Independent Jose Williams saw his partnerships tested this year under the economic pressures of the pandemic. He hauls blanket-wrap and other freight with this 2007 Kenworth outfitted with a 132-inch ARI custom sleeper. With him is business and life partner Lucille Torres. | Photo by Chet Gordon and courtesy of Williams.

Independent Jose Williams saw his partnerships tested this year under the economic pressures of the pandemic. He hauls blanket-wrap and other freight with this 2007 Kenworth outfitted with a 132-inch ARI custom sleeper. With him is business and life partner Lucille Torres. | Photo by Chet Gordon and courtesy of Williams.Jose Williams spent decades leased in the network of United Van Lines before going out on his own as Lyons Gate Group more than five years ago. Still running one truck, Williams has learned a lot in those years, including a tough lesson in partner loyalty brought about by COVID-19.

Pre-pandemic, Williams’ 2007 Caterpillar-powered Kenworth specialized in trade shows and other high-value blanket-wrap-type freight. Some was pulled under direct contracts, others via specialized brokers.

When the pandemic hit early this year, many of his regular customers and brokers saw business dry up or at best get hit hard. The Yorktown Heights, New York, native made moves to keep busy working load boards and attempting to use connections outside his principal specialty.

One of those connections was to a large broker he’d worked with and even fed freight to when he couldn’t cover a customer’s load. As business in general freight has picked back up since the beginning of the summer, salesmen from that particular broker have been calling, Williams said.

What he’s told several of them, after the experience of the disastrous second quarter: “When the crunch came down, you weren’t offering me anything worthy of the work I’ve done for you, the excellent service. You’re trying to stick me with $1 this and 80 cents a mile that.”

A far cry from any sense of appreciation he might have expected. As he told them: “That’s not loyalty, that’s not partnership — that’s every man for himself when the time comes for it, and I don’t appreciate that.”

Owner-operators, carriers and their customer brokers and shippers will be reckoning with decisions made during that crunch for years, even as memories of bitter experiences such as Williams’ fade. Wild swings in supply and demand as a result of COVID’s shifting of freight patterns and the population’s drastically altered buying habits have resulted in record spot market rates this fall. Barring unforeseen necessity of another, unlikely widespread lockdown, the favorable environment for carriers might be expected to continue through much of the winter.

Shippers’ near-term reliance on spot negotiations, combined with a new emphasis on technology and data analysis, is translating to an acceleration of changes that aren’t likely to be reversed even when a greater sense of stability returns to freight markets. Opportunity for sustained direct business for the smallest carriers could be a long-term consequence. Independents and small fleets would do well to keep an eye out for new contract opportunities. Some shipper contracts are taking on new flavors, including shorter terms to account for market volatility.

Shorter, more dynamic freight contracts

Small-fleet owner Ben Cadle, operating out of Augusta, Georgia, as Cadle Trucking and leased to and serving as an agent for Bennett Motor Express, saw a few weeks of very slow freight in the second quarter for his mostly open-platform business. He also has contracts for some van freight that were “made obsolete” with the summer surge to the spot market, pushing rates up to historic highs.

Van rates at large “went through the roof,” he said. If one or another of his 11 drivers and trucks couldn’t cover his customer’s van freight themselves, he could forget about covering it through another Bennett-leased carrier. Speaking in late October, he added, “We’ve been charging $4-$4.50 a mile for vans going up and down the East Coast.”

For most independents with authority, direct-ship contracts are either the reality or a goal of their business.

For most independents with authority, direct-ship contracts are either the reality or a goal of their business.A friend on the West Coast told him he’d seen owner-operators coming out of California at $5/mile. “Who’s ever heard of $5-a-mile freight coming out of California in a van? … If you’re in vans and you’re not making money now, you’ll never make it.”

As of October, Cadle’s regular customer had started a bid process for the new year, and Cadle submitted new rates with an eye toward appropriate longer-term upward adjustments on the account. Yet short-term adjustments had taken place prior to that, too, as the customer had difficulty getting its contracted carriers to move at the contracted rates. So the customer “put a premium” on top of Cadle’s and other carriers’ rates.

Small-fleet owner Ben Cadle, running in this 1982 custom Freightliner “Joy Ride 3,” typically doesn’t haul containers, but he jumped at the opportunity when a train derailed in his area in October. He’s diversified in other ways as well, also operating the Trelco Trailers sales and rental operation for mostly used trailers. He’s thankful for a cache of 60 used van trailers he bought early in the pandemic period. He sold every last one within just two months, he said, then “ordered five new ones and pre-sold them. … I think van rates are going to stay up for a while. There’s guys getting out of the flatbed business left and right.”

Small-fleet owner Ben Cadle, running in this 1982 custom Freightliner “Joy Ride 3,” typically doesn’t haul containers, but he jumped at the opportunity when a train derailed in his area in October. He’s diversified in other ways as well, also operating the Trelco Trailers sales and rental operation for mostly used trailers. He’s thankful for a cache of 60 used van trailers he bought early in the pandemic period. He sold every last one within just two months, he said, then “ordered five new ones and pre-sold them. … I think van rates are going to stay up for a while. There’s guys getting out of the flatbed business left and right.”Some watchers see this kind of dynamic contract adjustment amid volatility as boosting interest among shippers in shorter-term contracts. That’s as opposed to the typical annual contract of many large freight sources, where the shipper estimates volume but doesn’t guarantee it.

The lion’s share of truckload exists not in the spot market but in the broader contract market, said Chris Caplice, an analyst for DAT Solutions and executive director of MIT’s Center for Transportation and Logistics. In August, average spot dry van rates in DAT Solutions’ tracking rose 7 cents a mile above the average contract rate, the first time that had happened since January 2018. At the end of October, those rates remained 13 cents a mile above contract rates, as both averages rose.

“There’s a volatility now that’s unlike anything we’ve ever seen before,” pushing rates up, said Gail Rutkowski of the National Strategic Shippers Transportation Council.

While most shippers do value the contract relationships with the carriers they do business with, many are hearing the kind of message that Cadle sent to his van customer — “they want some variability within the contract rate,” Rutkowski said. “That opens up opportunities for small carriers,” particularly on lanes where volume has gone from a predictable 20 loads to, say, 75.

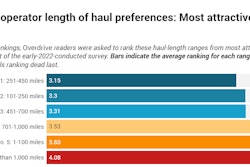

Securing such direct business is an active goal of the vast majority of independent Overdrive readers, according to recent polling. (See the chart above.)

Next in this series: Contract opportunities, strategy shifts for the smallest carriers