March 31 marks the end of the first open-enrollment period for health insurance purchased through the state and federal health-insurance exchanges set up by the Affordable Care Act, or “Obamacare.” For coverage to start April 1 and avoid tax penalties assessed for not having coverage in this first year of the ACA, you’ll need to purchase a plan by March 15.

There are two primary ways to shop for coverage – doing it yourself or working through your insurance company or insurance agent/broker. What you’ll need:

Most recent tax returns and estimated taxes for both you and (if applicable) your spouse. To determine whether you’ll qualify for reduced premiums, you’ll need to estimate your household 2014 Modified Adjusted Gross Income as accurately as possible, a fairly easy task for W-2 salaried employees, but not always so for owner-operators and drivers. Overestimate your income, and you may get premium dollars back come tax time in 2015. Underestimate, and the opposite is true.

Details on household size and any employer-based insurance available to a spouse. If you have access to that insurance, you will not qualify for reduced premiums on the exchanges unless the out-of-pocket cost for employer premiums exceeds 9.5 percent of household income.

|

Private exchanges: Driver-focused resources | Various associations and other entities have set up private exchanges geared toward providing health insurance options to their members outside of the state and federal exchanges. Following find details available at press time about two hubs geared toward drivers and owner-operators. OOIDA Members Healthcare Exchange | Follow this link to OOIDA.com for information on this partially online marketplace connecting members of the Owner-Operator Independent Drivers Association to plans offered through three insurers at various levels. The Association has plans available for coverage of residents in every state except New York and New Jersey. Call 800-715-9369 for more information. Residents of IL, IN, KS, MO, OH and TX can access options online via this link. Healthy Trucking Association of America | HTAA has set up a call center (855-648-1613) and a website to connect drivers to exchange plans. The program is a partnership between HTAA and others spearheaded by longtime Florida-based insurance broker Marc Ballard. The phone number, says Ballard, will connect you with licensed and certified insurance agents capable of offering advice – unlike the government-paid “navigators” getting individuals started in the enrollment procedures. Listen to Overdrive‘s October 2013 talk with Ballard and HTAA Director of Insurance Tom Smith via the special-edition podcast below. Podcast: Play in new window | Download |

Doing it yourself

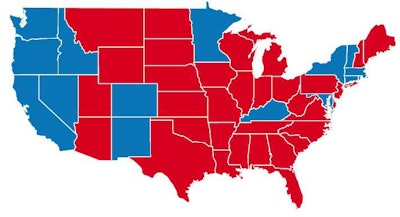

Start an application online. You’ll need a working email address. Start by following links to the individual portion of the website you’re using, whether HealthCare.gov or your state of residence’s website (refer to the map/list above to determine).

**Create an account with a username and password – and answers to security questions.

**Go through the lengthy process. Both federal and state online marketplaces will guide you through the entire three-tier process. 1) Select an agent if you want to use one for advice. Decline if you don’t. 2) Fill out what amounts to a 12-page application to determine whether you qualify for tax credits, says Fred Adams of the HSA for America insurance brokerage. 3) Compare plans and apply for insurance, paying the first month’s premium.

Start an application by phone. Refer to the map/listings above for your state’s primary application contact phone number. The process will follow steps similar to those detailed above.

Work through an agent or broker, or insurance company

Independent health insurance brokers’ standard line on their usefulness is that, given they work on commissions collected from insurance companies and not from clients, you don’t pay any more whether you use them or book your own insurance yourself. The key to using a broker under the Affordable Care Act is determining whether the broker is licensed to sell from the exchanges in your state of residence. That can be resolved through a Web search of the broker’s business name or a call to ask a question.

Following the insurance exchange technical problems early on, at this point most issues have been either ironed out, or brokers have discovered workarounds. Using a broker may be a good way to take some of the hassle out of the process, says Holly McCombs of Campbell Insurance Services. Campbell’s licensed to sell from the exchanges in Maryland, D.C., Virginia and West Virginia. (McCombs is also the wife of car-hauling owner-operator David McCombs.)

“You need to know what you’re getting into,” she says. Brokers understand the intricacies of how deductibles work, as well as the variety of options available on the exchanges among the standard plan levels.

See “Private exchanges” above for two driver-focused avenues toward licensed agent/broker assistance.

For other resources, two national Web-based brokerage sites are GetInsured.com and eHealthInsurance.com.

Coverage levels available

Preventive services are covered in all plans except those for catastrophic coverage. Those low-cost plans kick in only after a high annual deductible is met. Any nonpreventive medical care costs would be split between the insurer and insured at coinsured percentage rates specified in the different plan levels after any deductible is met.

A big part of the Affordable Care Act is the standardization of plan levels, with variations. For instance, there are PPOs and HMOs, the latter more limited in doctor options but generally cheaper. There are plans with varying deductibles at each standard level, and many set up to pair with a Health Savings Account for medical spending. Given that access to tax credits to reduce premiums is based on your income, and money put into an HSA directly reduces your taxable income, use of such a plan could be beneficial to overall premium costs if your household income is near the level at which you might qualify for premium reduction.

The subsidy line is drawn at 400 percent of the federal poverty level; that’s $45,960 for an individual, $62,040 for a family of two, $78,120 for three and $94,200 for four. If your household modified adjusted gross income is below that level and no employer-based insurance is in reach, you will qualify for reduced premiums.

Plan coinsurance levels

Platinum plans: 100 percent

Gold plans: 80/20 percent

Silver plans: 70/30 percent

Bronze plans: 60/40 percent

Catastrophic coverage: Available on the exchanges only for applicants under age 30