Trucking news and briefs for Wednesday, May 8, 2024:

New Jersey ups minimum liability insurance levels

Legislation in New Jersey signed into law in January by Gov. Phil Murphy will double the liability insurance minimum for truck owners to $1.5 million. The extent of the increase’s applicability is unclear, however.

The bill, introduced in 2022, was passed by the state assembly and senate early in January and signed by Murphy shortly thereafter. It adds language to existing state liability insurance requirements to require for commercial motor vehicle owners to maintain "an amount or limit of $1,500,000, exclusive of interest and costs, on account of injury to or death of, one or more persons in any one accident or for damage to property in any one accident.”

The law states the requirement can "be satisfied by a commercial automobile insurance policy, fleet insurance policy, commercial umbrella insurance policy, commercial excess insurance policy, similar insurance policy, or any combination thereof."

The federal minimum for liability insurance for interstate motor carriers, of course, is $750,000, though that has been under fire in recent years as medical bills and other expenses have ballooned. A bill introduced in December in the U.S. House, after past similar legislative attempts, would increase the federal minimum from $750,000 to $5 million.

As for New Jersey’s new law, the increase will take effect on July 1 and will apply to all liability insurance policies initiated or renewed on or after that date. The language of the law is unclear as to whether it applies only to New Jersey-based carriers, or if it also applies to out-of-state carriers operating in the state. The text of the law reads that the liability minimums apply to "owners or registered owners" of vehicles “registered or principally garaged” in the state. The International Registration Plan brings out-of-state carriers into question, as the IRP includes New Jersey.

Transportation law firm Scopelitis noted when the bill was signed into law in January that there was “no indication in the legislation that it is intended to apply only to intrastate New Jersey operations,” adding that “[t]here appears to be indirect evidence that the intent is that the new higher minimum limits under this legislation will apply to all commercial vehicles within its scope, whether in interstate or intrastate operations.”

In a March update, Scopelitis noted that it’s “unclear the extent to which it may apply to trucks in interstate operations with plates issued pursuant to the International Registration Plan. New Jersey has yet to offer clarification regarding the target of enforcement or how enforcement will occur.”

Scopelitis told Overdrive Wednesday that the firm expects the New Jersey Department of Insurance to issue a bulletin to clarify how the new law will be enforced, but that has not yet been released.

[Related: Congress again eyes massive trucking insurance hike]

FMCSA denies fleet’s request to allow CLP holders to participate in under-21 pilot

The Federal Motor Carrier Safety Administration has denied a petition from Pitt Ohio Express that would allow it to use drivers under the age of 21 who hold a commercial learner’s permit (CLP) to participate in the Safe Driver Apprenticeship Pilot (SDAP) program.

Currently, drivers under 21 who hold a CLP are limited to intrastate operations. The SDAP program allows registered motor carriers to use apprentice drivers between 18 and 20 years old with a CDL under certain circumstances.

Pitt Ohio’s request sought to allow CLP holders to participate in the program. Under the requested exemption, the CLP holders would still need to meet all the remaining apprentice requirements, as well as the existing regulatory requirements for CLP holders (such as presence of a valid CDL holder in the passenger seat). Pitt Ohio estimated that 25 CLP holders would operate under the exemption each year. The company said it believes the exemption would relieve them of “difficulty locating and recruiting apprentice drivers into [the] SDAP Program.”

[Related: Transportation spending bill aims to improve under-21 pilot participation]

In denying the request, FMCSA said that it found “there is insufficient basis to conclude that the exemption would likely achieve a level of safety equivalent to, or greater than, the level achieved without the exemption.”

The agency added that the “SDAP’s purpose is to determine whether there are conditions where safety data indicate younger drivers (18- to 20-year-olds) might be allowed to operate CMVs. Congress authorized SDAP, opening the pilot to those 18- to 20-year-olds who hold a CDL, not a CLP.”

By granting the request to Pitt Ohio, FMCSA added it “could potentially put young and inexperienced drivers in a position of high responsibility, potentially exposing them and surrounding drivers to crashes and incidents involving CMVs. The agency therefore believes that Pitt Ohio’s prospective apprentice CLP drivers should not be legally permitted to operate CMVs in interstate commerce if less than 21 years of age.”

[Related: Meet Will Dodson, among the first 'graduates' in the under-21 pilot program]

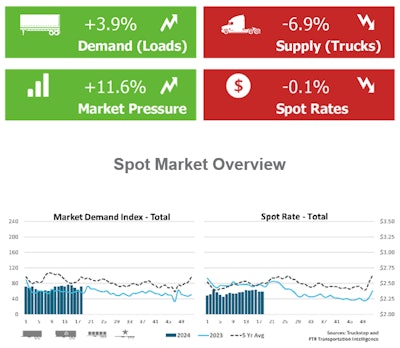

A little bit of a spring freight season in the offing? | The weekly spot market update from Truckstop and FTR Transportation Intelligence showed a sharp rise in reefer activity as well as rates ahead of the Mother's Day holiday (and the Commercial Vehicle Safety Alliance's annual Roadcheck inspection spree next week). Broker-posted spot rates for refrigerated equipment recorded their largest week-over-week gain this year, adding 16 cents a mile, and van rates ticked up slightly. Spot rates nationally across segments were essentially flat, the gains offset by a decline in rates for flatbeds. Reefer spot rates often rise sharply during the run-up to Mother’s Day, FTR noted, although the increase was the largest for a week 18 over at least the past decade but for 2021 when the week coincided with Roadcheck directly. Broker load posting activity was elevated, as shown, with truck posts falling, raising pressure for potential gains this week and next during Roadcheck. The Market Demand Index -- the ratio of load postings to truck postings in the system -- increased to its highest level in three weeks. Seeming good spot-market news follows depressing market news over the last week illustrating long-term pricing losses for carriers across contract and spot markets.

A little bit of a spring freight season in the offing? | The weekly spot market update from Truckstop and FTR Transportation Intelligence showed a sharp rise in reefer activity as well as rates ahead of the Mother's Day holiday (and the Commercial Vehicle Safety Alliance's annual Roadcheck inspection spree next week). Broker-posted spot rates for refrigerated equipment recorded their largest week-over-week gain this year, adding 16 cents a mile, and van rates ticked up slightly. Spot rates nationally across segments were essentially flat, the gains offset by a decline in rates for flatbeds. Reefer spot rates often rise sharply during the run-up to Mother’s Day, FTR noted, although the increase was the largest for a week 18 over at least the past decade but for 2021 when the week coincided with Roadcheck directly. Broker load posting activity was elevated, as shown, with truck posts falling, raising pressure for potential gains this week and next during Roadcheck. The Market Demand Index -- the ratio of load postings to truck postings in the system -- increased to its highest level in three weeks. Seeming good spot-market news follows depressing market news over the last week illustrating long-term pricing losses for carriers across contract and spot markets.

Trailer telematics offering launches as independent company

FleetPulse, a trailer telematics offering started by Great Dane in 2019, is now launching as an independent company following $11 million in seed funding.

The company also announced that former Uber Freight executive Carl-Christoph Reckers will serve as its CEO.

FleetPulse’s OEM-agnostic telematics platform enables end-to-end visibility into trailer and cargo safety and security. Development on the platform started in 2017 to address Great Dane’s own need to improve trailer data insights.

In working with fleet customers, many of whom operate trailers from multiple OEMs and need to digitize and leverage data across their entire trailer fleet, the need to build the technology platform as a standalone, independent company became clear.

Reckers previously served as Vice President of Operations at Uber Freight, where he oversaw the cloud-based freight management for midmarket customers, temperature-controlled freight and flatbed freight, as well as the drop-trailer program “Powerloop.” Prior to Uber Freight, Reckers was co-founder and CEO of the logistics technology company FR8Star.

“I’m excited to join FleetPulse at this inflection point as we scale to serve more fleet customers,” Reckers said. “We have a huge opportunity ahead of us to transform the trailer from a black box to a smart and strategic asset. Building on our incredibly deep roots in the trucking industry and strong tech talent, we are uniquely positioned to create visibility into this underserved area of the supply chain and help our customer unlock the safety and efficiency improvements needed to accelerate their business.''

FleetPulse’s trailer telematics platform digitizes and creates visibility on the trailer, allowing for many trailer-related improvements in safety, reliability, cargo security, and efficiency that are unattainable with traditional, tractor-focused telematics solutions, the company said. Its streamlined approach better informs operations, maintenance, and investment decisions, the FleetPulse added.

[Related: Telematics beyond ELD systems: Promise, redundancy and real expense/uptime benefits]