Following the recession, the owner-operator population continues to grow.

Following the recession, the owner-operator population continues to grow.Overdrive does the industry’s most authoritative annual survey of the owner-operator population. The latest report, just out, says demand for your services is high and the balance of leased and independent operators continues to shift.

Here are six key points from the survey, conducted by Commercial Motor Vehicle Consulting:

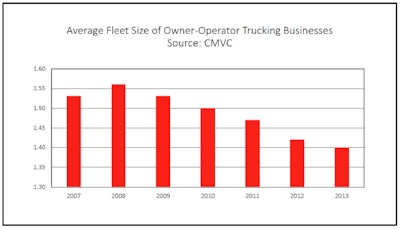

- 2013 was the third year in a row that the owner-operator population grew. It reached 171,400 in 2013, up from 149,900 in 2010, at the tail end of the recession. (For this survey, owner-operator businesses are defined as ones where the owner drives a truck and the business is engaged in for-hire transportation services.)

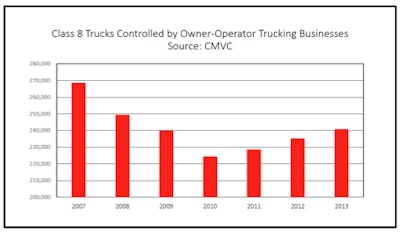

- 2013 was also the third year in a row that the number of trucks controlled by owner-operators grew, from 224,300 in 2010 to 240,800 in 2013. However, that growth isn’t as fast as the growth of owner-operators, who typically enter the industry with one truck, which leads to the next point:

- The recession really hurt. Even though the owner-operator truck population has grown for three years, it’s still 14 percent (38,200 trucks) below the peak in 2006.

- The outlook for owner-operators is good, Brady says. “Economic growth is stimulating demand for for-hire transportation services, and for-hire industry capacity utilization is at a relatively high rate, so carriers are increasing programs and compensation to attract and retain owner-operators,” he says.

The Overdrive report is based on U.S. Census data, carriers’ financial reports, Bureau of Labor Statistics data and other sources.