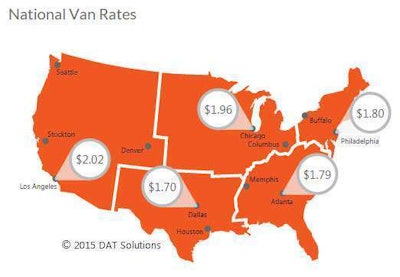

Outbound rates declined in major California markets and also in Philadelphia, Memphis, Chicago and Seattle last week. Those falls contributed to a 2-cents-per-mile drop in the national average van rate, now $1.77 on the spot market. That continued a trend in place during the the last van-specific demand update, based on rates derived from DAT’s RateView product and loads booked on its network of load boards.

Bright spots this week for dry van haulers? Rates edged up in Philadelphia, Memphis and Seattle.

From a demand perspective, areas to target now include a few local markets with a lot of loads available and few trucks, creating opportunities for small fleets. Look for loads in Buffalo, N.Y.; Harrisburg and Erie, Pa.; Baltimore, Md.; Roanoke and Winchester, Va.; and Evansville, Ind., DAT says.

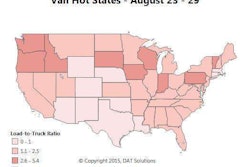

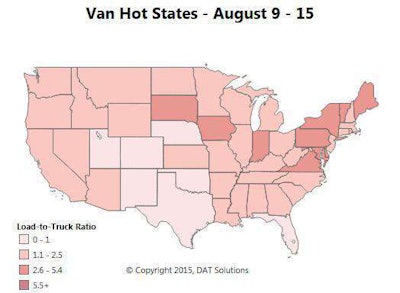

Nationally, with volume increases continuing for vans, the load-to-truck ratio had edged up since the last update (from 1.7) but fell week-over-week slightly to 1.8 loads per truck on DAT load boards with an influx of trucks. Freight availability declined most sharply in the Midwest and California. While states like South Dakota and Vermont show as dark red in this “Hot States” map, meaning that they had high load-to-truck ratios, both had relatively few loads available, so check outbound freight volume before taking a load into those states.

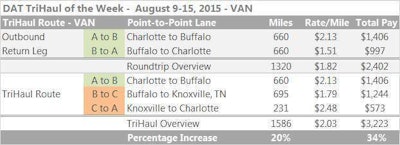

Nationally, with volume increases continuing for vans, the load-to-truck ratio had edged up since the last update (from 1.7) but fell week-over-week slightly to 1.8 loads per truck on DAT load boards with an influx of trucks. Freight availability declined most sharply in the Midwest and California. While states like South Dakota and Vermont show as dark red in this “Hot States” map, meaning that they had high load-to-truck ratios, both had relatively few loads available, so check outbound freight volume before taking a load into those states. The lane between Charlotte and Buffalo continues to be ripe for triangulation, given decent rate averages outbound from N.C. and low averages on the return trip. Rates fell for vans in both directions last week, and the roundtrip average was $1.82/mile for the three-day turn. Add 300 miles on the return with a load from Buffalo to Knoxville, Tenn., then another from Knoxville to Charlotte, and you can make $820 more in revenue all told, based on DAT average rates and as illustrated in the above chart. Buffalo to Knoxville paid $1.79 per mile last week – 28 cents more per mile than the Buffalo-to-Charlotte lane. From Knoxville, it’s less than 250 miles back to Charlotte, and the going rate on that leg was $2.48/mile last week for vans. “TriHaul” route suggestions are offered in DAT Express and DAT Power load boards, the company notes.

The lane between Charlotte and Buffalo continues to be ripe for triangulation, given decent rate averages outbound from N.C. and low averages on the return trip. Rates fell for vans in both directions last week, and the roundtrip average was $1.82/mile for the three-day turn. Add 300 miles on the return with a load from Buffalo to Knoxville, Tenn., then another from Knoxville to Charlotte, and you can make $820 more in revenue all told, based on DAT average rates and as illustrated in the above chart. Buffalo to Knoxville paid $1.79 per mile last week – 28 cents more per mile than the Buffalo-to-Charlotte lane. From Knoxville, it’s less than 250 miles back to Charlotte, and the going rate on that leg was $2.48/mile last week for vans. “TriHaul” route suggestions are offered in DAT Express and DAT Power load boards, the company notes.