It’s every operator’s nightmare: new California Air Resources Board regulations. This year’s been particularly chaotic with last-minute regs changes and a hardcore freight downturn making compliance even tougher for cash-strapped operators, who are starting to avoid California altogether. Likewise, shippers are expected to divert traffic from its ports to avoid higher fees. For port and reefer haulers, big enforcement deadlines loom at year’s end.

The Los Angeles and Long Beach Clean Trucks programs have banned all pre-1994 engines and require all diesel trucks with 1994-2003 model-year engines to be retrofitted with California Air Resources Board-verified Level 3 particulate filters by the end of this year. Now a statewide drayage rule that takes effect at year-end will mimick the rule in the Los Angeles/Long Beach ports, making it effective at all ports.

Los Angeles reports 5,800 trucks with 2007 or equivalent emissions technology have been registered in its program. Approved trucks are making 60 percent of the gate moves at Port of Los Angeles terminals, says spokesman Arley Baker.

For owner-operators like the Ibarras, though, getting information about the program has been difficult.

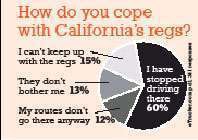

Emissions retrofits or truck replacements are expensive, and the regs themselves – pertaining in varying degrees to reefer engines, truck engines, APU engines, trucks, tires, aero equipment on trailers, and more – are complex and overlapping. Stories of problems obtaining funding are legion among port haulers and others in today’s tight credit situation. Many out-of-state owner-operators now totally avoid California, and others accuse the state of colluding with unions and environmentalists to drive them out of business.

“There have been so many rumors related to what California’s doing,” says Joe Rajkovacz, a 20-year produce hauler who’s also regulatory affairs specialist for the Owner-Operator Independent Drivers Association. He calls the year-end statewide drayage rule “the next shoe to fall. It will affect many of our long-haul members.”

Haulers are concerned that, like a reefer unit upgrade requirement that was delayed at the 11th hour, the drayage rule will also be delayed. Both regulations now have Dec. 31 compliance deadlines.

The reefer delay and its injection of supply-and-demand economics into the regulatory landscape has many wondering how seriously to take CARB, says Carl Dolk, controller for Bay Area-based Devine Intermodal, serving the Port of Oakland primarily.

“The reefer regulation was supposed to go in place in July,” Dolk says. “Just a week or two before that deadline they said, ‘Oh never mind, we’re going to extend it.’ The people who invested in new equipment are upset, saying, ‘Our competitors are benefiting from your late change.’”

And that was the second delay for the reefer rule. Watertown, Wis.-based owner-operator DuWayne Marshall, anticipating a rush at the end of 2008, the original 2001-reefer upgrade deadline, plunked down $71,800 in June 200 for a new, specialized spread-axle Utility reefer with a new unit to replace his 2001 Thermo King SB3 and Utility trailer. He says CARB’s “done such a disservice to the thousands of guys who spent millions of dollars to keep up with the rules.”

Owner-operators who had upgraded before the reefer rule was extended were hoping to command higher rates at the peak of the produce season, given that fewer qualified operators would be in the market, to help recoup their investments. “I got lots of calls from guys who were PO’d,” Rajkovacz says. At the same time, he adds, “there were guys who weren’t in compliance then and still won’t be in compliance at the end of the year. They were thrilled.”

Florida-based independent tomato and beef hauler Joe Cicciaro typically spends the California tomato season hauling to and from his primary shipper’s San Antonio, Texas, facility. He operates a 1998 Peterbilt with a 2001 Utility spread-axle refrigerated van with a cooling unit of the same vintage. In anticipation of the reefer rule going into effect, he had been angling for a Florida juice contract for summer runs to replace his California runs.

“I’d originally come out and done three runs from Texas and California in June with plans to head back to Florida ahead of the new regulation,” he says. “When they ultimately postponed it, I came back out here and got to work.”

Truckers like Cicciaro are drawing a line in the sand over California’s diesel regs. “I’m not investing any money to run California, he says. “As soon as they start that law, I won’t go back there.” He cites the strain a $3,000 payment for a new truck, trailer and reefer would put on his business, plus the added insurance costs for new equipment.

The irony is that like most owner-operators who don’t serve any of the California ports, this year Cicciaro would need only upgrade the reefer unit on his trailer to stay compliant through the end of 2013. That’s when a small-fleet exemption from the main powertrain upgrade requirement in the statewide truck and bus rule runs out. That rule requires pre-2007 trucks to be retrofit with diesel particulate filters.

By then, with a 16-year-old engine, Cicciaro could trade in for a new truck or even just “stick a newer factory reman in it and be in compliance” through 2019, Rajkovacz says. However, a reman with 2007-compliant technology is a complicated endeavor and cost-prohibitive for most owners, says Scott Ruland, with distributor Cummins

CalPacific. A 2007-compliant engine will “require its own harness, an upgrade of the cooling system. You’re pretty much starting from scratch,” Ruland says. Most of his on-highway repower business to date has been in converting to natural gas.

All the same, says Rajkovacz, “the majority of owner-operators will be able to cruise through these. CARB pushed off all enforcement on the statewide truck and bus rule – not on the drayage rule – to 2014. The second thing they did is to allow owner-operators with 2004-2006 engines, as long as they have a DPF retrofit, to go to 2019.”

The eventual aim is for all trucks operating in California to be powered by 2010 emissions technology by 2023.

Last December Devine Intermodal’s Dolk was working on securing $50,000 grants for truck replacements for 66 of its owner-operators through California’s large Carl Moyer bond fund program for diesel reduction assistance. Early this year, all grant assistance was put on hold as the revenue-strapped state sorted through priorities.

Bay Area Air Quality Management began granting money for retrofits rather than replacements. Now, Dolk hears there may be only 45 grants for his operators instead of 66. The delays also will likely increase the cost of the new trucks, due to the premium 2010 engine technology, and push the owner-operators against the deadline for the new drayage rule.

“We suggested they let us go ahead and order the new trucks now,” says Dolk, who was still waiting for the grants in August. “‘We’ll have you destroy the old trucks,’ we said, ‘and when money does become available, we want to be first in line – we’ll take the risk that it might not be there.’”

Owner-operator Marshall says he understands California’s air problems. “You drop off into the L.A. basin and you can see what you’re breathing. I have a lot of sympathy for the job they have to do – they changed the rules for the power plants and cars long ago. I think we caught a break in them waiting this long to regulate our emissions.”

All the same, it’s unfair for the government to change deadlines, he says. “It’s pretty hard to stay compliant with a moving target. The guys that don’t try to stay compliant are at a competitive advantage over me. They’re running equipment that should have been off the road years ago, and I still have to compete with them.”

CARB is moving “full speed ahead” with the drayage rule, says Bob Fletcher, chief of CARB’s stationary source division. “We do have the support of the ports – the L.A./Long Beach requirements mirror ours and they are actively implementing them. Incentives for compliance in L.A./Long Beach and Oakland are kicking in – we’re assisting them in getting applications processed.”

If California continues its strict emissions stance, there may be fewer trucks to inspect at the ports. “The freight diversion is already happening,” Rajkovacz says, citing tariffs the Los Angeles and Long Beach ports put on containers to “pay for replacing the trucks. I call it welfare trucking. It amounts to $70 per container.” If you import 20,000 containers from China through L.A./Long Beach yearly, for instance, and use anything less than EPA 2007 compliant technology for transport at the port that’s more than $1 million added to costs.

Compliance Costs

REEFERS

Reefer units of model-year 2002 and older must meet CARB’s emissions requirements of a 50 percent reduction in particulate matter, achievable by unit replacement or retrofit with Level 2 particulate filter by Jan. 1, 2010. At the end of 2010, 2003-built units will need to be replaced or retrofit with a Level 3 particulate filter to reduce emissions by 85 percent to remain in compliance. California-based owner-operators of reefer trailers had to register their units with CARB by last July, and are required to submit information on any changes that are made.

FINES

• Up to $500 for California operators not registering reefer units

• Up to $1,000 for reefers that don’t meet requirements

ESTIMATED COMPLIANCE COSTS

• $6,000 for DPF retrofit

• $10,000 for engine replacement

• $20,000 for new reefer unit

TRUCKS ENTERING PORTS

Older trucks entering California ports or rail yards within 80 miles of a cargo port will be affected by new regulations effective Jan. 1, 2010. Trucks with engines of model years 2003 and older will need to be retrofit with Level 3 particulate matter filters verified by CARB or replaced with EPA 2007-compliant trucks. By Jan. 1, 2012, 2004 engine technology will require Level 3 retrofit or replacement, and by Jan 1, 2013, 2005-06 engines will fall under the same requirement. If you’re serving the ports extensively, a safe long-term move is to adopt 2007 or newer technology to remain compliant: Jan. 1, 2014, is the deadline for all trucks to be utilizing 2007 technology or its equivalent. By Jan. 1, 2021, all trucks serving the ports must be utilizing technology meeting 2010 standards or its equivalent. Sept. 30 was the deadline for all trucks serving the ports to be registered in CARB’s Drayage Truck Registry.

ESTIMATED COMPLIANCE COSTS

$10,000 to $31,000 for retrofit and/or truck replacement

OTHER RULES

TRUCK & BUS RULE

Fleets of three or fewer trucks are exempt from this rule until Jan. 1, 2014. It requires pre-2007 trucks to be retrofit with diesel particulate filters. Between 2013 and 2023, the goal is to get all trucks to the 2010 standards.

SMARTWAY TRUCK EFFICIENCY RULE

According to CARB heavy-duty branch chief Tony Brasil, out of state operators who report/register their equipment with CARB in 2010 may be granted some leniency on compliance with this regulation when it comes into play for them. In essence, it requires van trailers of model year 2011 and newer to use EPA SmartWay-certified aerodynamic side skirts and other equipment, such as low-rolling-resistance tires and SmartWay-certified reefer units if applicable. Phase-in of pre-2011 trailers to comply is included, depending on fleet size.

‘The consumer is going to pay’

The SmartWay efficiency regulation’s phase-in of trailers will require Con-way Truckload’s 2,700-plus power unit fleet of company and owner-operated trucks to retrofit 420trailers per year beginning in 2010, says Vice President Bruce Stockton. The cost: $1,500 to $2,000 apiece. The return on investment: Zero.

“The consumer is going to pay for that added investment,” Stockton says. “There’s not a valid return that allows us to avoid rate increases.”

CARB info

For information on compliance with California regs, including details about funding assistance, visit the new Truck Stop portal at the California Air Resources Board’s website, https://www.arb.ca.gov/truckstop

Ports still seeking owner-operator ban

The Port of Los Angeles’ Clean Trucks program originally included a phase-out of independent contractors as a requirement for transporters granted concessions to do business there. That element of the program was enjoined this year after a successful lawsuit by the American Trucking Associations alleged an illegal attempt to regulate interstate commerce.

But Los Angeles continues to pursue the phase-out mandate, as the case is on appeal. And Port of Oakland officials have resolved themselves to appeal to Congress to get the necessary legal changes to allow them to do essentially the same thing without fear of legal challenge.

“There’s a big push here to make an environmental issue an employment issue,” says Devine Intermodal’s Carl Dolk. “It’s moved up [from L.A./Long Beach] to Oakland big-time.” Essentially, the effort to mandate employee status for drayage drivers is viewed as necessary by the ports and environmental groups for the accountability it places on the fleets for updating the equipment used by their drivers. In many cases, port owner-operators run on extremely tight margins and tend to use older equipment.

These efforts also are championed by the Teamsters, who need employees, not owner-operators, to potentially boost their ranks.

OOIDA’s Joe Rajkovacz says, “The Teamsters and environmentalists are pursuing legislation to allow the Federal Aviation Administration to regulate port drayage.” The legal maneuver sought by the Port of Oakland would essentially circumvent ATA’s argument about the L.A. port’s violation of interstate commerce regulations and give local authorities more power when environmental issues are at stake.

It’s likely that California’s congressional delegation will support Oakland’s initiative, as it did the one in Los Angeles, Rajkovacz says.

Los Angeles port spokesman Arley Baker calls the independent contractor phase-out in the Clean Trucks’ program a move to get contractors “a consistent paycheck, benefits, workers’ comp, and establish a more stable/secure work environment on port property. It also made the drivers more accountable to the [fleets], which is better for the ports, since the concession program places responsibility for the trucks and the drivers” on the fleets.

Enforcement of idling rule scant

Contrary to what some owner-operators say, CARB spokesperson Mary Fricke says enforcement of the five-minute idling time limit in California is well under way.

On average in 2008, though, there were fewer than 17 daily spot checks of sleeper berth vehicles, leading to 389 citations. For daycabs and other non-sleeper-berth trucks, citations numbered about a third of that.

When the drayage and reefer rules begin, Fricke says, “We expect to take a progressive approach to enforcement, treating initial infractions as outreach opportunities and not issuing citations. Eventually, citations will be issued.”

CARB estimates reefer fines will range up to $1,000. For the drayage rule, no numbers have been suggested. Fricke says, “Enforcement will primarily be against the motor carriers for sending non-compliant trucks to the terminals. We can also fine owner-operators for not properly maintaining their emission control device.”

“When you start talking about owner-operators in their late 50s and 60s, these regulations will mean nothing to them. They’ll retire out of the industry before they have to make changes to their operation. Then you look at a lot of the younger guys just coming into the industry – they’re buying fleet-spec’d equipment that is in compliance.”

– Joe Rajkovacz, OOIDA regulatory affairs specialist

One owner’s solution

As many owner-operators leased to Bay Area port hauler Devine Intermodal await grant assistance funding to upgrade to 2009 technology, some instead are upgrading to used trucks to comply.

Late last year, owner-operator Robert St. John traded up from a 2000 Freightliner Century Class to a 2005 of the same model, working through Cascade Sierra Solutions (cascadesierrasolutions.org) and ShoreBank Pacific to secure low-interest financing. The 2005 model year put him ahead of the drayage rule coming at year-end.

He’s also avoided the various problems facing those who went after large new-vehicle grants.

His drayage trips often involve out-of-state hauling, but the $50,000 new-truck grants come with a stipulation that all miles the first few years of the truck’s service must be run within the state.