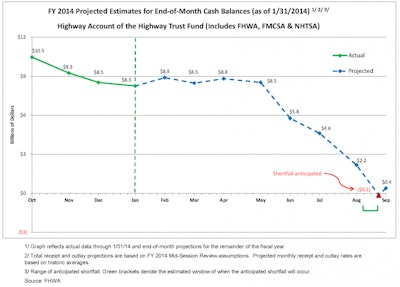

The DOT’s Highway Trust Fund “ticker” — showing that a shortfall for the fund is anticipated to happen in late August or early September. (click to enlarge)

The DOT’s Highway Trust Fund “ticker” — showing that a shortfall for the fund is anticipated to happen in late August or early September. (click to enlarge)Highway bill talk — and highway funding talk, in general – has heated up in recent weeks, stemming from the looming shortfall facing the Highway Trust Fund (now projected for around August or September), the Sept. 30 expiration of MAP-21 and general budget talk in Washington.

The good news is there’s a consensus among policymakers: Yes, transportation infrastructure, particularly surface transportation infrastructure, needs funding.

The bad news is there’s no consensus on how the country can pay for it, though there are several ideas being tossed around, from new taxes, raising taxes and changing taxes.

The reality is there’s not much time to act, even if it means extending the current MAP-21 law for a three-month period while Congress works out some kinks, which is what lawmakers did the last go-around — and more than once — through 2012.

Here are the four biggest proposals so far, along with who’s pushing for each:

Raising fuel taxes: Introduced in the House in December was a bill by Rep. Earl Blumenauer (D-Ore.) that would raise the per-gallon fuel tax by 15 cents as a way to stabilize the Highway Trust Fund until Congress could find a different solution. The bill also would attach the fuel tax rate to inflation as a longer-term measure.

This approach is simple: The Highway Trust Fund gets its money from fuel taxes, and more fuel efficient vehicles — compounded by a drop in mileage in recent years due to the economic downturn — have been restricting the HTF’s blood flow. By raising the per-gallon tax on diesel and gasoline (which hasn’t been done in 20 years), the fund would get a healthy boost of revenue.

It’s also a “user pays” method, as those who use more fuel and are on the road more pay more for highway funding. Trucking obviously picks up a big chunk of that tab.

The American Trucking Associations has long been a proponent of increasing fuel taxes to boost the Highway Trust Fund, and, speaking on behalf of its fleet members, the group says trucking’s willing to pay more for the roads the industry needs and relies on. Fuel tax is also more efficient and more fair than methods like tolling, ATA says.

But ATA’s not the only group that supports a fuel tax increase: The Chamber of Commerce’s President Thomas Donohue recently told a Senate committee at a hearing that raising fuel taxes is the obvious way to get the funding the U.S. needs to invest more in roads and bridges.

At the same hearing, AFL-CIO President Richard Trumka also pushed for a fuel tax increase.

The House bill, however, has gone nowhere yet, though a fuel tax increase could easily be rolled into the upcoming highway bill.

Reforming corporate taxes to fund highways: President Barack Obama unveiled last week his plan for upping highway funding: Closing tax loopholes for corporations, among some other tax reform, and using the money for a $302 billion, four-year highway funding plan. This is the same plan included in his budget proposal released this week, and it’s the plan he alluded to in his State of the Union address in January.

However, the president’s plan may not be able to gain much traction, especially in the Republican-controlled House.

Sen. Barbara Boxer, Chairman of the Senate’s transportation committee, likes the president’s plan, but said in a speech last week she “[doesn’t] hold out hope for it.”

Also, given the partisan politics of the day, the president’s plan — and his budget — are more political documents than they are contenders for passage.

Changing tax code, dedicating highway funding: Rep. David Camp (R-Mich) chairs the committee in the House that controls the purse strings — the chamber’s Ways and Means Committee. Coming on the same day as the president’s plan last week, Camp’s proposal would raise business taxes and taxes on the rich and lower taxes for just about everybody else. The proposal simplifies the country’s tax code and is designed to create jobs and boost U.S. economic growth — and the proposal sets aside about $125 billion for highway and infrastructure funding.

Though Camp’s proposal seemingly would accomplish a little of something for both parties, reaction has been lukewarm and mostly unexcited — most of it sounding something like “It’s good to hear a proposal, now what are we going to do about this highway funding?”

Taxing mileage: Rep. Bill Shuster (R-Pa.), chair of the House’s transportation committee, recently brought this proposal back to life, dismissing the idea of raising fuel taxes as politically feasible.

Rep. Bill Shuster

Rep. Bill ShusterLike the fuel tax, a vehicle mileage tax acts as a user pays system, in which the amount you pay is proportionate to the amount you use the roads. The issue, however, is in administering and collecting the tax: Either the IRS has to rely on an honor system in which everyone tells tax collectors how many miles they traveled that year or the government must use some type of tracking device. “Tracking” there used loosely, as mileage would be the key, not necessarily location.

But people don’t like being tracked, and convincing the motoring public to go along with a plan to monitor mileage would be difficult.

Rep. Blumenauer (the representative who introduced the fuel tax bill in December), introduced a bill in December 2012 that would implement a pilot program to test VMT.

His state, Oregon, already has a pilot program in place, as do one or two other states, so the feasibility of a mileage tax may be greater after more state testing has been concluded.

***

OD sister site CCJ Senior Editor Kevin Jones has a great slideshow of the major players in the highway bill. Click here to check it out.

If you like good roads — and you should — keep your fingers crossed Washington can come up with something to keep them funded.

Drop a comment below to tell us what you think about the proposals.