Transport Capital Partners’ Second Quarter 2013 Business Expectations Survey reveal, released last week, revealed trends for rates and volumes that were positive in aggregate for the trucking industry, but for smaller carriers the outlook was less rosy.

Results overall broke a three-year trend of declining expectations, TCP reports, for volume growth. More carriers now report expecting volumes for Q2 to hold steady. Opinions diverge between larger carriers, defined as those with more than $25 million in revenues, and smaller carriers. While 50 percent of both groups expected volumes to increase, almost 40 percent of smaller carriers saw volumes on the decline, with only 3 percent of their larger competitors expecting a decrease. While 40 percent of larger carriers expect volumes to remain the same, just 11 percent of smaller carriers see volumes holding steady.

“As the economy waits to sort out the cross currents of macro events and the change in Federal Reserve policies, freight volumes struggle to grow significantly,” said Richard Mikes, a TCP partner.

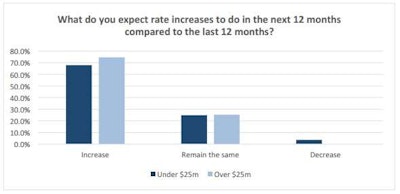

Smaller carriers were slightly less optimistic on rates than large ones, according to results here from Transport Capital Partners Business Expectations Survey for Q2 2013.

Smaller carriers were slightly less optimistic on rates than large ones, according to results here from Transport Capital Partners Business Expectations Survey for Q2 2013.Rate performance, meanwhile, remains at idle, TCP reports. Looking back, just 18 percent of carriers have seen rates increase in recent times, up slightly from 11 percent reporting the same last quarter. In a bright spot for smaller trucking companies, more smaller carriers are reporting rate increases than larger carriers — 25 percent versus 14 percent.

Though “even with modest improvement in freight demand, carriers are anticipating much needed higher rates from customers,” says Steven Dutro, TCP partner. A large majority of carriers in aggregate (80 percent) have seen rates hold steady over the past quarter. Optimistically, most carriers large and small (73 percent) also expect rates to increase in the next 12 months.

For full results from the survey, download this TCP analysis.