Q: How will the new e-log rule affect us that are under 26,000 lbs.? —Sam Hart, Newburgh, Ind.

As we’ve chronicled here in past reporting, vehicles of 1999 model year or older are exempt from complying, and the agency sets a threshold for short-haul drivers who only keep hours of service records of duty status part of the time.

Essentially, under the terms of the final rule, which won’t require ELDs of most operators until December 2017 (assuming it is not derailed or delayed significantly by court challenges), you’ll need an ELD if you’re operating with a logbook for 8 days out of any given 30-day period. Take a listen to the mailbag podcast below for a little more discussion of answers to short-haul/niche-specific questions that came in from readers in December.

One such answer came to a question from an agricultural-only hauler, moving by and large his own product: Would the mandate apply?

Such operators running that product within the 150 air mile agricultural short-haul exemption to the hours of service exclusively are in the clear on e-logs and won’t have to use them.

Run outside of that radius and have to keep logs more than 8 days out of any 30-day period, however, and the rule says you’ll be required to use an ELD. In essence, FMCSA didn’t address the various short-haul hours of service exceptions directly within the ELD rule but rather has made ELD use contingent on that 8 of every 30 days threshold. Essentially, if you cross that threshold in any 30-day period, the mandate will require the ELD.

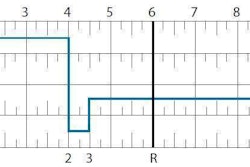

FMCSA did field requests for exemptions for straight and combo trucks plated under 26,000 lbs. in the explanatory text that was published alongside the final rule. The 26,000-lb. threshold is also the one that, when crossed, triggers independents’ participation in the IFTA fuel-tax rules, likewise the necessity of holding a Commercial Drivers License. The rules for hours of service, however, can apply to drivers of lighter-weight straight trucks and combinations.

As FMCSA explained the rule, the 2012 MAP-21 highway bill that laid out a path for FMCSA pursual of the ELD mandate rule “requires that the Agency impose the ELD mandate on drivers who prepare handwritten RODS [record of duty status] …”

Rewriting hours rules with under-26,000-lb. trucks in mind to allow relief of RODS requirements would not “enhance safety,” FMCSA writes in its ELD rule. “Regardless of the size of the vehicles being operated, any driver who is unable to satisfy the eligibility criteria for the short-haul exception must use RODS.”