If you’re an owner-operator running on your own authority or have a small fleet of trucks, you know broker days-to-pay has been high in recent years.

Paul Wrzesinski, operations manager for Bethlehem, Pa.-based 15-truck Patrick Trucking Services, says some of the biggest, most credit-worthy brokers often pay beyond 30 days. He says he’d seen days-to-pay of up to 46 days from one of the nation’s largest truckload freight brokers.

Since the 2008 financial meltdown, credit is much tighter, too, further squeezing cash flow, says Wrzesinski. The smaller the trucking company, he adds, the harder it is to get credit.

“It is not uncommon for me to deliver a load and do the paperwork in my truck, using FedEx and having funds wired to my checking account within 24 hours.” — Angel Teaming owner-operator Tom Rethelford, about nonrecourse D&S Factors. D&S offers free TripPak Services for mailing, though Rethelford says he uses FedEx for better speed.

“It is not uncommon for me to deliver a load and do the paperwork in my truck, using FedEx and having funds wired to my checking account within 24 hours.” — Angel Teaming owner-operator Tom Rethelford, about nonrecourse D&S Factors. D&S offers free TripPak Services for mailing, though Rethelford says he uses FedEx for better speed.Instead of waiting for slow and sometimes uncertain payment, some independents turn to factoring companies to get access to invoiced amounts from their loads as quickly as 24 hours after delivery. Competition has reduced factor rates below what many brokers charge for their quick pay option, plus factors have expanded services to include providing access to broker credit information, collections and accounting services. While still saddled with an unsavory image, factors today can streamline cash flow for independents at a reasonable rate, freeing their clients to focus on finding freight.

Using a factoring service, you’re selling your broker or shipper invoices in return for immediate payment minus a percentage of the total. There are two types of factors.

Recourse factors

Recourse services typically fund 90 percent or less of the invoice initially, taking 3 percent to 5 percent off the top. They put the remainder in an interest-bearing reserve account, available upon collection of the invoice from the broker (usually) or shipper. In this type, the factor holds the “recourse” in its name, as ultimate responsibility for obtaining the invoice lies with the carrier. If the factor’s attempts to collect from a broker continue to fail after about 70 to 90 days, Wrzesinski says, “the factor has the right to go after us” for the entire amount of the load.

Because responsibility for obtaining payment ultimately lies with carrier, recourse factors offer independents and small fleets a low rate, generally, and a great deal of flexibility in what loads they will factor, making them popular with haulers working with new, untested brokers and other customers.

“My average customer is doing about $80,000 to $100,000 a month,” with five or more trucks, says Jeff Foil, president of SevenOaks Capital Associates, the company Wrzesinski’s worked with for seven years. “Daily or weekly, they send their invoices to me – we send 80 to 90 percent up front. When [the broker or shipper] pays in 30 days, we take out our fee and the difference [goes] in a reserve account,” available to the customer immediately.

The percentage rate ranges and variance in contract terms with SevenOaks that Foil describes depend, as with other factors, on carrier size, volume of carrier invoices and the “quality of the people you haul for,” he says. “My average guy might pay 2 percent for anything paid under 30 days, an additional 1 percent every 15 days thereafter.”

Other factors customize rate structures to fit client needs. “Our rates vary depending on the volume,” ranging from 1.5 percent to 4 percent, says Chad Wulf, vice president of RMP Capital. He says some customers, rather than take a flat rate that bumps to another rate after a predetermined period, prefer to go with a per diem, or daily, rate.

Nonrecourse factors

Internet Truckstop’s D&S Factors is a nonrecourse service, one that takes on the collection burden entirely. These have a simpler, though higher rate structure, and will not factor just any invoice.

“As a nonrecourse factoring company, we’re going to be more selective about the brokers we’re willing to take a risk on,” says D&S Factors President Diana Clover. The benefits for the carrier come in not having to worry about a struggling broker not paying, or, worse, going out of business, putting you on the hook for the money.

Nonrecourse factors have no reserve accounts. “We fund the entire load immediately,” taking a flat fee of 5 percent that doesn’t vary by the account, Clover says. “With us it’s kind of what you see is what you get.”

Some companies, like Factor Loads, offer both nonrecourse and recourse programs.

Angel Teaming two-truck fleet owner-operator Tom Rethelford, of Kentland, Ind., factors his mostly direct loads for a shipper of aluminum coils, hauled in dry vans, with D&S Factors. He and haulers like him prefer the simplicity of the flat nonrecourse rate to the tiered rates and withholding used by recourse factors.

When Rethelford switched to a recourse factor for a brief time, they were “a couple percentage points better initially, but if the broker didn’t pay within so many days, it’d get up to the price that D&S charges,” Rethelford says.

Factors as partners

Omaha, Neb.-based Nydin Transport owner-operator Terry Angleton sends the majority of his brokered loads through recourse factor Outsource Financial Services at a flat 3 percent rate. Before that, he frequently took quick pay advances from a broker for a flat $30 each. “Sometime it was an advance on $1,000, sometimes $1,250,” says Angleton. “But sometimes the load might have paid only $700, and he was still charging me $30.”

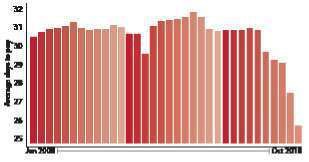

PAYMENTS SPEED UP -- Speed of payment increased significantly in late 2010 as freight demand picked up and brokers worked harder to retain their customers. The days-to-pay average reflects all brokers, shippers, freight-forwarders and manufacturers in Internet Truckstop’s CreditStop database.

PAYMENTS SPEED UP -- Speed of payment increased significantly in late 2010 as freight demand picked up and brokers worked harder to retain their customers. The days-to-pay average reflects all brokers, shippers, freight-forwarders and manufacturers in Internet Truckstop’s CreditStop database.Factoring solved Angleton’s cash flow problems and saved him a little on advances. But as with others using factoring services, he found added value in collections assistance, online accounting services and credit information gathering.

Mainstream factoring companies view their customer relationships as a partnership, though memories of past loan-shark practices remain with many carriers, says Foil. “When I go to an ATA [American Trucking Associations] conference, you say you’re a factor and they look at you cross-eyed.”

Those old tactics have faded away in recent years. Competition has reduced rates and broadened services factors offer. Both recourse and nonrecourse factors often offer broker credit information at no charge to their customers, via phone and/or online portals.

Some also serve an advisory function, too. Says Clover, “When [carriers] call in to see whether a load’s factorable with D&S or not, some will say, ‘What information do you have on this company?’ ” If the broker will pay quickly, Clover adds, it makes sense for the carrier to skip the factor. Giving customers that freedom is a hallmark of a good factoring service, she says.

RMP Capital approaches the subject similarly, says Wulf. “We kind of take the guesswork out of loads hauled for some of these companies.” A customer worried about an unfamiliar broker will often call to ask whether RMP’s done business with them. “If we have some experience” with that broker, he says, “we can tell them, or at the least pull a credit report on them.”

In accounting, too, a recourse factor can be a useful partner in tracking business performance via online invoice inventories and accessible payment histories. In the collections department, good factors often help apply payment pressure on a broker or, less frequently, a shipper. Says Foil, “On day 30, we call. About 40 to 45 days we’ll get a collection call out there. If we need to file on the bond for a broker, we’ll do that.”

When a factor is used, in effect, as an outsourcing of your collections effort, it can free up time for you to focus on gaining new business. It can also help a one-truck independent get established with a stable shipper, says Aaron Rapaport of Outsource Financial Services. That’s what happened with Angleton, who snagged his primary direct contract after working with Outsource on brokered loads from that shipper.

As an added service, RMP Capital offers a fuel card that comes with rebates. Because it’s a debit card, Wulf says, it can facilitate cash flow between a factor and customers.

“They send a batch of invoices for $10,000, and we can transfer a portion of that – say, $2,500 – to the fuel account and just draw down over time.”

That sort of partnership approach is a hallmark of a reputable factor. “Our philosophy is the healthier the carriers are, the more healthy we’ll be,” Clover says.

Getting better rates

Factoring became attractive for owner-operator Terry Angleton when he negotiated a 3 percent rate, below the 4 percent quick pay rate he was charged by one of his high-volume brokers. He recently negotiated an even lower rate by allowing the factor to hold more than its standard 7 percent in reserve.

Finding a good factor

One criteria for evaluating a factor is membership in the International Factoring Association. Its members must adhere to a code of ethics, which is spelled out at the association’s website, factoring.org. “We have had to take disciplinary action against IFA members who did not follow our code of ethics,” says IFA Executive Director Bert Goldberg. “Membership was revoked.”

A search tool at the IFA site allows you to match the size of your business to an appropriate factor.

RMP Capital’s Chad Wulf suggests that potential customers get references on any factor. He and other factors also recommend checking on the following considerations:

TRANSACTIONAL FEES. Contract termination, start-up and transactional fees can effectively pad a low-percentage teaser rate.

Owner-operators: Do you use a factoring company?

Owner-operators: Do you use a factoring company?EXCLUSIVE CONTRACTS. Some contracts require the carrier to assign all loads to the factoring company. Most good factoring services give the carrier a lot of leeway in the arrangement, though many recourse factors will require carriers to factor all loads on a particular account.

RESERVE MANAGEMENT. Keep an eye on how a recourse factor handles the reserve. For instance, some companies have been accused of holding funding of an invoice payment beyond the 30th day to get extra fees.

The requirements vary for starting business with a factor, but you’ll need:

• Proof of active U.S. DOT authority and current MC number

• Proof of active insurance

• A list of brokers/shippers you’d like to factor. This will help in customizing the service to your needs.

Using reserve as maintenance account

When Showers Transport owner-operator Bill Showers, based in Knox, Pa., was having cash flow problems in 2005, he signed with Outsource Financial Services. This not only enabled him to get fast payment on his invoiced bills, but it also yielded unexpected advantages in long-term financial management.

“I’m like anybody else – if they send it to me, I’ll spend it.” — Owner-operator Bill Showers, who has extra revenue diverted to his reserve account.

“I’m like anybody else – if they send it to me, I’ll spend it.” — Owner-operator Bill Showers, who has extra revenue diverted to his reserve account.Outsource, like other recourse factors, keeps a certain amount of the invoice in reserve until the broker pays. In a typical arrangement, 90 percent of the invoice goes immediately to the carrier, a 3 percent fee is charged by the factor, and the remaining 7 percent goes into reserve. Today, says Showers, “I make them take 10 percent plus their fee out of every load I factor – that’s like a reserve account for me.”

If he needs tires for his 2001 Peterbilt 379, “I call them and take the money out of the reserve,” he says.

Showers, 72, is close to retirement. Factoring, he says, helped him get through the economic trials of the last few years. “It’s hard, especially when you’re digging up your own freight,” he says. “If it wasn’t for Outsource, I don’t know what I would do. Factoring has been a profit in my life – it’s made the difference between day and night. I’m not waiting on money, and I’m not sitting around worrying about it either.”

RESOURCES

D&S Factors, www.dsfactors.com, (888) 777-5543

FactorLoads, www.factorloads.com, (866) 218-0030

Neal Freeman Investments, www.nealfreeman.com, (253) 875-7200

Outsource Financial Services,

www.outsourcefinancialservices.com, (800) 997-7330

Riviera Finance, www.rivierafinance.com, (800) 872-7484

RMP Capital, www.rmpcapital.com, (631) 738-0047

SevenOaks Capital Associates, www.sevenoaks.com, (225) 757-1916 n