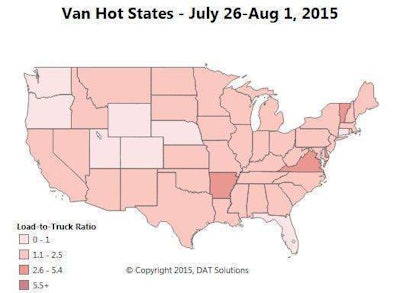

Arkansas was along among larger-market states to hold on to a favorable demand measure, calculated as a ratio of the number of loads per truck, in the DAT network of load boards last week. Since Overdrive‘s last van-specific spot market update, demand in California, Arizona and Mississippi have fallen off considerably, though a bright spot could be seen on the East Coast as freight volume overall increased slightly nationwide and the national load-to-truck ratio held steady at 1.7.

Virginia metro areas around Roanoke, Richmond and Norfolk, in addition to the continuing hot area of Southwestern Arkansas, performed considerably better than two weeks ago.

More local markets where freight is plentiful that DAT highlights this week include Atlanta, and trucks are scarce relative to freight availability in Charleston, W.Va.; Erie, Penn.; Taylorville, Ill.; Toledo, Ohio; and Evansville, Ind.

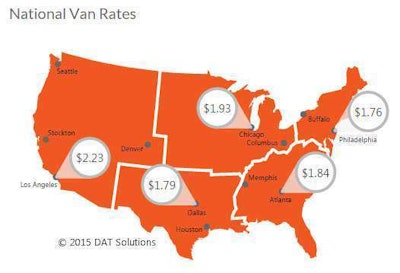

Van rates fell in most major markets, the national average dropping a cent, but a turnaround may be on the horizon with East Coast freight and rates rising. Average outbound rates rose 1.2 percent in both Philadelphia and Buffalo. Charlotte, N.C., made for a strong origin point in spite of recent declines. Out on the West Coast, Stockton followed suit.

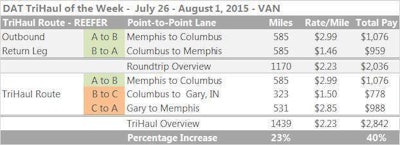

Outbound rates on average were up for the van run between Memphis and Columbus in both directions, but the roundtrip average stood at just $1.74 for all loaded miles. It’s Ohio to Tennessee haul that’s the problem — it averaged $1.46 a mile, less than half of what Memphis to Columbia haulers took in last week. Adding another load to Chicago-area Gary, Ind., then grabbing yet another for a round back to Memphis from Columbus, based on last week’s average rates, could add $807 to the total round’s revenue, for an average rate of $1.98 per loaded mile. Investigate the details in the chart below.