Spot truckload posts edged up 19% last week as shippers cleared their docks to meet end-of-month targets and get ahead of Winter Storm Orlena, the first major snowstorm of 2021, said DAT Freight & Analytics, which operates the DAT load board network and freight data analytics service.

Truck posts, concurrently, declined by 8%, yielding a boost in the load-to-truck demand metric. National average spot van and refrigerated freight rates were virtually unchanged compared to the previous week after softening through the first month of the year.

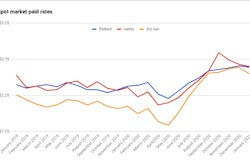

Rates averages shown are

Rates averages shown are

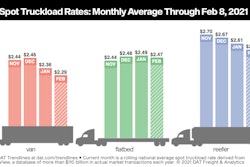

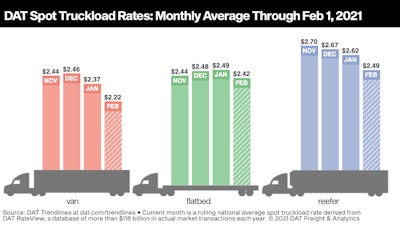

Entering February, the national average spot van rate was $2.22 per mile; flatbed was $2.42 per mile; and the reefer rate was $2.49 per mile—well below their January averages. These averages are based on actual transactions negotiated between the carrier and broker or shipper.

Van/reefer load-to-truck ratios improve: The national average van load-to-truck ratio increased from 3.2 to 4.3 last week and the number of loads moved on DAT’s top 100 van lanes by volume was up 3.9%. The average spot truckload rate fell on 72 of those 100 lanes, however. It increased on 14 lanes and was neutral on 14 others. While weaker spot van rates and volumes are typical for late January, the average spot rate slipped below the contract rate for the first time in nearly seven months.

The national average reefer load-to-truck ratio was 8.7, up considerably from 5.9 the previous week. The number of loads moved on DAT’s top 72 reefer lanes by volume increased by just under 1% week over week and the average rate was lower on 59 of those lanes.

Flatbed activity picking up: The average flatbed load-to-truck ratio rose from 44.9 to 53.0 and the number of loads moved on DAT’s top 78 flatbed lanes by volume jumped 19.3% last week. The number of loads moving was higher on 67 lanes, week over week, although the direction of rates was plenty mixed up and down: 19 lanes were up, 37 lanes were neutral, and 22 lanes were down compared to the previous week. While the gap between spot and contract rates for vans and reefers has narrowed substantially, contract flatbed rates have outpaced spot rates by roughly 15 cents a mile for the last 12 months.