As the economy stabilizes, owner-operators can emerge from debt and cope with tight credit markets by scrutinizing expenses and focusing on essentials.

“I was ready to give up,” Nemeth says of costly repairs needed on her 2002 model truck. “But there are people out there who are willing to help you.”

Following advice from trucking financial advisers, she took the drastic step of selling the Dallas house she’d had for 14 years. Nemeth is now running hard and living frugally in her rig.

Owner-operator Sherry Nemeth of Dallas is cutting costs by living out of her truck.

Owner-operator Sherry Nemeth of Dallas is cutting costs by living out of her truck.Like Nemeth, other owner-operators struggle with debt or are delaying equipment purchases as the economy tries to stabilize from the recession. Yet financial specialists say that contractors can thrive, eventually improving credit scores, if they avoid credit card use, cut expenses to essential items, seize opportunities to increase revenue, and stick to a budget.

The recession has not been the direct cause of owner-operators leaving the business, says Richard DeForest, vice president of Denver-based ATBS, the nation’s largest owner-operator financial services company. Instead, it’s their overreliance on credit and subsequent bills they were unable to pay. But the recession has prompted advisers at ATBS to focus on helping operators reduce expenses, since “it’s harder to increase revenues right now,” DeForest notes.

Still, for some clients, more time on the road is essential to stay financially solvent, says Robert Butcher, an ATBS counselor who develops recovery plans for owner-operators. He says some of his clients have experienced unforeseen calamities – traffic accidents, divorce, children in jail or a serious illness in the family.

Yet Butcher says those who are open to assistance can often manage debt without declaring bankruptcy, a move counselors advise against because it stays on a credit report for 10 years. His guidelines for getting on better footing financially include careful scrutiny of fuel costs, truck maintenance and home expenses.

Selling extra cars or motorcycles can help. “Truckers don’t have to have two new vehicles,” Butcher says. “Most truckers I talk to have personal vehicle debt of $800 to $1,200 per month.”

Nemeth, an ATBS client, had missed her first truck payment as she tried to pay $5,000 in repairs for five breakdowns in the first month of ownership. She had no money left when her engine failed in September 2009, and she tried to return the truck to her local dealership.

Instead, the dealer offered to help, paying for a few nights’ hotel stay while the truck was repaired. The dealer did an in-frame overhaul, including new injectors and a new turbo, at a discounted cost of $11,000, and deferred two monthly payments.

Not only did Nemeth sell her house, she borrowed $2,100 from family members for the engine overhaul and now hauls freight for two-month intervals before she stops at her sister’s house in McKinney, Texas, to rest.

Jerry Lee, her German shepherd, and two small dogs ride in her truck. She fixes all of her meals in a cab equipped with a refrigerator and microwave.

“Everything seems against you out here. Sometimes you’re surprised that people are out there willing to help,” she says.

Mike Burbidge found assistance from Landstar Systems, to whom he is leased. Landstar lent him the money to pay $8,000 in towing fees and repairs on his 1999 model truck. He is repaying the debt in his settlements over a year.

The 63-year-old resident of North Las Vegas, Nev., is relieved that he postponed buying a new truck in 2008.

“That was my best year,” Burbidge says. “Now, things are tough. Your credit has to be perfect, and you have to pay down at least 20 percent.” With 22 years in trucking, Burbidge adapted to the recent downturn by selling his car, which he says he didn’t use anyway. Like Nemeth, he has no permanent residence and stays with his children when he’s not hauling freight.

David Owen, president of the National Association of Small Trucking Companies, says he was able to help a small fleet in securing a loan to add two or three trucks. NASTC’s fuel card partner, Fleet One, wanted the fleet owner to make a larger cash deposit, but Owen negotiated to have the owner agree to pay his fuel card twice weekly instead of once a week. Fleet One agreed to extend the credit.

Three years ago, NASTC started conducting monthly training for owner-operators who want to start small fleets. “The locking up of the credit system has totally dwarfed growth, particularly in small trucking companies,” Owen says.

Not only is credit much tighter than it was before the recession, many owner-operators have seen their credit scores drop as they struggle to stay in business. Because it takes years to significantly improve credit scores, perseverance in financial discipline is key.

“Budget – this is the big thing,” says Russell Fullingim, of Truckers Financial Services in Corning, Calif. The 77-year-old former owner-operator says clients rarely plan or follow through on a budget. He advises clients to record every expense and examine their spending closely. “It’s ridiculous how much money we spend playing video games,” he says.

He says that, despite the freight downturn and financial turmoil, hard-working owner-operators can stay alive if they control expenses. For example, driving at lower speeds will reduce fuel costs and prevent tickets, Fullingim says. He and Burbidge advise looking for higher paying freight or accepting loads to challenging regions, such as northern states during the winter.

Jay Seaton of the Cleveland, Ohio, branch of nonprofit Consumer Credit Counseling Service cautions owner-operators to separate personal and business finances. “Small businesses often use personal credit to pay business bills. That’s when they get into trouble,” he says.

Stuffing fuel receipts under a cab visor or in pants pockets doesn’t work, says Linda Shedrow, debt management manager at the Consumer Credit Counseling Service of Northwest Indiana. Shedrow also helps prepare truckers’ taxes outside of her debt management service.

“Truckers need to track their expenses and have a file system they put in the seat next to them,” Shedrow says. Keeping consistent weekly records of spending by category, such as diesel and food, helps show where expenses can be trimmed, she explains. She also recommends reviewing credit card statements and credit reports for accuracy.

“You’ve got to stop using credit cards,” Shedrow says. “Now it’s going to take longer than before to get out of debt.”

The Credit Card Accountability, Responsibility, and Disclosure Act of 2009, which went into effect Feb. 22, introduced several consumer protection measures, but at the same time gave lenders leeway to charge higher fees or rates, especially for small business owners. “Even if you weren’t late [paying], they could raise rates. And even if you pay in full, there’s talk that they may charge an annual fee,” Shedrow says.

Even with such cautionary advice, the outlook for owner-operators is beginning to brighten. “The owner-operator who has survived now is going to survive going ahead,” says Chris Brady, president of Commercial Motor Vehicle Consulting of Manhasset, N.Y. “I think we’ve seen the worst.”

Burbidge agrees that prospects are picking up for owner-operators. “But if they come out here,” he says, “they’d better have a good company with enough freight to make it.” n

Checking your credit report

To stay familiar with your credit record and correct errors that will reported to lenders, check your credit report periodically.

Every 12 months, you can print a free copy of your credit file from all three credit reporting agencies by calling (877) 322-8228 or going to www.annualcreditreport.com. Or you can reach each agency directly:

• Equifax (800)-685-1111, www.equifax.com;

• Experian (888) 397-3742; www.experian.com;

• TransUnion (800)-888-4213, www.transunion.com.

Where your report has a negative incident that needs an explanation, such as circumstances beyond your control, contact that credit bureau about adding that information. Negative history is less harmful the longer it has been in a report, and is dropped after seven years.

Likewise, positive information, such as accounts paid on time, should be added to your report if it would help develop trust with a potential lender.

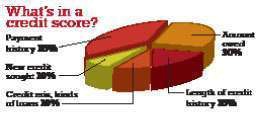

Know the score

Your credit score, the rate lenders use for determining credit risks, differs from your credit report. At an average cost of $15, credit scores, which include the credit report, can be ordered from any of the three major credit bureaus or from www.MyFICO.com.

Under the current tight credit market, lenders put more emphasis on payment time and differ more on what makes a good score, says Linda Shedrow of Consumer Credit Counseling Service. Historically, a score of 700 to 850 is a low credit risk; 600 to 699 is a fair risk; and below 600 is a bad risk, for which borrowing would be very expensive, if not impossible. Visit bankrate.com or myFICO.com for more details.

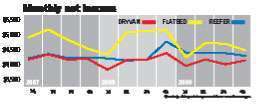

Staying the course

Overall, the recession has not hurt the bottom line of owner-operator clients of financial services provider ATBS.Flatbed operators, after a rebound in 2008, experienced a slow 2009 as construction continued to stagnate.

Tips for improving your credit

• Open accounts for both checking and savings. Doing so shows you plan to pay bills and be responsible.

• Never bounce checks.

• Use only one credit card.

• Pay all bills on time.

• If in serious debt, pay off the balance of one card while making minimum payments on others. Then pay the next one off.

• Quit using all credit cards until debt is under control.

• Avoid getting new credit cards, such as when department stores offer an on-the-spot discount if you make a card application.

• Avoid easy-fix lending products, such as pay-day loans or so-called checking advance products being offered at some banks that charge annual rates of up to 120 percent.

• Get your credit report at least once a year to correct errors and monitor it in general.