For a more updated version of this guide to filing against a broker's bond in the event of nonpayment for a load, read the story at this link, part of Overdrive's Broker Reforms 2020 series and current as of June 2021.

Federal rules pertaining to broker surety filings are in flux following congressional action last year that raised the minimum bond from $10,000 to $75,000. Still, basic procedures for filing are expected to remain.

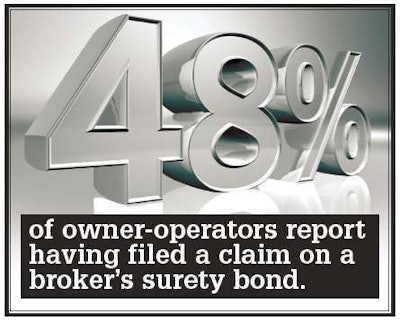

The most high-profile filing incidents involve brokerages in trouble. If a broker is late on payment, odds are you’re not the only party who’s thinking about filing. If the broker closes and the broker’s bond limit doesn’t cover all debts, claims are paid on a “pro rata” basis – a percentage of what each carrier is owed.

“It doesn’t take long to burn up a 10K bond,” noted Overdrive reader Mike Philips on our Facebook page in January.

| Types of bonds BMC-84: A surety bond commonly issued by an insurance company. BMC-85: A trust fund agreement issued typically by a financial institution.Both instruments satisfy the federal bonding requirement of brokerages, and providers approach claims payments in similar ways. However, BMC-85 issuers on occasion market themselves to brokers as a better service; the Pacific Financial Association’s website touts its BMC-85 instruments as superior to BMC-84 sureties given the “control that you have as a broker. When a claim is presented against a trust, you are notified immediately. If you can provide a valid reason why the claim should not be paid, it won’t. When bonding companies receive a claim, they will make the decision for you.” |

In cases of broker business failure, getting your claim in early may not be particularly helpful. Federal Services Corp., which handles claims against financial institutions authorized as trust providers for brokers by the Federal Motor Carrier Safety Administration, notes it doesn’t file claims on a “first come, first served” basis. Rather, “while this practice may be followed by some of our competitors,” the company says, “it just encourages premature claim filings – sometimes even before loads are delivered!” [Exclamation point theirs.]

FSC notes that in 95 percent of claims it receives, “the broker pays the claimant after being informed a claim has been filed against their trust.” This avoids what it describes as a time-consuming process of mailing out documents for the carrier to complete and return, detailed below.

How to file

Determine when it’s time to file. After a broker has not paid within a reasonable or contracted time, you can file. Contracts often state 30, 60 or 90 days after delivery.

Find the broker’s surety provider.

- Visit li-public.fmcsa.dot.gov, FMCSA’s public licensing and insurance information site. Click through the disclaimer page and choose “Carrier Search” from the pull-down menu at top right.

- Supply as much information about the broker as you can by using the fields for DOT number, legal name, DBA name, base state and docket filing number. Brokers typically will have an “MC” prefix. “FF” refers to freight forwarders, which last year’s MAP-21 legislation for the first time also put under the requirement for a bond. Click search. (If you didn’t already know the broker’s MC number, save it for future reference.)

- When the broker you’re filing against comes up, click the “HTML” button to view licensing information on the web page or “Report” to download a pdf. On the pdf, the surety provider is listed under “Active/Pending Insurance” near the bottom. If you’re viewing the HTML report, click the “Active/Pending Insurance” hyperlink for the surety provider’s information.

Have this information ready to file: Broker’s legal name and MC number, as well as your own and relevant contact information; amount owed to you; load date (or oldest load date if more than one); commodity hauled.

Have this information ready to file: Broker’s legal name and MC number, as well as your own and relevant contact information; amount owed to you; load date (or oldest load date if more than one); commodity hauled.Contact the surety provider.

- You may need to do further searching to find phone or website information for the provider. Several pulls of broker licensing reports showed neither phone or online points of contact for the listed surety provider. A simple Google search for company name and location, in most cases, will bring up the provider’s website and contact phone numbers.

- When you make contact, follow the provider’s claims process. Some companies, such as the Pacific Financial Association, will send you to a web page to fill out a preliminary form. Most sureties, however, will handle this step via a telephone call to their office. From there, documents will be mailed to you to fill out and return.

- If luck’s on your side, you’ll get paid by the broker after notification of the claim from the provider. If not, follow the provider’s claims process to the end and hope the bond or trust isn’t exhausted by similar claims if the broker’s business is failing. If some broker groups’ efforts to derail the new $75,000 minimum bond requirement are unsuccessful, at the least you’ll have a better chance of getting more money in such cases fairly soon. MAP-21 directed FMCSA to establish the new requirements of brokers, freight forwarders and surety providers by Oct. 1.