Trucking news and briefs for Thursday, May 2, 2024:

Freight markets continued to underperform in first quarter

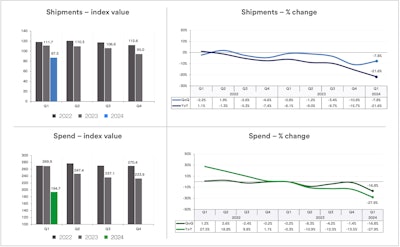

Truck freight continued to underperform the broader economy during the first quarter of 2024, according to the latest U.S. Bank Freight Payment Index. The index, representing contract markets primarily, contracted significantly from both the final quarter of 2023 and the same quarter a year earlier.

Several factors contributed to declining freight levels during the first three months of the year, U.S. Bank said, including bad winter weather in many parts of the country.

“While there are indications that freight levels rebounded slightly in February, a strong March freight market didn’t materialize as it would during a typical first quarter,” the report noted. “While this was a tough season for motor carriers, shipper spend fell substantially during the first quarter," making it even tougher. "Capacity was still high compared with the amount of freight available, leading to lower spend.”

U.S. Bank reported that its Shipments Index was down nearly 8% in the first quarter from the fourth quarter of 2023, and down 21.6% from Q1 2023. Likewise, shipper spend is down nearly 17% from the previous quarter and 28% from a year ago.U.S. Bank

U.S. Bank reported that its Shipments Index was down nearly 8% in the first quarter from the fourth quarter of 2023, and down 21.6% from Q1 2023. Likewise, shipper spend is down nearly 17% from the previous quarter and 28% from a year ago.U.S. Bank

Given freight spend contractions and other indicators, the outlook for capacity, noted Commercial Motor Vehicle Consulting analyst Chris Brady, likely wouldn't start improving before the end of the second quarter, after which he forecasted "sluggish to moderate growth. ... For-hire carriers, who largely operate in linehaul applications, will initially absorb higher freight volumes by increasing truck utilization." That's been the case for owner-operators going on two years now, with miles up since mid-to-late 2022.

[Related: How owner-operators still standing have weathered big rates drops through the present]

In its analysis of the many freight-generating sectors of the U.S. economy, U.S. Bank in its report pointed to a decline in the household consumption of goods as a major factor in freight volumes contracting during the first quarter, the report said. “While retail sales grew modestly, they were far too low to generate significant additional truck freight.”

According to Census Bureau data, retail sales were up between 0.5% and 1.5% compared to the first quarter a year ago, however, U.S. Bank said that if adjusted for inflation, sales figures likely fell between 1.5% and 2.5%, “which is a better indicator of freight volumes because it removes price effects.”

Brady and CMVC didn't expect the pricing pendulum to swing toward carriers from shippers' current strong position before 2025. Even then, the swing, he felt, might only "slowly improve profit margins" combined with higher utilization. Class 8 truck sales in linehaul applications, thus, aren't expected to grow much, either.

Noted by U.S. Bank, other economic sectors like home construction and factory output were flat during the first quarter, impacting shipment volumes and hampering freight pricing. Additionally, international trade was affected by various factors slowing shipments, including the conflict in the Red Sea targeting cargo ships.

According to the 2024 Q1 U.S. Trade Report, West Coast ports saw an increase in imports, while reductions occurred in southern and eastern ports due to re-routing from the Suez and Panama Canals. Many ships were forced to adjust routes, adding significant time (up to two weeks) to transit, making for a challenging quarter for truck freight.

[Related: Trucking's 'bloodbath': Did brokers or carriers take the biggest hit?]

FMCSA proposes to incorporate new CVSA out-of-service handbook into regs

The Federal Motor Carrier Safety Administration is proposing amendments to its Hazardous Materials Safety Permits (HMSPs) regulations to incorporate by reference the updated Commercial Vehicle Safety Alliance out-of-service criteria handbook.

The updated handbook contains inspection procedures and Out-of-Service Criteria (OOSC) for inspections of shipments of transuranic waste and highway route-controlled quantities (HRCQs) of radioactive material (RAM), part of CVSA’s Level VI inspection program.

FMCSA said federal regulations currently reference the April 1, 2023, edition of CVSA’s handbook, and it is now proposing to incorporate the April 1, 2024, edition. As previously reported, there are 11 changes in the 2024 edition that distinguish it from the 2023 edition. The full list of changes can be found here.

FMCSA will accept public comments on the proposal, a generally routine matter conducted annually after development and publication of the OOSC, for 30 days beginning Friday, May 3. Comments can be made at www.regulations.gov by searching Docket No. FMCSA-2024-0073 when the notice publishes Friday in the Federal Register.

[Related: CVSA's new out-of-service criteria: What truckers need to know]

Fuel card provider AtoB now accepted at TA

AtoB, a fuel card provider founded in 2020, announced this week a collaboration with TravelCenters of America.

The company said the partnership will bring a cost savings of an average of 42 cents per gallon, providing AtoB users with competitive prices on fuel at any of TA’s more than 300 locations nationwide.

“At TA, we are constantly seeking opportunities to enhance the guest experience and better serve our fleet customers and professional drivers,” said Debi Boffa, CEO of TA. “AtoB is a platform that will save our customers time and money, and we are pleased to work with a company that is at the forefront of digitizing and modernizing the trucking industry.”

AtoB Fuel Cards help prevent fuel fraud, enable custom controls for more efficient fleet management, and offer savings on diesel gallons, the company said. The AtoB Driver App gives fleets visibility into fuel prices per gallon and the option to easily navigate to the closest TA location.

“Drivers can also use the Fuel Map in the AtoB Driver App to find stations with the best fuel prices and cost savings,” said Vedant Khamesra, Lead Product Manager, digital payments at AtoB. “AtoB users can utilize the platform at TA travel centers and diesel fuel pumps. In addition, the AtoB Perks program allows fleets to receive significant savings on fuel costs, tires and vehicle maintenance.”

[Related: Fuel payments providers boost theft protections amid card-skimming explosion]