“The fireworks are over,” says DAT’s Ken Harper, but flat and van volumes remain above average for this time of year in the last week. At once, “rates slipped for vans as urgency around the end-of-quarter inventory moves, holiday shipments and Amazon Prime sales” fell off a bit.

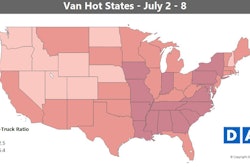

In the first full week after the Fourth of July, van load posts on DAT boards were up 21 percent across the Top 100 lanes, Harper points out, but truck posts moved even higher with a 30 percent boost. It all brought the national load-to-truck ratio down to 5, in some areas still contributing to considerable carrier leverage as you’ll see in the map below.

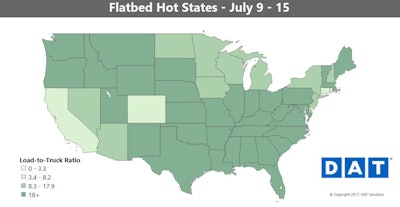

Flat freight volumes remain high — up 50 percent over the last week — and rates are at a two-year high, Harper notes.

The flatbed boost of late is “pretty much a nationwide phenomenon with the notable exceptions of California and Colorado,” Harper says.

The flatbed boost of late is “pretty much a nationwide phenomenon with the notable exceptions of California and Colorado,” Harper says.Hot markets: Rates were on the rise last week for flatbeds in two Atlantic seaport markets: Baltimore, Md., and Jacksonville, Fla. Two Southeastern freight hubs, Atlanta and Memphis, also got a big boost. Atlanta’s outbound rates hit an average of $2.70 per mile, very close to Houston’s $2.71-per-mile high-water mark. (Houston is the leader for flatbed volume and rates.)

Not so hot: The biggest decline last week was out of Fort Worth, where the outbound average dropped below $2 per mile last week. But rates next door in Dallas were up in the $2.25-per-mile range, due to a more favorable mix of freight and lanes. Rates are dropping in Roanoke, Va., too, but they were still $2.75 per mile last week, which is pretty good. The rate-per-mile leader in the region was Savannah, at $2.93 per mile despite a downward trend.

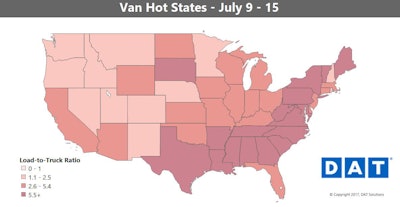

Van overview: While volume increased on the top 100 lanes, rates moved down 2.5 percent, suggesting movement toward the typical summer pattern of declining rates in July.

Hot markets: Exceptions last week were two markets where rates held steady: Columbus and Denver. Over the last 30 days, Columbus has had the sharpest rate increases, followed by Allentown, Pa., where outbound averages lost 11 cents just last week.

Not so hot: The two markets with the sharpest declines last week, Charlotte and Los Angeles, were also the same markets that offered the highest outbound rates. Dallas rates declined last week, too, losing 6 cents per mile.