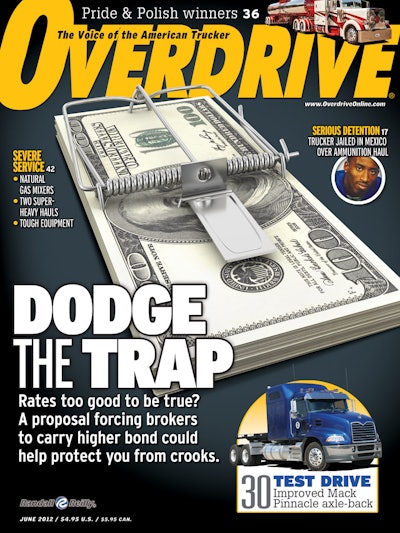

Claims filed against a bad broker sometimes exceed over $100,000, though only $10,000 is required for bonding.

Claims filed against a bad broker sometimes exceed over $100,000, though only $10,000 is required for bonding.Small brokers oppose proposed regs to increase the minimum bond to $100,000 and add other owner-operator protection.

The high-profile case of fraudulent freight middleman Kulwant Singh Gill stunned many for its sheer brazenness. In March, Gill was sentenced to 11 years in prison and ordered to pay restitution to his carrier victims. In the wake of the case, debate over broker fraud got some new legs.

A big part of that debate is H.R. 2357, or the Fighting Fraud in Transportation Act, introduced in Congress last year. It’s been included this year in attempts at a multi-year transportation reauthorization bill in the House and Senate. The measure would raise the broker surety bonding minimum requirement from $10,000 – a level that hasn’t been changed since the late 1970s – to $100,000.

Moreover, it would impose new requirements on brokers and freight forwarders and the financial services companies that back them. At press time, the two-year MAP-21 Senate legislation that included the bond hike was in a House-Senate conference committee. There, it would be combined with a House-approved temporary extension of current funding levels. New initiatives, like the bond increase, might not survive the committee compromise.

Supporters of the hike, including the Owner-Operator Independent Drivers Association and the Transportation Intermediaries Association, which represents large and some smaller brokers, say the increased bond would make it more difficult for irresponsible operators to enter the business.

New regulatory requirements would also help ensure prompt payment to owner-operators who utilize brokers. Specifically, surety providers would be required to pay claims no later than 30 days after the 60-day period for submission of claims. They would also have to post public notices of claims and to notify the Federal Motor Carrier Safety Administration in advance of any pending bond cancellation.

The U.S. government would be equipped with the power to take civil actions with penalties against brokers, freight forwarders or surety providers who violate the law.

Detractors object to the cost of higher bonds, roughly $3,000 to $5,000 more for a financially secure operation per year to secure $100,000 coverage. They believe it would kill some legitimate small brokerages. The bond hike would go much further than compensating for inflation – $10,000 in 1980 dollars is roughly $26,000 today.

“Every day we hear from truckers who have been cheated by bad brokers out of compensation for hauling a load,” OOIDA says in a policy paper. “Often when we file a claim against a broker’s surety bond, $150,000 or more of claims have already been filed against the $10,000 bond.” Claims filed in excess of the minimum bond amount are often never paid.

Today’s broker regulatory system “was created when there was an Interstate Commerce Commission and there were fewer than 100 brokers in the country,” says OOIDA Executive Vice President Todd Spencer. “Deregulation opened the door for anyone to do anything they chose to in trucking, and the lack of any real effective oversight of brokers has created an opportunity that many have taken full advantage of to exploit the system to short truckers.”

All too commonly, he adds, brokers offer shippers and truckers “too-good-to-be-true rates” with no intention to pay. He asks, “Is it unreasonable to expect a service provider – a regulated, authorized entity in the motor carrier industry – to have at least the financial security to ensure $100,000 worth of payments to motor carriers?”

Despite the harmony suggested by the bond-increase measure’s mutual support from OOIDA and TIA – the nation’s most prominent broker association – debate on the issue hasn’t exactly been warm and fuzzy.

A group representing small brokers, the Association of Independent Property Brokers and Agents, believes $100,000 is too high. Its “Open Letter to OOIDA,” published on the association’s website after the introduction of H.R. 2357 last year, pleads with OOIDA members to consider the plight of small brokers.

One proposed new regulation would help ensure prompt payment to owner-operators who utilize brokers.

One proposed new regulation would help ensure prompt payment to owner-operators who utilize brokers.“If the bond were to be drastically increased as proposed,” the letter reads, “small and mid-sized property brokers would not be able to afford the premium and/or the cash collateral requirements that would be imposed by surety companies. As a result, thousands of small business owners … would be forced out of business.”

AIPBA has around 130 members. It formed after the first such bond increase was proposed, with the support of TIA, in the Senate in 2010.

AIPBA’s leader, former New York DOT investigator and independent broker trainer James Lamb, says a $10,000 bond can be purchased for $350 to $550 yearly. At that same rate, a $100,000 bond would cost $3,500 to $5,500.

However, for small brokerages, it doesn’t make sense for surety companies to guarantee $100,000 when there isn’t enough collateral to back that up, he says. Instead, surety providers would have to demand as much as $100,000 cash paid up front for some small operators.

Lamb also believes backers of the bond increase misrepresent the problems by overusing the term “fraud.”

In the high-profile Gill case, for instance, the perpetrator was posing as a carrier, booking loads from load boards, then posing as a broker to other carriers who actually moved the loads while he took payment for nothing. To mask his activities, Gill reportedly changed the names on his carrier and broker company filings.

While a higher bond could act as a deterrent for such people, most payment problems are much less dramatic or deceptive, and could be addressed in ways that don’t discourage competition in the industry, Lamb says.

He favors regulatory adjustment over what he sees as “Congressional overstepping.” He offers a compromise bond level of $25,000, which would adjust for inflation since 1980.

He would also require brokers to maintain cash in a “fiduciary trust account” at a level proportional to freight volume. “Money is collected from the broker and it has to go into an escrow account – they can’t touch that money because it goes to carriers.”

Some brokers voluntarily allocate their operating and reserve monies in this manner already, says Lamb. “When they’re starting to go down, they use that money. This idea is that they couldn’t touch the money – if we can incorporate that idea with the $25,000 amount, it would still be a level playing field” for smaller brokerages with their large competitors, Lamb believes.

Landstar Ranger-leased, formerly independent owner-operator Gordon Alkire favors graduated minimum bond or trust levels. “If you make $500,000 yearly and you use a lot of trucks, you need to have a bond to cover a lot of trucks,” he says.

Not so for a truck driver’s wife who may broker a load a week, he says.

Spencer says OOIDA has considered such graduated levels, but doesn’t see a need for it. “This isn’t a problem that exists with large brokers,” Spencer says. “I doubt there’s a large broker that’s ever had their bond tapped. There’s simply no point in designing something that’s broader than it needs to be to address the issue.”

A $100,000 bond “doesn’t ensure that a bad broker will never be around, but the crooks have had free reign for decades,” Spencer says. “The legitimate business people shouldn’t have to compete with the crooks.”

New tool in the anti-fraud arsenal

Broker Dan Metully, of TFI Logistics in Stevensville, Mont., has launched an online tool that he hopes will enable owner-operators, carriers and other parties to self-police the freight world.

TransportWatch.com allows users to market their services as well as post alerts on bad actors — whether brokers, carriers or shippers — they’ve dealt with.

“We may not be able to get anybody’s money out to him,” Metually says, “but we might be able to save the next guy, and then the next guy provides some information about somebody else he has dealt with, and maybe that information will save you.”

OOIDA Executive Vice President Todd Spencer is skeptical. The service “looks to me like we’ll tell him who the bank robbers are so he’ll let the banks know and they can lock the door when they see” the bank robbers coming. Instead, the bond increase would do more to “close the door … to begin with,” he says.

How to spot bad brokers

Owner-operators can do a lot to prevent getting stiffed by a bad broker on a load. Absent a personal referral, do your research on any freight middleman you’ve never worked with.

Long-operating credit-rating services such as RED BOOK (redbooktrucking.com, $150 annually, $25 monthly) and RTS CREDIT (rtscredit.com, (800) 506-7438 for pricing after five-credit-report free trial) offer a wealth of information on registered brokers. RTS’ daily credit alert e-mails make note, likewise, of any significant credit-rating downgrade.

Likewise, premium memberships with load matching services like those of INTERNET TRUCKSTOP (truckstop.com) and Transcore’s TRUCKERSEDGE (truckersedge.net) both offer users days-to-pay credit scoring on brokers who utilize their boards.

GETLOADED.COM offers the credit-scoring services of TRANSCREDIT (transcredit.com, also available as a stand-alone service) in its $29.99 monthly package.

Bonding companies’ role in payment conflicts

It’s too easy for truckers to file claims on surety bonds, says Sanders Transportation Management President James Sanders. For that reason, he’s been mobilizing “opposition against this bond issue,” says Sanders, who’s a consultant to bond provider Pacific Financial Services.

“The word among motor carriers is,” he says, “if you file a claim with a bond company with an adjuster that doesn’t understand the business, you can get paid for delivering a load of Christmas trees on New Year’s Eve.”

Pacific Financial, he says, writes sureties for roughly 5,000 brokers large and small — “a quarter of all 20,000 licensed brokers in the country,” he says.

“Claim volume has been going down,” he says, from roughly 15,000 claims inquiries in 2010 to 10,000 in 2011. “Ninety percent of these are resolved through a telephone call” to the broker saying something like “you’re 120 days out — if you don’t pay [the carrier], we’re going to have to cancel your trust.”

Extrapolating from Pacific’s numbers, a total 4,000 claims a year are actionable, whether disputed or in the case of the broker going out of business, Sanders estimates.

That’s “one claim filed in the calendar year for every 100 motor carriers,” he says. “That’s the ‘financial emergency’ that’s caused the TIA and their buddies to try to get rid of 75 percent of the brokerage industry?”

OOIDA’s Todd Spencer says surety providers are part of the overall problem. “The bonding companies are the partners of these crooked brokers,” he says. “They can sit on claims for 60 or 90 days without notifying anyone that claims are being filed on the bond.”

For claims that go the distance, after subtracting attorney’s fees and other costs, “virtually no one gets anything,” he says.