A truck from Gill Freightlines sits under a Convoy load back before the collapse. Payment for the final hauls would never come, but will carriers like Gill ever consider hauling for Convoy again?Surinder Gill

A truck from Gill Freightlines sits under a Convoy load back before the collapse. Payment for the final hauls would never come, but will carriers like Gill ever consider hauling for Convoy again?Surinder Gill

In the fight to survive a tough market, owner-operators and small carriers often have to bite the bullet and deal with a certain shipper or broker when previously they'd said, "never again."

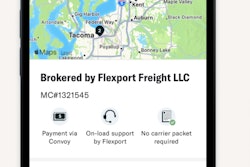

Perhaps nothing illustrates that as clearly as Convoy's relaunch under Flexport. Convoy's new owner has solicited carriers to use the service, even canvassing among those who'd been stiffed the last time they hauled for Convoy.

Eagle Radovish, one of the carriers left unpaid by Convoy and now tied up in the $519,000 lawsuit with former Convoy customer Ikea, claims Convoy left it unpaid on $160,000 worth of invoices back in October, something that pushed the eight-truck, Oswego, Illinois-based fleet to the breaking point.

Yet as of last week, the fleet is back using the Convoy Platform after personal conversations with top staff at Flexport. And Eagle Radovish isn't the only carrier still owed money by Convoy that has signed back on.

Why would anyone do that? Two reasons: First, the Convoy app, by all accounts, is good and easy to use.

Second, even if small trucking companies wanted to protest Convoy, it's a down market, and the economic reality is they just might not have better options.

Flexport/Convoy's pitch to carriers: Business is business

"If they give me a good price on good loads ... yes, I will haul for them," said the owner of Eagle Radovish, who still wasn't 100% happy about the arrangement. "The application is good, but the people are not good," he said of the leadership of the fallen broker. "Convoy now has a bad name and bad reputation."

But business is business for many, and a good rate is a good rate. Recall the National Owner Operators Association boycott of TQL and other big brokers. When it made sense for some NOOA members, they continued to pull for TQL (leading, in at least one case, to a particularly heated standoff.)

[Related: 'TQL PAY ME MY $8,000': Owner-op confronts broker face-to-face over nonpayment]

A.J. Sandhu, operations manager at five-truck Mountview Transport in Covington, Washington, pulled Convoy loads for three years up until October 2023, when the broker's collapse left the business out some $38,000. Now, Mountview is registered to haul for Convoy again, as the broker slowly starts onboarding new carriers -- and eventually brokers other than just Flexport Freight -- to post to and haul from the platform.

"Whatever we lost, we lost," said Sandhu. "We tried to recover it, we tried Convoy's email address," but to no avail, he said.

Sandhu's back with Convoy because his last experience on the platform just made life easier with respect to load selection and dispatching his mostly local fleet, he said. "It's really hard to make a schedule with spot market loads. If you get a good load, it always clashes with other ones, so you have to haul less loads so that you can be on schedule."

At Convoy, Sandhu was on "the dedicated side, so we would get loads every night," he said, calling it a "consistent amount of work" hauling for freight container supplier CHEP.

"You can’t get anything like that except on Convoy," he added. "That's why I'm hoping to do the same thing with Flexport."

Between using Convoy to keep his trucks busy and nearby, or dealing with "10-12 brokers," Sandhu said it wasn't really a hard choice to come back in through Flexport, even with the $38,000 nonpayment still stinging.

"I had to pull my credit line of $55,000, and we're still struggling," Sandhu said of the aftermath of Convoy's October crash. "I had to lay off a couple guys."

But Sandhu believes Flexport, an established freight forwarder with some shipper/customer contracts, has what it takes to operate the Convoy platform faithfully, without the risk of being foreclosed on by a creditor, as was Convoy's ultimate fate.

[Related: Convoy's unpaid carriers: Where to seek payment?]

Skepticism remains high for many carriers

Surinder Gill, owner of Gill Freightlines, poses with a Convoy blogger back when he was a model carrier for the digital freight broker.Surinder Gill

Surinder Gill, owner of Gill Freightlines, poses with a Convoy blogger back when he was a model carrier for the digital freight broker.Surinder Gill

Sandhu's story mirrors that of another young West Coast fleet owner, Surinder Gill, owner of four-truck Gill Freightlines, a formerly dedicated Convoy hauler who now says the dead-and-back-again broker owes him around $35,000.

"I helped them start their power only program," said Gill. "I was the first carrier to park my trailer and run theirs on these lanes in California and Nevada. I thought they would cover me when I would hear murmurs of their collapse," but no such luck.

A few years into the hauling relationship, Convoy moved Gill to a 28-day pay term, which ended badly when things blew up in October.

"We were running nine trucks" power-only, and "they were dedicated contracts, year in, year out, with the volume quite high," Gill said of the months before Convoy's collapse. "It was 50-60 loads a week, but I didn't get paid for work between the second week of September and October 18," when Convoy shut off for good last year.

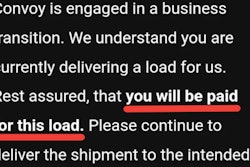

Convoy told Gill to keep hauling, and that the Convoy outage in mid-October was just an "app issue," something Convoy representatives also told Overdrive at the time.

"The next day we got word they’re out of business," just like countless other carriers under a Convoy load did, from media reports. Gill jokes now that he should have kept a Convoy trailer, or maybe at least a tire or two, given the ghosting treatment received since October.

For months, Gill went after his contacts at Convoy, which included the brother of a senior employee at the brokerage. They assured Gill payment would come, but months passed. Gill took the loss on the chin, letting go some of his hardworking owner-operators, damaging those delicate relationships in the process.

[Related: Ikea v. Convoy: Lawsuit reveals glimpse at contract rates, broker margins]

By Gill's account, the now 28-year-old owner's business had been a model carrier for Convoy, with Convoy's media team even flying out to California and taking pictures with him for a blog post. Gill loved the platform's ease of use and no-hassle load negotiations, as well as pioneering power-only loads there at the height of the pandemic -- all of it appealed to the young entrepreneur.

"It's absolutely a great app, better than Uber Freight," said Gill.

After months of nonpayment and no response from Convoy's former staff, something surprising happened. "When Convoy went over to Flexport, my same contact reached out and said, 'we got bought out, let's rekindle this thing,'" said Gill.

His response: "Yeah, if you're going to give me my money."

Flexport said one reason it brought Convoy back to the market was that in "hundreds of conversations" with carriers, the carriers said they wanted the platform back. Overdrive can confirm staff high up within Flexport did call carriers to probe the relaunch, and Gill was one of them.

"These guys are unashamed," said Gill. "They don't care, they get to pick their lives back up as normal," Gill said, describing the Convoy team members who took jobs at Flexport.

"They had Head of Trucking Bill Driegert [a VP at Flexport] call me," Gill said. "He's asking me questions about the app, and of course my first response was 'When do I get paid'?"

Unlike Sandhu, Gill said he doesn't want to haul with Convoy again, mostly due to the nonpayment issue. When a carrier doesn't get paid, it's not just a void in a balance sheet. Gill's fleet isn't the same now. He doesn't have enough owner-operators to tackle the kind of work Convoy wanted him to take anyway. In that way, for him, bygones can't just be bygones.

[Related: Rock-bottom rates stir 're-regulation' debate among owner-operators]

How might Flexport succeed where Convoy couldn't?

Corey Person's C.P. Truckings was a one-truck operation when he hauled for Convoy before the crash, and he was left unpaid just about $1,000 in the end. Now, he's back hauling with three trucks under loads booked on the platform "every day" over the last few weeks, but taking things with a healthy grain of salt.

The small fleet mostly moves bottled water to Costco, Walmart, and Sam's Club on local routes from Person's native Virginia. Like Gill, Person got the runaround in October with Convoy leaving him unpaid. But Person notes today that the economics just work out too well to shut them out entirely.

"I'm averaging $3.60, $3.70 and sometimes even $4" a mile "and getting paid the same day" on local runs now, he said. Person appreciates that Convoy's quick pay option takes just 1.75% for same-day pay, below most factoring rates, though the figure it up from the 1.5% it offered before the crash and Flexport's acquisition.

Person loves how easy it is to run the Convoy app, too, yet the theatrics and optics of Convoy's near seamless handoff to Flexport, all while keeping unpaid carriers in the dark, bother him.

Remarking on prior reporting around Ikea's contract with Convoy, Person said it "really pissed me off so much" to see that the broker could bank revenue at rates 78% more than average spot rates, and here he "couldn’t get $1,000" owed to him.

For now, it's "so far so good" under the new Convoy, according to Person.

Top staff at Flexport pressed the idea that by landing big, Fortune 500 shippers like Costco or Ikea, the digital brokerage "democratized" freight, giving small carriers a chance to haul for big companies when normally a mega-shipper wouldn't solicit or respond to bids from a small carrier.

"A big shipper won't look at a small guy like me," said Person. "Convoy gets us access to big shippers, but to what extent?" Person pointed out that he can't exactly solicit Costco for direct freight, and that in all his time reaching out to shippers, perhaps 150 calls since 2014, he's landed maybe three direct freight relationships.

"They’ll pay Convoy, for example, $12 a mile, but they're gonna eat up all the money," said Person. Prior reporting on Ikea's Convoy contract showed the shipper agreeing to $20/mile for some cross-town runs in Los Angeles.

Perhaps most importantly, Person, now with three trucks out on any given day, worries Convoy's fate could hit Flexport, too.

The former Convoy's Article 9 filing under Uniform Commercial Code allowed it's creditor, Hercules Capital, to seize all assets and accounts receivable, but let them off the hook for Convoy's debts and liabilities, according to a source involved in Convoy's transition. That means the millions Flexport paid for Convoy's app likely didn't, and won't, go to the unpaid carriers. Flexport recently told Overdrive it couldn't pay the carriers, and pointed the unpaid carriers towards an email address established by the transition team.

[Related: 'We understand the stress and frustration': Flexport responds to Convoy's unpaid carriers]

"Who is to say the same thing won’t happen again?" asked Person. "What is [Flexport] doing different" to make sure the company doesn't go under and leave carriers unpaid?

Like Convoy was, Flexport is a venture-capital-backed, admittedly unprofitable private company. Flexport has raised $2.7 billion in venture and debt funding, according to TechCrunch. (Venture debt obligations ultimately killed Convoy.) Flexport has had big layoffs and a high profile CEO reshuffle since October. Recent media reports indicated that Flexport is losing $2 million a month on its high-profile deal to import iPhones for Apple on Flexport-branded Boeing 747s.

Asked why Flexport might better succeed at running the new Convoy Platform, and why carriers should trust it, the company had this to say through a spokesperson:

Flexport already has a growing and successful trucking business, and significant volumes that will benefit from the Convoy Platform. Flexport is on track to return to profitability, and we’re building a long-term sustainable business to better serve our customers and partners. Our fortress balance sheet -- which includes a recent $260 million investment from Shopify -- will allow Flexport to navigate the uncertain waters of global logistics.

Person isn't exactly convinced by Flexport's pitch, but cautiously hopes for the future and will continue to haul Convoy loads, as long as the pay is good. "I'm a small carrier, I need all the loads I can get to get to the next level," he said. "They caught me at a vulnerable time" in the down market. "Fool me once, shame on you. Fool me twice, shame on me. There won't be a third time."

If Flexport's Convoy fails to pay, "I don't care if it's $20 -- I'll go to the newspapers and social media" to chase payment, he said. Otherwise, he's hoping Flexport's shipper relationships and volumes make them both successful on the Convoy platform.

In the end, trucking in general has shown a remarkably weak ability to collectively punish entities that harm trucking companies and truck drivers (whether through unfair parking regulations, predatory towing or banning certain equipment) or to push against political causes drivers dislike. Remember the recent trucker's boycott of NYC? No such thing happened. Same with the Texas Truckers Convoy.

[Related: Trump endorses trucker's 'boycott' of NYC -- but what's really going on?]

Eagle Radovish, Person, Sandhu, and Gill all have stories of nonpayment, but with bills to pay and no one to listen, sending a collective message to Convoy's leadership isn't a luxury they can afford. Nobody at Convoy or Flexport even disagrees with the carriers -- they did the work and deserve to get paid.

In this market, if a load pays well and gets a carrier where they need to be, most likely they'll take it, whoever it's from. For now, Flexport's Convoy Platform appears to have the loads, and the tech, that these carriers need.

Keep tuned for more from these carriers in a few months. Contact [email protected] if you are in a similar situation or have another tip.