, up 9 cents

Flatbed: $2.63/mile, up 10 cents

Last week also marked the first week during which trucks could be placed out of service for not having an electronic logging device installed. Truck posts were down, though not as dramatically as they fell back in December when the mandate first went into place. Still, it made for tighter capacity in many parts of the country, thus higher rates.

Last week also marked the first week during which trucks could be placed out of service for not having an electronic logging device installed. Truck posts were down, though not as dramatically as they fell back in December when the mandate first went into place. Still, it made for tighter capacity in many parts of the country, thus higher rates.Van hot markets: Rates from Los Angeles and Stockton, Calif., were up 2.6 percent and 2.5 percent respectively, with stronger shipper demand out of Stockton. Columbus, Ohio, was up 3.1 percent, and even perennial dead zone Denver had a solid 2.5 percent increase in outbound rates. Houston was up 1.8 percent but has gained more than 9 percent over the past four weeks.

Not so hot: Rates edged down again out of Chicago on lower volumes, but the decline was just 1.3 percent.

Van rates have been strong for loads going from Chicago to Atlanta, averaging $2.75 per mile for revenue, before expenses and including any fuel surcharge, last week. Prices on the return trip are better than they were a month ago at $1.76, but that’s still quite a bit less than the southbound trip. You can break that northbound trip into two hauls and boost your revenue on the roundtrip. Rates on the lane from Atlanta to the Huntington, W.V., market area surged up to an average of $3.28 per mile last week. From there, you can look for a load going back to Chicago. That last leg averaged $2.29/mile last week. The normal there-and-back trip averaged $2.26 per mile, while the TriHaul would boost the average revenue rate per loaded mile all the way up to $2.78. It adds a little over 200 miles to the trip, not counting deadhead, and if it works with your hours, it could be an extra $1,300 in revenue.

Van rates have been strong for loads going from Chicago to Atlanta, averaging $2.75 per mile for revenue, before expenses and including any fuel surcharge, last week. Prices on the return trip are better than they were a month ago at $1.76, but that’s still quite a bit less than the southbound trip. You can break that northbound trip into two hauls and boost your revenue on the roundtrip. Rates on the lane from Atlanta to the Huntington, W.V., market area surged up to an average of $3.28 per mile last week. From there, you can look for a load going back to Chicago. That last leg averaged $2.29/mile last week. The normal there-and-back trip averaged $2.26 per mile, while the TriHaul would boost the average revenue rate per loaded mile all the way up to $2.78. It adds a little over 200 miles to the trip, not counting deadhead, and if it works with your hours, it could be an extra $1,300 in revenue. Tighter capacity last week affected reefer rates, too. Prices rose on the majority of the top 72 reefer lanes, despite lower volumes, suggesting that brokers and shippers had a harder time finding trucks last week.

Tighter capacity last week affected reefer rates, too. Prices rose on the majority of the top 72 reefer lanes, despite lower volumes, suggesting that brokers and shippers had a harder time finding trucks last week.Hot reefer markets: Out of California: Fresno outbound pricing jumped 4.4 percent on higher volumes, and Los Angeles rates rose 3.9 percent. Ontario prices climbed 2.3 percent on average, but volumes out of the Imperial Valley were once again lower last week.

Dallas volumes were weaker, but the average outbound rate increased 4.9 percent. Several outbound Dallas lanes posted solid gains:

- To Houston, up 8¢ to $3.15/mile

- To Phoenix, up 22¢ to $2.28/mile

- Columbus, Ohio, up 13¢ to $3.15/mile

Not so hot: That lull after Easter? It was in force in Philadelphia, despite the fact that the rest of the state is dark in the map above, indicating high load-to-truck ratios and typically high demand. Without the run-up to the holiday weekend, the volume of outbound reefer loads dropped and the average rate was down 2 percent.