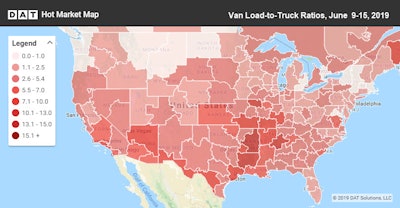

The West and Southeast were solid regions for finding van freight last week.

The West and Southeast were solid regions for finding van freight last week.As expected, the number of trucks posting their availability to DAT Solutions’ spot freight market jumped last week — the week after CVSA’s annual Roadcheck enforcement initiative, when many owner-operators tend to take a week off. The number of truck posts climbed 14 percent during the week ending June 16, DAT says. But the number of load postings also fell, causing the load-to-truck ratio to swing against truckers’ favor in all three major truckload segments — dry van, reefer and flatbed.

Still, national average per-mile rates are trending above May’s averages.

National average spot rates, through June 16:

*Van: $1.90/mile, 11 cents higher than the May average

*Reefer: $2.26/mile, 11 cents higher than May

*Flatbed: $2.32/mile, 4 cents higher than May

Trend to watch: Produce in full swing

While the national average reefer load-to-truck ratio dropped from 6.4 to 4.5, refrigerated volumes increased out of California and Texas, signaling that produce season has begun. Average outbound reefer rates were higher in Sacramento ($2.76/mile), Ontario ($2.80/mile), and Fresno ($2.46/mile)—three of the top four California markets (Los Angeles fell 2 cents to $2.93/mile). Freight volumes were up more than 40% out of Nogales, Arizona, on the Mexico border. The largest reefer lane-rate increase was Nogales to Dallas, up 49 cents to $3.36/mile. There’s a need for reefers to move cross-border produce, DAT says.

Market to watch: Vans in the Southeast

The national average van load-to-truck ratio dipped from 3.8 to 3.0 and rates were lower on 61 of the top 100 van lanes by volume. But key lanes for retail goods in the Southeast have started to pick up. Memphis to Charlotte paid $2.16/mile, up 6 cents, and Charlotte to Memphis paid $1.65, up 3 cents, for a roundtrip average of $1.91/mile. That’s a 9-cent gain compared to the previous week.

Even on lanes where the rate dropped in one direction, several major roundtrip averages still improved over the previous week. Memphis to Atlanta went for $2.50/mile, up 10 cents, while Atlanta to Memphis paid $1.86/mile, down 3 cents. The roundtrip average was $2.18, up 7 cents week over week.