Van volumes have been holding firm in recent weeks, but there have been more trucks competing for those loads, notes DAT analyst Matt Sullivan. “That, plus the relative lack of urgency when it comes to long-haul freight during this time of year, has pushed prices lower on the spot market.”

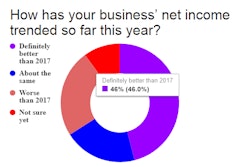

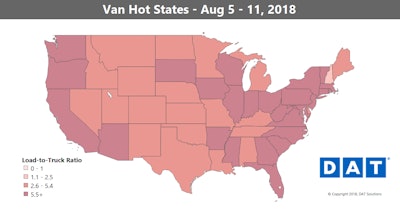

Van volumes have been holding firm in recent weeks, but there have been more trucks competing for those loads, notes DAT analyst Matt Sullivan. “That, plus the relative lack of urgency when it comes to long-haul freight during this time of year, has pushed prices lower on the spot market.”Van overview: Brokers and shippers have had an easier time finding trucks in recent weeks, at least when compared to the first half of the year. That’s taken some of the pressure off of pricing, but rates are still high on a year-over-year basis. Overall, van volumes have settled to around the same level as 2017, but the national ratio of 6.9 van loads per truck is much higher than a year ago. The ratio for August 2017 was 5.2.

Hot markets: Van load counts were on the rise out of Los Angeles and Atlanta, but that was offset by declines out of Texas (more on that below). Prices were down in most major markets last week, but rates in the Midwest held up the best. With the lack of urgency for long-haul freight Sullivan mentioned earlier, a lot of shipping has moved over to rail. The increases we did see were on regional lanes like Columbus, Ohio, to Buffalo, N.Y., which was up 23 cents to an average of $3.77 per mile.

Not so hot: Outbound van rates from Dallas and Houston have fallen more than 10 percent in the past month. Pipelines are filled to capacity in the West Texas oilfields, leading to a slowdown in drilling. Steel tariffs have also made new pipeline projects more expensive, since it’s not easy to source domestically.

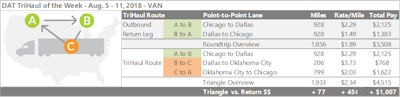

Van rates for moves between Chicago and Dallas pretty well illustrate how Midwest prices are holding steady while rates out of Texas have slipped. The southbound trip paid an average of $2.29 per mile last week, while the northbound trip out of Dallas fell to a paltry $1.49. Splitting the return could push your average rate well above $2/mile with a short haul from Dallas to Oklahoma City. That paid $3.73/mile on average last week. For the final leg of the trip from OKC to Chicago, the average rate was $2.03. The extra leg only adds about 77 miles, but if you just negotiate for the average rate on each lane, you’d be getting $2.34 per loaded mile for the TriHaul instead of just $1.89 on the regular roundtrip. That works out to more than $1,000 in revenue if you can make it work with your schedule.

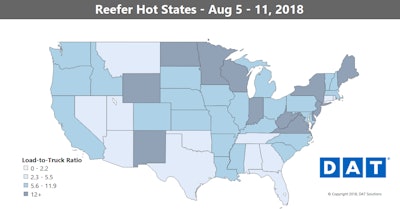

Van rates for moves between Chicago and Dallas pretty well illustrate how Midwest prices are holding steady while rates out of Texas have slipped. The southbound trip paid an average of $2.29 per mile last week, while the northbound trip out of Dallas fell to a paltry $1.49. Splitting the return could push your average rate well above $2/mile with a short haul from Dallas to Oklahoma City. That paid $3.73/mile on average last week. For the final leg of the trip from OKC to Chicago, the average rate was $2.03. The extra leg only adds about 77 miles, but if you just negotiate for the average rate on each lane, you’d be getting $2.34 per loaded mile for the TriHaul instead of just $1.89 on the regular roundtrip. That works out to more than $1,000 in revenue if you can make it work with your schedule. Reefer markets took a step back last week, and the national load-to-truck ratio actually dipped below where it was at this time a year ago — it’s showing its weakness all around the nation in the map above.

Reefer markets took a step back last week, and the national load-to-truck ratio actually dipped below where it was at this time a year ago — it’s showing its weakness all around the nation in the map above.Part of the softening demand in reefer this past week is that freight moves out of California have stalled, perhaps hampered by wildfires and the heat wave. As a result, the California volumes weren’t there to offset the declines in other parts of the country, which led to more available trucks.

Hot markets: Melon shipments bolstered load counts from McAllen, Texas, down near the Mexico border. Apple season also boosted volumes out of Upper Midwest markets like Green Bay, Wis., and Grand Rapids, Mich. From a pricing standpoint, Elizabeth, N.J., was the only major reefer market with rates trending upward.

Not so hot: Two of the biggest declines were out of California. The average rate from Fresno to Seattle dropped 24 cents to $3.41 per mile. Sacramento to Portland, Ore., fell 21 cents but still averaged $3.90 per mile.