Help-wanted ads in local newspapers are dominated by the 800- numbers of trucking companies looking for CDL holders. On the Internet, anyone who visits a few trucking-related pages soon will find banner ads by driver-desperate carriers appearing next to a favorite cat video. The quarterly earnings reports of publicly traded trucking companies caution investors about the high cost and potential dangers of the growing driver shortage.

Yet many company drivers and owner-operators are skeptical, having heard carriers crying wolf about a driver shortage for years. They want hard proof – higher pay – that would validate claims of high demand for drivers amid low supply. By some analyses, a substantial industry-wide pay raise is imminent, but that’s hardly certain.

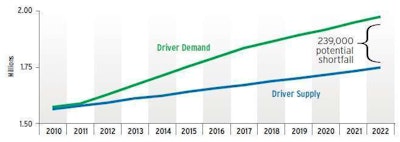

The American Trucking Associations, assuming a current shortage of more than 20,000 truck drivers compared to available jobs, projects the gap to grow annually over the next 10 years.

The American Trucking Associations, assuming a current shortage of more than 20,000 truck drivers compared to available jobs, projects the gap to grow annually over the next 10 years.

Some factors that could lead to a more severe driver shortage – and a resulting pay hike – are simple enough:

**A large number of long-time drivers are approaching retirement age.

**New regulations – notably the Compliance, Safety, Accountability (CSA) program – have pushed many drivers out of the industry, either involuntarily or in disgust.

**Productivity losses due to the new hours of service regulations mean more drivers are required to deliver the same amount of freight.

**Many fleets have been cautious about rebuilding their capacity since the recession, due to the sporadic recovery, and would be hard-pressed to quickly add trucks and drivers should demand spike.

One possible explanation is that the wage data does not count extra payments, such as hiring bonuses and increases in accessorial charges, says economist Noel Perry, managing director and senior consultant at FTR Consulting Group.

Indeed, nearly half of carriers are offering sign-on bonuses, compared to only 12 percent two years ago, consultant Gordon Klemp told trucking fleet executives during the 2013 CCJ Spring Symposium. Bonuses range from $250 to $5,000 for solo drivers and $2,000 to as much as $15,000 for teams, said Klemp, principal with the National Transportation Institute.

“Recruiters say bonuses are here for the foreseeable future,” he said.

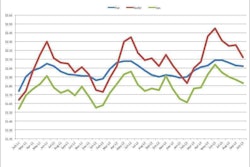

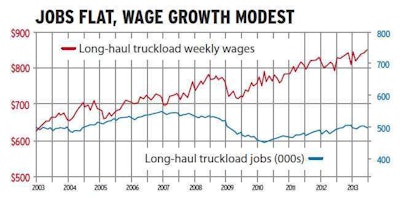

Click through the image for a larger version of the table, based on government data, showing truck driving job availability and wages movement. The number of jobs in long-haul trucking basically has been flat for the past decade, though with some substantial losses during the recession. Since its December 2006 peak, truckload employment has dropped 8.6 percent. Wages rose by a third over the decade, mirroring private sector wage growth. Trucking generally has fared better than manufacturing and construction in job growth and wages.

Click through the image for a larger version of the table, based on government data, showing truck driving job availability and wages movement. The number of jobs in long-haul trucking basically has been flat for the past decade, though with some substantial losses during the recession. Since its December 2006 peak, truckload employment has dropped 8.6 percent. Wages rose by a third over the decade, mirroring private sector wage growth. Trucking generally has fared better than manufacturing and construction in job growth and wages.Also boosting productivity, Perry says, “Drivers are getting a lot of miles, so their W-2s are going up even though their per-mile wage is not. So that’s keeping them happy.”

Nevertheless, considering the demand for labor, “The fleets have been underpaying the drivers,” he says. “If this hits the fan in the next year, the industry will have to radically change its behavior.”

Many owner-operators appear to have fared better than company drivers in recent years, thanks to the entrepreneurial nature of their business and the timing of the economic rebound.

“Generally, owner-operators and smaller operators are among the first to experience either upturns or downturns in the economy,” says Todd Spencer, executive vice president of the Owner-Operator Independent Drivers Association.

Owner-operators likewise are seeing somewhat larger paychecks, said Matt Amen of owner-operator financial services provider ATBS during the Great West Truck Show in June. This is evidenced by averages of thousands of ATBS’ owner-operator clients. During 2012, ATBS clients saw net income rise 8.6 percent to almost $52,000, Amen said during an Overdrive Partners in Business presentation at the Great West Truck Show in June.

Those owner-operators drove 2,500 fewer miles on average than they did in 2011, but higher rates made up the difference. The segment with the biggest gain was true independents running under their own authority, whose average net income rose $5,813 to $55,994.

One reason for the lower miles is a major trend of recent years – the shortening in average length of haul Overdrive reported on in July– and it will continue, Amen said. “We’re going to see more regionalization of freight, and truck drivers are going to be staying closer to home.”

Even though many owner-operators have profited from the economic upswing, that alone doesn’t prove there is a driver shortage, by Spencer’s reasoning. “A tight driver market would mean better pay, better rates, better service in the loading and unloading environment,” he says. “It would include things that would encourage retention and recognize years of safe driving. If we had a tight driver market, you would see those things.”

Instead, he says, “There’s sort of a myth that floats around that because companies buy more trucks than they have drivers for, then they have a driver shortage. That’s not a shortage. When a third or more shippers say they’re having a hard time finding trucks, then we have a shortage.”

But Perry sees carriers’ “capacity buffer” already exhausted, so any boost in freight demand or additional regulations that cramp productivity will throw the market into “a really critical situation,” including sporadic supply chain failures, he suggests. “Maybe the industry has been crying wolf about hours of service, but I don’t think so,” he adds, estimating a 40-50 percent probability “that there will be a crisis.”

His current truck/driver shortage number is 200,000. While there might not be enough freight to support all those trucks, it does indicate shippers no longer can expect to find multiple carriers waiting at the dock, hoping for a load. At some point, shortages – and delays – are likely to emerge, compelling shippers “to compete aggressively for capacity increases,” Perry said.

Find Part 2 in this series, “Many are called, fewer are chosen,” via this link.