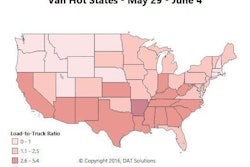

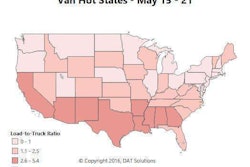

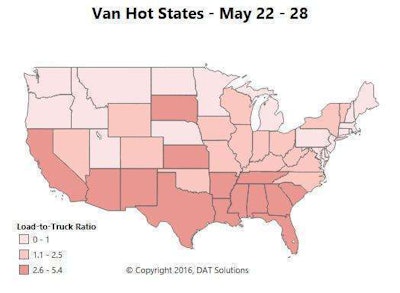

That’s according to DAT’s Ken Harper, who noted with this week’s update that, after the two steps forward, one step back sort of spring on the spot market thus far this year, this past week showed some substantial gain, particularly on high-volume lanes. “Two-thirds of the high-volume van lanes,” the top 80 in terms of loads moved, in other words, “got a rate increase in the past week alone,” he says. “You can tell by the darkening colors on the Hot Market States [maps] that freight is finally picking up more generally.”

The Sun Belt is hot for vans, as high demand and a shortage of trucks turned the map red across the Southern band of states. Van rates rose sharply last week in Los Angeles and Stockton, Calif., and are also rising in Dallas and Houston. (Though they’re still not great.) On the other hand, you can always find a load out of Texas. Chicago and Columbus are finally showing some signs of life after a few disappointingly quiet months. In the Southeast, rates are rising in Atlanta and Charlotte, but Memphis outbound rate trends were mixed, with some lane rates increasing while others declined. Vans even got a rate increase in the Northeast last week, as outbound lanes improved in Philadelphia and Buffalo.

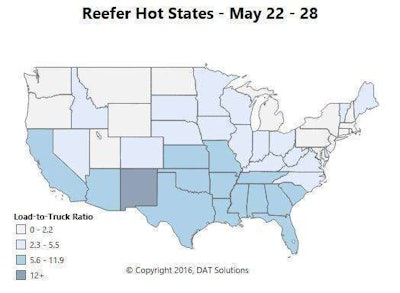

The Sun Belt is hot for vans, as high demand and a shortage of trucks turned the map red across the Southern band of states. Van rates rose sharply last week in Los Angeles and Stockton, Calif., and are also rising in Dallas and Houston. (Though they’re still not great.) On the other hand, you can always find a load out of Texas. Chicago and Columbus are finally showing some signs of life after a few disappointingly quiet months. In the Southeast, rates are rising in Atlanta and Charlotte, but Memphis outbound rate trends were mixed, with some lane rates increasing while others declined. Vans even got a rate increase in the Northeast last week, as outbound lanes improved in Philadelphia and Buffalo. Reefer demand showed similar strengthening when compared to the van map for the week, though reefer rates were unchanged as a national average.

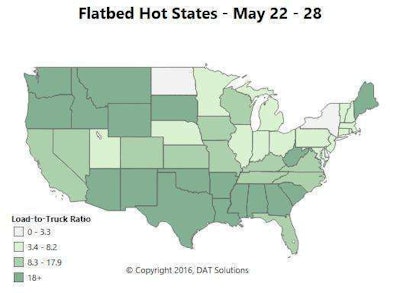

Reefer demand showed similar strengthening when compared to the van map for the week, though reefer rates were unchanged as a national average. The flatbed freight picture tells a different story. Every region has at least one hot market. On the West Coast, look for loads in Los Angeles, where outbound rates rose another 7 cents per mile last week. In the South Central region, Houston is the biggest source of flatbed loads, and rates rose 30 cents to $2.38 per mile last week, in both directions, between Houston and New Orleans. On the East Coast, choose between Baltimore to the north and Raleigh to the south, or go from one to the other, with a triangular route to replace the low-priced southbound leg.

The flatbed freight picture tells a different story. Every region has at least one hot market. On the West Coast, look for loads in Los Angeles, where outbound rates rose another 7 cents per mile last week. In the South Central region, Houston is the biggest source of flatbed loads, and rates rose 30 cents to $2.38 per mile last week, in both directions, between Houston and New Orleans. On the East Coast, choose between Baltimore to the north and Raleigh to the south, or go from one to the other, with a triangular route to replace the low-priced southbound leg.