The consultants at owner-operator business services firm ATBS have put together a helpful primer on the particulars of the Affordable Care Act, also known as Obamacare, as part of a regular newsletter you can download via this link. The piece is intended to help owner-operators make the decision about what route to take for health insurance under the act — without some kind of coverage come tax time in 2015, individuals will pay a penalty. Such penalties grow to as much as $2,085 or 2.5 percent of total income over $20,000, whichever is greater, for tax year 2016.

Put together by ATBS Tax Manager Andy Erwin, the informational piece also details various metrics that owner-operators currently without insurance can use to make their decision, including dollar figures for potential subsidy assistance if purchasing on the newly established individual health-care exchanges. Enrollment in the new exchanges is scheduled to begin October 1.

Download Erwin’s report via this link.

Given the delay in the mandate for employers of more than 50 individuals to offer an insurance option, many have suggested a delay in the individual mandate should also be granted. Tell us what you think in the comments here.

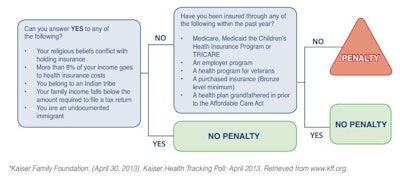

Some exemptions to the individual requirement to have health insurance under the ACA do exist. The following chart from ATBS’ newsletter shows them.