Carriers chase after a diminished pool of owner-operator candidates with higher pay, bonuses and more compensation options.

Marten Transport leases about 100 owner-operators but would like to double that number over the next year.

Flatbed owner-operators enjoyed higher rates of pay and net income during the spring, thanks to increased freight demand in a segment where many operators had left the business during the recession.

Flatbed owner-operators enjoyed higher rates of pay and net income during the spring, thanks to increased freight demand in a segment where many operators had left the business during the recession.Prime Inc. works with approximately 3,000 independent contractors and expects to grow that total 8 percent to 14 percent into 2012, says John Hancock, director of recruiting. “The market is asking for more capacity than is out there,” he says.

More than 120 owner-operators are leased to Barr-Nunn Transportation, and the Granger, Iowa-based carrier aims to increase its capacity. “If we could go to 200 owner-operators, we would,” says Jeff Blank, recruiting director.

These and other carriers are competing for a pool of qualified operators that has been shrinking because of the recession, growing government regulations and retiring drivers. “I don’t see that number increasing,” Blank says. “It’s hard to say where they’re going to come from.”

With the recession’s end and an increase in freight, many carriers are posting bonuses, hiking pay and offering other inducements to sign owner-operators.

The quality of unaffiliated driver prospects is “marginal at best,” says Gordon Klemp, president of National Transportation Institute, who has been tracking driver compensation for 16 years. Plus, the Compliance, Safety, Accountability program and other regulatory efforts are further whittling the ranks of operators.

In some cases, carriers have restored rates that were cut during the 2008-09 slump, while others have increased to higher levels. “We’re seeing fleets get downright shrewd about how to target pay to find things that motivate drivers,” Klemp says. He forecasts owner-operator pay will climb 4 to 6 cents a mile in the next 12 months, with the lower figure achievable even if the economy is still limping along.

“I don’t think this is over,” says Tom Kretsinger Jr., president of American Central Transport. “This is the first round.”

Mileage pay

This year Barr-Nunn raised rates in its Pure Pay program, where the contractor pays for his license plates and permits, to $1 per loaded mile from 97 cents, and 80 cents per empty mile from 70 cents. Its Band Pay program, which is based on length of haul and where the company covers cost of plates and permits, lifted pay 2 cents a mile.

ACT boosted its top pay for an operator with a hazardous materials endorsement to 98 cents under load and 90 cents empty. Without hazmat, the pay increased to 94 cents loaded and 90 cents empty. “Our higher rates account for the operator paying for plates, permits and getting more pay,” Kretsinger says. “They can buy their own plates or buy it through us at cost.”

On May 1, Marten increased its mileage rates by 4 cents so that it ranges from 88 cents to $1 a mile based on length of haul. For hauls up to 150 miles, the carrier pays 50 percent of the load’s net revenue, the only instance where it pays a percentage, says Tim Norlin, director of recruiting.

In August Christenson Transportation hiked its per-mile pay and differentiated between driving on the East Coast and elsewhere. Now the all-owner-operator Springfield, Mo.-based carrier pays 96 cents a mile in the East and 91 cents elsewhere, up from a flat 88 cents before. For empty miles, a graduated pay scale begins at 50 percent of the loaded rate on the first 100 miles, another 25 percent on the second 100 miles and the rest of the rate on the next 100 miles, says Vice President Barry McGowen.

Schneider National this year increased its van contractors’ pay 5 cents a mile to 95 cents, with up to $1.65 a mile for short haul premiums.

Boyd Bros.’ recent 1 cent-a-mile increase to 95 cents was the fourth hike of the year.

Bonus money

One of the biggest bonuses is offered by all-owner-operator RoadRunner Transportation. It offers $10,000 to operators with at least one year of experience. “The competition is more aggressive in recruitment than it was a year ago when everyone was in the doldrums,” says Mark Pluff, director of linehaul development.

Some large fleets are introducing strong detention pay programs to ensure fair compensation for owner-operator time.

Some large fleets are introducing strong detention pay programs to ensure fair compensation for owner-operator time.Panther Expedited extended its sign-on bonuses through August. The extra money ranged from $4,000 for a solo operator to $8,000 for a team with hazmat endorsements and Canadian access. Jeff Garra, manager of capacity development, says the bonus is paid over six months. A $500 fuel card is provided when the owner-operator completes orientation.

Christenson offers a $3,500 bonus, McGowen says, paid by reducing contractor lease payments.

Jacobson Companies raised its sign-on bonus to $2,500 from $1,000, paid over 90 days, while also lifting its mileage rate to 95 cents. “We’re talking with people whose miles have fallen off a bit,” says Joe Santone, vice president of carrier services. The company also introduced a program to attract contractors with their own authority, who will get Jacobson’s fuel optimization and fuel discount benefits.

Barr-Nunn offered a sign-on bonus of $1,500 through Aug. 26, and its Band Pay contractors receive a performance bonus of $800 or $975 every 30,000 miles.

Marten doesn’t believe in bonuses, Norlin says. “We would rather take that money and put it in their weekly settlement than use it as a gimmick.”

Detention payments

More carriers are compensating owner-operators for time lost at the docks. For several years, ACT has been paying contractors for wait time after two hours for most customers or four hours with some, says Kretsinger. The detention rate is $35 an hour, with a $350 maximum over 24 hours.

Beginning July 1, Marten made detention pay automatic, Norlin says. Before, the carrier charged customers but the contractor didn’t always receive it. Now contractors automatically get paid $20 an hour if they’re on time and have to wait more than two hours, even if the customer doesn’t pay Marten, he says. In cases where the shipper or receiver is known for delays, detention pay is $30 an hour.

Detention time is calculated as part of the revenue that is shared by contractors and Prime, Hancock says. The installation of electronic logs makes it easier to confront customers. “We’re putting the bill on the customer and making them pay,” he says.

Lease option

One traditional option for a carrier to boost its owner-operator ranks is through lease-purchase programs.

FFE Transportation Services is cutting lease rates up to 25 percent in its Drive to Own program. In January the carrier opened a new driver academy that covers driving skills, obtaining a CDL and career paths. An 18-day course is followed by a six-week driver training program. Drivers can enter the lease program within four months of finishing driver training.

“Our growth and future driver capacity is going to come from our academy, rather than from traditional owner-operator recruiting,” says Rob Newell, vice president of capacity development for FFE. Newell says that from late March to mid-July the company approved 39 drivers for the program.

Prime’s approach is to treat the truck lease more as a rental. Instead of traditional lease-purchase, the program offers the operator the option of buying the vehicle or walking away with a “completion bonus,” reasoning that most of the truck’s useful life has been used up during the lease.At the end of a typical three-year term, that bonus can range from a few thousand dollars to $30,000, Hancock says. “The more miles he runs, the more money he receives,” he says.

Barr-Nunn’s lease-purchase plan attracts about 70 percent new contractors, the rest existing owner-operators, with most of those from outside the company. “We’re getting a high experience level, with a majority with more than five years’ experience,” Blank says.

Richard Forney was one of the first at Barr-Nunn to move from company driver to owner-operator when the company launched its lease-purchase program. He paid off the lease early on his 2005 truck and is considering buying a new truck next spring.

Forney says he receives an additional 5 cents a mile in hazmat pay for all miles and extra pay of at least 3 cents a mile, depending on length of haul, under the carrier’s Band Pay program.

Klemp says that while some carrier lease-purchase programs have earned a black mark for conditions that heavily favor the company, in some cases leading to lawsuits, he sees the environment changing.

“Carriers are recognizing the value of owner-operators and are putting together mutually beneficial contracts for lease-purchase,” he says, listing as good examples Barr-Nunn and Anderson Trucking Service, which recently announced reduced weekly lease rates.

Other options

While Prime prefers paying a percentage of revenue, it reinforced that model by adding a compensation guarantee. The carrier retained its 72 percent share for contractors but raised its guarantee per mile to $1.02 for most, $1.15 for tank haulers. That is, if you drive 100,000 miles a year, you’ll receive at least $102,000 for all miles.

“I believe a percentage split of revenue is the best model,” Hancock says. “If the freight rate moves up, the operator receives the benefit of that movement. If the rate goes the opposite way, the contractor would probably not choose to haul it,” putting pressure on the shipper that wants to cut the price.

Carriers are offering bonuses as high as $10,000 to attract the best owner-operators.

Carriers are offering bonuses as high as $10,000 to attract the best owner-operators.Kretsinger sees it differently. Percentage pay “adds a lot of complication,” he says. “We are known for good customer service and by paying every mile the same. The owner-operator is less likely to get choosy in turning down freight.”

Schneider and J.B. Hunt offer both, Klemp notes. The contractor is able to switch between per-mile and percentage.

Christenson’s higher pay for East Coast routes is an example of carrier regional pay plans. Klemp estimates the number of carriers offering regional pay has risen 48 percent in the last 12 months.

RoadRunner pays by geographic origin, ranging from $1-$1.05 a mile up to $1.80-$1.90, plus fuel surcharge, Pluff says.

Marten has recast its operating model from primarily long-haul to a mix of 40 percent long-haul and 60 percent regional. It now operates with 10 regions and an average length of haul of 630 miles, Norlin says.

Revenue per mile by trailer type

Dry van $1.29 per mile

Flatbed $1.52 per mile

Reefer $1.24 per mile

Large and medium-sized carriers surveyed by the National Transportation Institute report these average pay rates to owner-operators for the 12 months ending in June 2011. Average annual pay and mileage: dry van, $150,630, 116,000 miles; flatbed, $159,834; 104,603 miles; and reefer, $159,030, 127,693 miles.

Health insurance option spreads

Although an increasing number of carriers is offering health insurance plans as a benefit in recruiting independent contractors, the share of the total industry remains small.

Inquiries at TrueNorth Companies about insurance programs from carriers in the first half of the year were double the same period the previous year and sales were up about 20 percent, said Mike Vogel, a vice president. The company serves 90 carriers offering health insurance and related products to contractors.

Because of law that prohibit employers from offering employee benefits to independent contractors, any insurance products for owner-operators must be totally separate from the carrier’s group plan for employee drivers, says Jason Smith, executive vice president of transportation for TrueNorth. A carrier may provide individual products for major medical, limited medical, dental, vision and life insurance to contractors.

Carriers offering individual plans usually lease out to 100 owner-operators or more, Vogel says. “For smaller carriers, it just doesn’t typically make a lot of sense administratively to put a program in place,” he says.

Cost for a major medical plan for a contractor will typically be higher — $500-$750 monthly — because the carrier isn’t contributing to it. A limited medical policy covering pre-existing conditions, doctor’s office visits, minor surgeries and hospital stays might cost one-fourth as much.

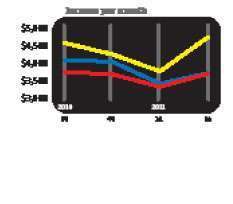

FLATBED LEADS PACK Owner-operator net income was stagnant or falling in late 2010 and early 2011, according to averages from clients with owner-operator financial services provider ATBS. Flatbed earnings rose markedly in the second quarter. Because much of that segment’s capacity was wiped out early in the recession, increased demand from governmental stimulus spending and elsewhere produced strong rate increases, says ATBS President Todd Amen.

FLATBED LEADS PACK Owner-operator net income was stagnant or falling in late 2010 and early 2011, according to averages from clients with owner-operator financial services provider ATBS. Flatbed earnings rose markedly in the second quarter. Because much of that segment’s capacity was wiped out early in the recession, increased demand from governmental stimulus spending and elsewhere produced strong rate increases, says ATBS President Todd Amen.DRY VAN — RED

FLATBED – YELLOW

REEFER – BLUE

Talking about pay

Gordon Klemp

Gordon KlempGet in-depth information about the current state of owner-operator compensation by listening to a recent Overdrive webinar presented by Gordon Klemp, president of National Transportation Institute. Download the free, one-hour presentation at TruckerWebinars.com.

Among NTI’s top-ranked carriers

• American Central Transport – Liberty, Mo.

• Barr-Nunn – Granger, Iowa

• Crete Carrier – Lincoln, Neb.

• Heartland Express – North Liberty, Iowa

• Hunt Transportation – Omaha, Neb.

• Marten Transport – Mondovi, Wis.

• Millis Transfer – Black River Falls, Wis.

• Roehl Transport – Marshfield, Wis.

• Shaffer Trucking – New Kingstown, Pa

• Schneider National – Green Bay, Wis.

• Transport America – Egan, Minn.

• USA Truck – Fort Smith, Ark.

The National Transportation Institute ranks these dozen carriers, listed here alphabetically, among the highest in overall compensation for over-the-road and regional owner-operators. Carriers come from about 300 companies of all sizes that provide detailed information to NTI and are ranked against competitors of similar size, with weighted results. All rank highly in pay, benefits and stability, based on measurements such as Dun & Bradstreet rating and driver turnover.