For two years, trucking industry watchers have predicted a "bloodbath" where drooping rates and rising diesel press tens of thousands of carriers, particularly small carriers and owner-operators, out of the market and maybe all the way to total failure.

"Rates down, fuel up: Is a 'trucking bloodbath' on the way?" Overdrive reported back in April 2022, when diesel hit record highs that would get even higher a couple months later. A full two years later, there's still nearly a hundred thousand more carriers in business with authority than there were at the beginning of the pandemic, plenty of trucking capacity, and even some fleet executives shocked by the sturdiness of small carriers.

For sure plenty of small carriers and owner-operators have thrown in towel, succumbing to the "bloodbath." In part, trucking pundits got it right. But few seem to ask a relevant question: How are the brokers doing? It turns out owner-operators may have had a few tricks up their sleeves, and likely gave as good as they got when negotiations got down to the wire.

First, a recap of how the carrier population is faring.

Carrier authorities start to crash

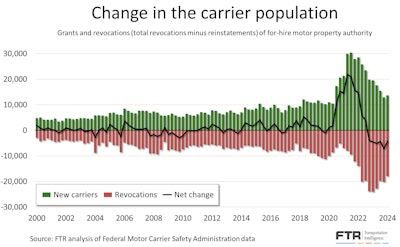

As Avery Vise, vice president of trucking at FTR Transportation Analysis, recently told Pamela De Leon for a report that first aired in Overdrive sister publication CCJ, carrier authority revocations peaked in late 2022 and early 2023, and remain steadily higher than before the pandemic. Since then, they've slowed considerably from the highest points.

In some ways, though, it looks like carriers who came in through the gold rush of 2021 have mostly stuck around.

“The absolute number of carriers exiting is historically high due to the unprecedented surge in the carrier base, especially in 2021,” Vise told De Leon. “Even with the large number of carrier failures through March, the market still has 94,000 more for-hire carriers than it did immediately before the pandemic.”

Perhaps those extra 94,000 carriers have kept rates from coming back up, as the spot market remains filled with trucking capacity. Vise told Overdrive that over a more typical four-year period, the market would expect to add about 23,400 carriers. Instead, we've still got more four times as many, all looking for a slice of the same pie.

And the spot market story isn't just about small carriers. Even some of the biggest carriers have relied on spot freight as contract volumes and (more so) rates also take a beating. Knight-Swift in a recent earnings release admitted they'd rather not sign year-long contracts near the bottom of the market.

"The full truckload industry continues to be challenging and oversupplied with capacity," the company wrote. "The early part of the bid season led to greater than expected pressure on freight rates as some shippers are still trying to push rates down further. In some cases, we have lost contractual volumes because we were not willing to commit to further concessions on what we view as unsustainable contractual rates. This resulted in more of our capacity being allocated to the spot market."

Since some signs that the market might be turning positive for some spot market carriers in January, both spot and contract rates for vans have fallen further back, the spread between the averages widening, according to DAT's Trendlines analysis.DAT Trendlines

Since some signs that the market might be turning positive for some spot market carriers in January, both spot and contract rates for vans have fallen further back, the spread between the averages widening, according to DAT's Trendlines analysis.DAT Trendlines

Basically, truckers are getting hammered from all angles and in all segments. More competition from fellow small carriers, more competition from bigger carriers chased out of the contract market, and more competition for shippers with brokers, who are seeing revenues and margins shrink right alongside carriers.

ATBS' analysis of owner-operator financials, presented at the Mid-America Trucking Show in a joint session with Overdrive, demonstrated that small carriers, in many cases, simply outran the hammering. Owner clients of ATBS ran on average 6,337 more miles in 2023 to keep up the numbers. Revenue for owner-operators was down an average of 2.6%, or $4,796, to $176,817. Net income was down 2.1%, or $1,331, to $62,932.

They accomplished all this despite rates falling 9.4%.

Now, finally, there's some sign that the tide at long last has started to turn.

"If you compare where we are today to February 2020, we're up 38%" in carrier authorities, said Vise. But "from a peak level, the number of authorized carriers is down 8.5% since September 2022."

Brokers, too, are starting to see authorities disappear at a quick clip.

Brokers crashing right behind carriers

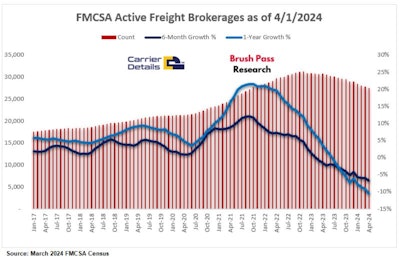

If the height of the carrier gold rush of new entrants happened in September 2022, then brokers weren't far behind, reaching their peak population of 31,225 in November 2022, according to Kevin Hill of Brush Pass Research.

By July 2023, broker authorities entered negative year-over-year territory, he said, eventually falling to 27,450 by March this year. That represents a 12% decrease in the broker population, and a much bigger fall than that in the carrier population, which fell just 8.5% over a slightly longer term.

Brokerage revenues went down 15.1% in 2023, according to Hill, much steeper than owner-operator revenues as reported by ATBS. According to Kevin Hill, broker margins are getting squeezed, too.

"If you were making 15%" margins as a freight broker, "it might go down to 12% a load to stay competitive," said Hill. "Commissions go down, cash flow goes down, budgets constrict, so any purchase of technologies are hampered. It all puts a strain on working capital."

Ken Adamo, freight analytics lead at DAT, in January pegged average gross margins at around 15%, and concurred that they're going down. (For an in-depth guide to where broker margins are the highest, look here.) As of March, his research indicates they've slipped down closer to 13 or 14%.

[Related: Broker margins, rates data, transparency: What owner-operators really think]

This may be obvious, but though they're in the same basic business as carriers -- trucking -- brokerages happen to be completely different businesses than trucking companies. Truckers manage massive mobile assets and contend with road hazards, law enforcement, huge insurance requirements and a hundred other operational challenges. Brokerages manage their offices and people, shipper and carrier relationships and technology. Even so, according to this admittedly crude bit of analysis, carriers on the whole have found ways to stick it out in this market at greater rates than have brokers.

Two years into the bloodbath, many small trucking companies continue to outwit, outplay and outlast their asset-light competition for direct customers, often on pure elbow grease.

So to the small carriers (one truck or more) in the audience who have made it this far: What's your secret? If you've made major moves or small shifts to hang on and stay profitable over the last two years, what did you do? Get in touch with [email protected] to share your story for an upcoming feature on the habits and tactics of the indomitable owners getting it done day in, day out, whatever the market conditions.