1. Data analytics and communication and its real use among carriers in determining variable pay rates. He talks a little about this element in the video below. It’s something that’s been enabled by the profusion of in-cab communication devices and the ability of fleets and drivers to track their own performance. A measurable percentage — 6 percent — of pay packages Klemp tracks are now utilizing such a system, updating driver per-mile or other pay quarterly or in some cases as frequently as monthly following performance: miles, fuel mileage, idle time, and other indicators. Anybody, company driver or leased operator, out there operating such a scheme today? Tell me in the comments.

2. The 65-and-overs are falling as a share of the total driver population. Klemp’s been following age demographics among drivers for nearly two decades. After 19 years of tracking along fairly steadily, the share of the 65-and-overs among the total group fell for the first time in his numbers. He interprets the drop as clear evidence, as has been predicted for many years now, that the boomers among you are exiting the business is outsize numbers, and (looking at other data as well) that they’re not being replaced on the other end of the age spectrum. This is giving carriers, he notes, more incentive to better compensate drivers and will create opportunities for innovative independents.

What do you think?

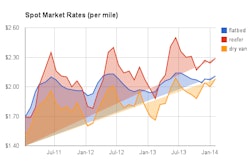

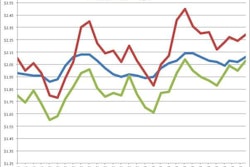

In the vid below, Klemp likewise shows some optimism for the coming year particularly relative to owner-operators under percentage-pay plans — and independents hauling non-contract spot-market freight, where rate gains are most likely.

[youtube A53Jlb_UVxI&list=UUVb9_pwbvG99tK1apahFyIg&feature=c4-overview nolink]