Updated July 18, 2022, to include information about the 2022 2290 filing season.

ATBS Business Consulting Manager Chris Goodsell notes that early in Form 2290 filing season for working independents there's plenty of time to avoid e-file service fees by just

ATBS Business Consulting Manager Chris Goodsell notes that early in Form 2290 filing season for working independents there's plenty of time to avoid e-file service fees by just

The summer of 2020 was remarkable in many ways – a spot freight surge began to change rates dynamics in fundamental ways as the COVID-19 pandemic scrambled supply chains, the virus itself was moving all around the nation, and nearly every in-person trucking event to speak of was canceled. Plenty tax deadlines had been extended, furthermore, from the spring in order to give U.S. citizens and businesses relief in an increasingly topsy-turvy time, in economic terms.

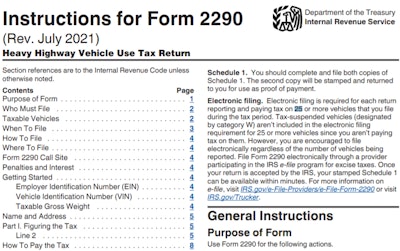

One deadline, however, would stand firm – the Aug. 31 date on which most independent owner-operators and fleets of all sizes must file Form 2290 with the Internal Revenue Service to pay annual Heavy Highway Vehicle Use Tax.

There was no relief on the deadline in 2021, either, and for 2022, July 1 as usual marked the opening of the 2022-'23 filing season..

For single-truck owner-operators running continuously throughout the year, the HHVUT isn't a heavy lift at a maximum of $550 per truck. As such, it's a tax that can be easy to overlook, with penalties for late payment or nonpayment as with other filings, business service firm ATBS said in a recent reminder/primer on the subject: "It's an important tax for owner-operators to be aware of and to be prepared to address every year."

Some exceptions to that rule apply for operators in lease-purchase agreements with carriers and/or leasing companies, said Chris Goodsell, ATBS business consulting manager. The owner of the truck is required to pay the tax. Thus, if you're leasing the truck, the title remains with the carrier or leasing company until your purchase at the end of the term. "Is the carrier filing the 2290 or does the owner-operator file it?" Goodsell notes a question that comes up often enough. A number of carriers might chargeback the cost of the tax with the terms of the lease, handling it through settlement deductions, or a leasing company could require the operator to file the tax in the terms of the lease contract.