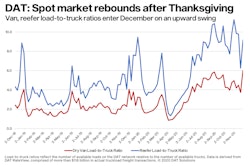

Spot truckload freight postings fell 15% by volume while the number of trucks posted as available on the DAT load boards increased 13% last week, a sign metrics are loosening ahead of the Christmas holiday, said DAT Freight & Analytics.

National average rates, December through the 13th

**Van: $2.48 per mile, 4 cents higher than November

**Flatbed: $2.44 per mile, 1 cent higher

**Reefer: $2.66 per mile, 3 cents lower

More van freight, lower rates | The number of loads moved on DAT’s top 100 van lanes by volume jumped 24.2% compared to the previous week, but the average spot truckload rate fell on 62 of those lanes. The rate was neutral on 19 lanes and increased on 19 lanes.

Each of the top 10 van markets registered double-digit increases in volume compared to the previous week but recorded lower average outbound rates. Among them:

**Chicago: $2.99/mile, down 11 cents even with a 23.4% increase in volume

**Los Angeles: $3.34, down 11 cents on a 24% increase in volume

**Stockton, California: $2.77, down 16 cents on an 18% increase in volume

**Atlanta: $2.50, down 16 cents on a 20% increase in volume

**Houston: $2.09, down 1 cent on a 27% increase in volume

The busiest lanes for van load volume last week involved Los Angeles and Stockton. L.A. to Stockton averaged $3.76 a mile, up a penny, while Stockton to L.A. averaged $2.16 a mile, down 8 cents.

Reefer volumes cool | Nationally, the average reefer load-to-truck ratio dropped from 9.0 to 5.5 last week, with food shipments in a lull between holidays. The number of loads moved on DAT’s top 72 reefer lanes by volume has fallen nearly 21% over the last four weeks.