Of the top 100 van lanes, 45 had higher rates in the last week while 46 paid less. The other nine held steady from the week before.

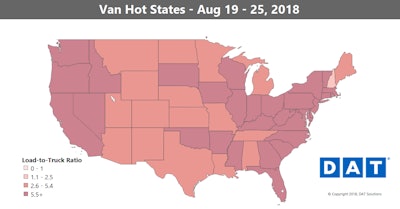

Of the top 100 van lanes, 45 had higher rates in the last week while 46 paid less. The other nine held steady from the week before.Back-to-school season and the upcoming Labor Day weekend made for a tighter spot market last week. That slowed the recent trend of falling rates. The national average for van rates was down just 1 cent at $2.15 per mile, and on a lane-to-lane basis, the market stayed pretty well balanced.

Hot markets: The West and Midwest gained strength last week, offsetting the softer markets in Texas and parts of the Southeast. Prices rose the most out of Denver and Columbus, Ohio. Even when they’re up, Denver rates usually aren’t much to get excited about, but the average rate on the lane from Columbus to Buffalo, N.Y., jumped up 23 cents to $3.86 per mile.

Not so hot: Outbound rates for Houston and Memphis have dropped off the most in the past month. The slowdown in Texas has had a nationwide impact, with the capacity that was busy there earlier in the year now spread across other parts of the country.

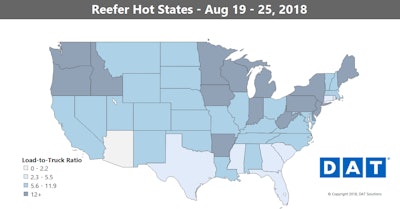

The combo of Labor Day and back-to-school season can lead to an especially big surge in reefer demand. This year that happened to coincide with late-summer harvests in the Upper Midwest, Pacific Northwest and parts of the Northeast.

The combo of Labor Day and back-to-school season can lead to an especially big surge in reefer demand. This year that happened to coincide with late-summer harvests in the Upper Midwest, Pacific Northwest and parts of the Northeast.Hot reefer markets: We’ve seen triple-digit load-to-truck ratios for flatbed freight before, but it’s extremely uncommon for reefers. The Pendleton, Ore., market crossed that threshold last Friday, with 117.8 reefer loads per truck. That market includes parts of Southern Washington and Northeast Oregon, where apple, pear, onion and potato harvests are underway.

Not so hot: As you can see in the Hot States Map, most of the activity has moved northward, with loose capacity across the flash-frying southern band of states this late August.

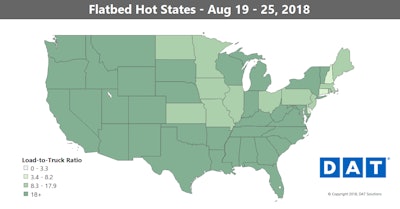

The national load-to-truck ratio for flatbeds spent the first half of the year setting all-time records, with more than 100 flatbed loads per truck across the country. That’s fallen steeply in recent months, but volumes rebounded last week, with the national ratio edging up to 28.4 loads per truck after 10 weeks of declines.

The national load-to-truck ratio for flatbeds spent the first half of the year setting all-time records, with more than 100 flatbed loads per truck across the country. That’s fallen steeply in recent months, but volumes rebounded last week, with the national ratio edging up to 28.4 loads per truck after 10 weeks of declines.Hot flatbed markets: There were more loads moving out of Cleveland and Houston last week, but the big surprise has been Roanoke, Va. That’s typically a small market for flatbed freight, but a newly expanded steel mill there appears to be generating more freight and may be benefiting from the tariffs on foreign competition. Roanoke is also home to warehouses and distribution centers that take advantage of railroad access that serves seaports that are two to three hours away.

Not so hot: Some flatbed sectors have slowed seasonally. Raleigh, N.C., to Miami is a lane that often bounces up and down, and last week it was down 60 cents at $2.91 per mile. Las Vegas to Los Angeles and Rock Island, Ill., to Indianapolis were a couple other lanes with big declines.