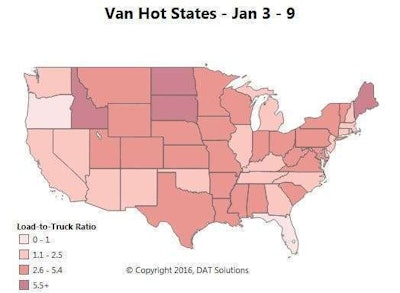

This week’s spot market update sees the van load-to-truck ratio dropping back to 2.7 loads per truck on DAT load boards from its prior-week spike to 3.4. That brief reminder of 2014 was mostly due to a relative shortage of trucks during the holidays. A ratio of 2.7 is still very strong, especially for January, DAT says.

It may drift down in the coming weeks.

The hot states map for last week still shows a lull on the West and East Coasts, with more intense demand in the Midwest, Northeast and parts of the South, including Texas. This week’s hot local markets include: Houston, Memphis, Minneapolis, Green Bay and Toledo. Those cities all offer exceptional load volume, coupled with high load-to-truck ratios making negotiation strength possible.

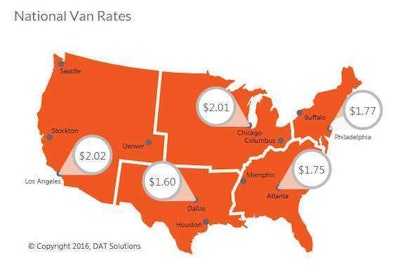

Spot van rates continued to lag behind contract rates but rose a couple cents following the high-truck-demand holiday week to a national average of $1.73 per mile last week, despite a decline in the fuel surcharge. Rates fell on van loads originating in Los Angeles, Dallas, Chicago, Atlanta, and Philadelphia, but outbound rates trended up in Houston and Memphis. Rates shown above are all-in, reflecting fuel. To see linehaul rate averages separated out for both contract and spot markets, visit the van rates page at DAT Trendlines.

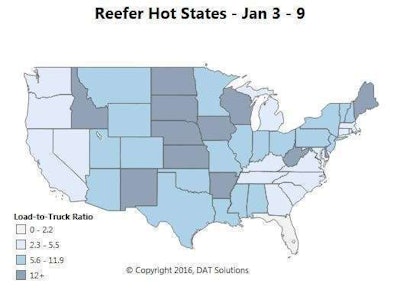

Spot van rates continued to lag behind contract rates but rose a couple cents following the high-truck-demand holiday week to a national average of $1.73 per mile last week, despite a decline in the fuel surcharge. Rates fell on van loads originating in Los Angeles, Dallas, Chicago, Atlanta, and Philadelphia, but outbound rates trended up in Houston and Memphis. Rates shown above are all-in, reflecting fuel. To see linehaul rate averages separated out for both contract and spot markets, visit the van rates page at DAT Trendlines.The reefer market showed a more dramatic demand drop following the holiday, at least as measured by load-to-truck ratios, DAT says. The national ratio declined from 9.6 to 6.7 loads per truck. That’s a big drop, but 6.7 is still high compared to 2015 levels this time of year.

Reefer rates added another cent last week, moving to $1.96 per mile. Hot local markets included Twin Falls, S.D.; Albuquerque, N.M.; and McAllen, Texas, where an influx of Mexican produce led to a shortage of trucks that continues this week. Outbound rates increased for reefer loads originating on the West Coast, and in McAllen as well.

Reefer rates added another cent last week, moving to $1.96 per mile. Hot local markets included Twin Falls, S.D.; Albuquerque, N.M.; and McAllen, Texas, where an influx of Mexican produce led to a shortage of trucks that continues this week. Outbound rates increased for reefer loads originating on the West Coast, and in McAllen as well.