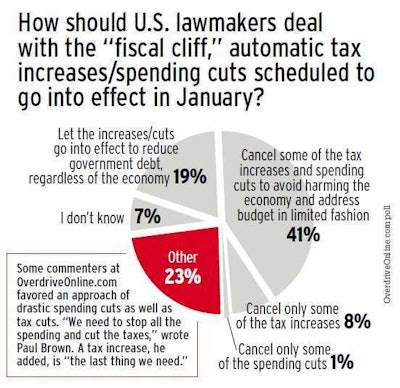

But before the next Congress gets under way, the current crop of Senators and Reps will have to deal one way or another with what many have seen as a looming short-term crisis in the coming “fiscal cliff,” a package of tax increases and spending cuts set to go into effect the first of this year if lawmakers don’t get together and agree on a debt-reduction deal. The national debt stands at upward of $16 trillion today.

Overdrive readers well know the problems associated with debt/revenue imbalance where the rubber hits the road – potential for asset loss, declining credit ratings, inability to borrow when necessary, default/bankruptcy. They apply to government as well as business.

The cliff is a bed of our own making: the product of the lame-duck 2010 session’s extension of Obama’s payroll tax cuts and the Bush tax cuts, intended to stimulate the economy, and the deal reached with the Budget Control Act in August 2011 after House Republicans forced the debt issue in exchange for a further increase of the debt ceiling. Speaking of which, don’t look up: We may well reach it before the end of the year.

Ultimately, however, with much of the public debt financed by foreign governments – China, chiefly – it’s also a national security concern, some commenters noted, and should be paid down as soon as possible. “If we can’t pay back what we owe,” noted Dex Jones on Overdrive’s Facebook page, “who is to stop [the lenders] from taking over the country, fiscally speaking, and running us through the wringer.”

And on OverdriveOnline.com, one commenter expressed the ultimate frustration with inaction on the issue this way: “The ‘lawmakers’ should be the ones going over the cliff …”

William S. Janoch: Cut taxes and cut spending. If we do not need it enough to take a loan, cut it. Let D.C. take a pay cut – a real one, not a cut here to be spent over there to fill the same people’s pockets. I feel as a company driver I need to make $1 a mile, but I cannot call it a pay cut every time I get a pay raise that does not get me to that dollar. In D.C. talk, that’s a pay cut. “I wanted $10,000 but only got $5,000. I had to take a $5,000 pay cut.”

Dennis Carter: Put someone in office who understands how to create and sustain business. It doesn’t make sense to punish your moneymakers.

Billy Fannin: Simple – take the cuffs off the free markets and let the movers and shakers do what we do. Also, energy exploration: This will create jobs, which creates revenue, which creates a tax base that is untapped. Energy independence fixes the economy, period. Fix high fuel prices, and you fix the fiscal uncertainty.

Tom Puckett: The economy will not be fixed by using slogans designed to distract!

M. Rick Richards: Bring in a gallows. And tell the obstructionist Republicans if they keep it up, they will be tried for high treason!