The Association of Independent Property Brokers and Agents is suing the Federal Motor Carrier Safety Administration over a substantial hike in the broker bond requirement.

The FMCSA requires a $10,000 surety bond or trust fund agreement for brokers and freight forwarders. The 2012 highway reauthorization act mandates that amount increase to $75,000 on Oct. 1.

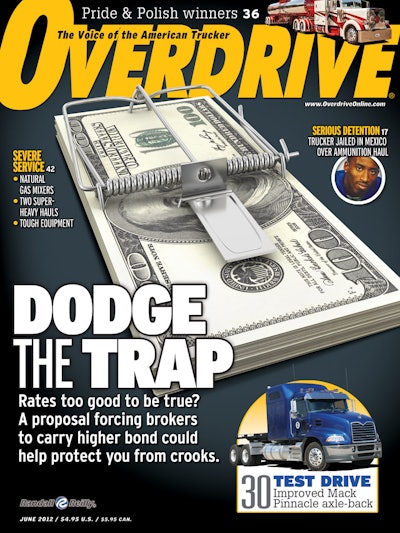

Overdrive reporting on efforts to raise the broker minimum surety requirements in June 2012. Read that story here.

Overdrive reporting on efforts to raise the broker minimum surety requirements in June 2012. Read that story here.On July 16, the 1,800-member not-for-profit trade group filed its complaint in federal district court in Ocala, Fla. Association President James Lamb said the $75,000 bond amount is arbitrary and “not rationally related to a legitimate government purpose.” Other charges include that the FMCSA violated the Administrative Procedure Act by not conducting rulemaking to set the new bond amount, he said.

The increase marks the first change in the amount required since the mid-1980s and was backed by the Transportation Intermediaries Association, the third-party logistics industry professional group.

TIA worked with the Owner-Operator Independent Drivers Association and the American Trucking Associations on the legislation they said was targeted at mitigating marketplace fraud.