Even when times are flush, there are lenders eager to take advantage of small businesses in a bind. With countless small fleets struggling to get by now during the COVID-19 crisis, there’s even more bait for finance predators.

With thousands of small fleets threatened by the COVID-19 lockdown on the economy, lenders that prey on cash-strapped owners of small businesses have a fertile field for prospecting.

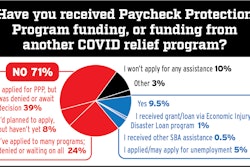

With thousands of small fleets threatened by the COVID-19 lockdown on the economy, lenders that prey on cash-strapped owners of small businesses have a fertile field for prospecting.Some fraud has focused on the federal aid programs intended to help small businesses weather the pandemic, as Executive Editor James Jaillet has reported. What we’re also looking at predates the coronavirus outbreak. It’s a questionable niche of small-business financing in which business owners are offered “merchant cash advances.” MCA providers target owners with poor credit ratings who need cash immediately.

This voice-mail I received, which certainly sounds like an MCA offer, gives you an idea.

If you’ve had an experience with a financial provider like this, please comment below or write me directly at [email protected]. We’ll be reporting on this practice in more detail.

An MCA gives a small business quick cash to buy a share of future receivables. Repayment is set up as an automated bank draft, often done nightly. The amount is a percentage of any revenue that comes in, such as credit and debit card receipts in the case of retailers. The pitch is that the percentage structure keeps repayment affordable – if business gets slow, you pay fewer dollars.

That’s true. But what too many business owners have learned is that those payments still add up to far more than the cash they received. Many businesses end up taking out additional MCAs to cover their repayments and stay in business, certainly a losing prospect.

MCA providers sometimes avoid stating terms as an annual percentage rate. Instead of APR they use terms that often confuse the client, says a U.S. Federal Trade Commission report following a “Strictly Business” forum it held a year ago with stakeholders in business lending. Among the forum’s findings: Poorly informed MCA customers were paying “estimated APRs in the triple digits.”

Those pushing MCAs argue they’re not loans, and so far have avoided usury laws that apply to loans. MCAs are a form of factoring, though their true costs among the bad actors are far less clear than the simple percentage cuts on collections taken by the legitimate factoring companies in trucking.